Form St-9a - Dealer'S Work Sheet For Computing State And Local Retail Sales Abd Use Tax

ADVERTISEMENT

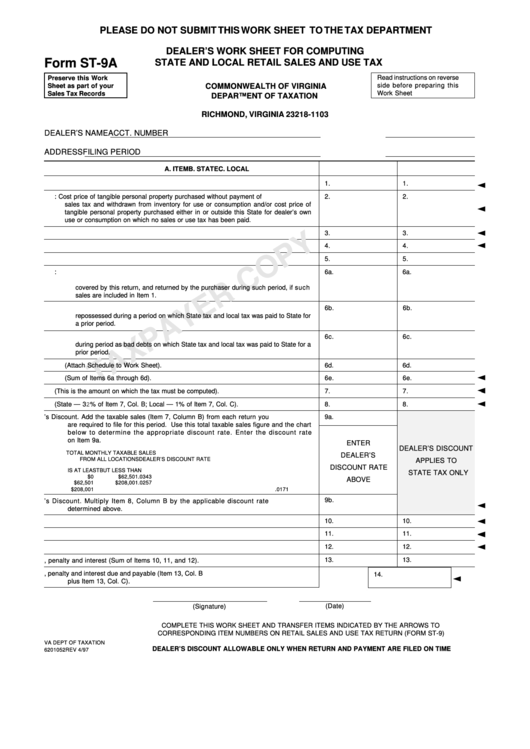

PLEASE DO NOT SUBMIT THIS WORK SHEET TO THE TAX DEPARTMENT

DEALER’S WORK SHEET FOR COMPUTING

Form ST-9A

STATE AND LOCAL RETAIL SALES AND USE TAX

Read instructions on reverse

Preserve this Work

side before preparing this

Sheet as part of your

COMMONWEALTH OF VIRGINIA

Work Sheet

Sales Tax Records

DEPARTMENT OF TAXATION

P.O. BOX 1103

RICHMOND, VIRGINIA 23218-1103

DEALER’S NAME

ACCT. NUMBER

ADDRESS

FILING PERIOD

A. ITEM

B. STATE

C. LOCAL

1. Gross sales and/or rentals made during the period covered by the current return.

1.

1.

2. Personal Use: Cost price of tangible personal property purchased without payment of

2.

2.

sales tax and withdrawn from inventory for use or consumption and/or cost price of

tangible personal property purchased either in or outside this State for dealer’s own

use or consumption on which no sales or use tax has been paid.

3. Item 1 plus Item 2.

3.

3.

4. Amount of exempt sales.

4.

4.

5. Item 3 less Item 4.

5.

5.

6. Allowable deductions:

6a.

6a.

a. Sales price of items of tangible personal proper ty sold during the period

covered by this return, and returned by the purchaser during such period, if such

sales are included in Item 1.

b. Any part of sales price of items of tangible personal property returned or

6b.

6b.

repossessed during a period on which State tax and local tax was paid to State for

a prior period.

c. That par t of sales price of items of tangible personal property charged off

6c.

6c.

during period as bad debts on which State tax and local tax was paid to State for a

prior period.

d. Other deductions (Attach Schedule to Work Sheet).

6d.

6d.

e. Total deductions (Sum of Items 6a through 6d).

6e.

6e.

7.

Item 5 less Item 6e. (This is the amount on which the tax must be computed).

7.

7.

8.

Tax (State — 32% of Item 7, Col. B; Local — 1% of Item 7, Col. C).

8.

8.

9a. Dealer’s Discount. Add the taxable sales (Item 7, Column B) from each return you

9a.

are required to file for this period. Use this total taxable sales figure and the chart

below to deter mine the appropriate discount rate. Enter the discount rate

on Item 9a.

ENTER

DEALER’S DISCOUNT

TOTAL MONTHLY TAXABLE SALES

DEALER’S

FROM ALL LOCATIONS

DEALER’S DISCOUNT RATE

APPLIES TO

DISCOUNT RATE

IS AT LEAST

BUT LESS THAN

STATE TAX ONLY

$0

$62,501

.0343

ABOVE

$62,501

$208,001

.0257

$208,001

.0171

9b.

9b.

Dealer’s Discount. Multiply Item 8, Column B by the applicable discount rate

determined above.

10.

10.

10. Item 8 less Item 9b.

11.

11.

11. Penalty for late filing and payment.

12.

12.

12. Interest for late filing and payment.

13.

13.

13. Total tax, penalty and interest (Sum of Items 10, 11, and 12).

14. Combined State and local tax, penalty and interest due and payable (Item 13, Col. B

14.

plus Item 13, Col. C).

(Signature)

(Date)

COMPLETE THIS WORK SHEET AND TRANSFER ITEMS INDICATED BY THE ARROWS TO

CORRESPONDING ITEM NUMBERS ON RETAIL SALES AND USE TAX RETURN (FORM ST-9)

VA DEPT OF TAXATION

DEALER’S DISCOUNT ALLOWABLE ONLY WHEN RETURN AND PAYMENT ARE FILED ON TIME

6201052

REV 4/97

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2