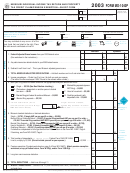

Form Mo-1040p - Missouri Individual Income Tax Return And Property Tax Credit Claim/pension Exemption - Short Form - 2003 Page 4

ADVERTISEMENT

FORM MO-1040P

PAGE 4

MISSOURI ITEMIZED DEDUCTIONS

• Complete this section only if you itemized deductions on your federal return. (See the instructions.)

• Attach a copy of your Federal Form 1040 (pages 1 and 2) and Federal Schedule A.

1

00

1. Total federal itemized deductions from Federal Form 1040, Line 37 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

00

2. 2003 (FICA) — yourself — Social security $

+ Medicare $

. . . .

3

00

3. 2003 (FICA) — spouse — Social security $

+ Medicare $

. . . .

4

00

4. 2003 Railroad retirement tax — yourself (Tier I and Tier II) $

+ Medicare $

. .

5

00

5. 2003 Railroad retirement tax — spouse (Tier I and Tier II) $

+ Medicare $

. .

6

00

6. 2003 Self-employment tax — Amount from Federal Form 1040, Line 28 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

00

7. TOTAL — Add Lines 1 through 6. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

00

8. State and local income taxes — See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

00

9. Earnings taxes included in Line 8 — See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

00

10. Net state income taxes — Subtract Line 9 from Line 8. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

00

11. MISSOURI ITEMIZED DEDUCTIONS — Subtract Line 10 from Line 7. Enter here and on Form MO-1040P, Line 8. . . . . . . .

NOTE: IF LINE 11 IS LESS THAN YOUR FEDERAL STANDARD DEDUCTION, SEE INSTRUCTIONS.

Checklist Before Mailing Return

K Make sure you are eligible for the property tax credit. See the instructions.

K Sign your return.

K Report all income and benefits, including temporary assistance (TA), Social

Security Administration (SSA), and/or Supplemental Security Income (SSI).

K Correctly complete Form MO-CRP.

K Attach all required documentation.

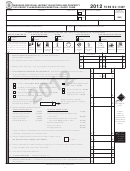

STANDARD DEDUCTION CHART FOR PEOPLE AGE 65 OR OLDER OR BLIND

FORM MO-1040P, LINE 8

Check the following boxes that apply to you and/or your spouse:

Enter the number

of boxes checked

YOURSELF:

Age 65 or older

Blind

to the left:

YOUR SPOUSE:

Age 65 or older

Blind

If your filing

AND the number

THEN enter on

status is:

in the box above is:

Form MO-1040P, Line 8:

Single

1

$ 5,900

2

$ 7,050

Married filing combined

1

$10,450

or

2

$11,400

Qualifying Widow(er)

3

$12,350

4

$13,300

Married filing separate

1

$ 5,700

2

$ 6,650

Note: If 3 or 4 boxes are checked, please see federal return. An example of this would be when a married individual filing separate can

claim a spouse’s additional standard deduction if the spouse has no income and isn't the dependent of another taxpayer.

Head of household

1

$ 8,150

2

$ 9,300

This form is available upon request in alternative accessible format(s). TDD (800) 735-2966

MO 860-2954 (11-2003)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4