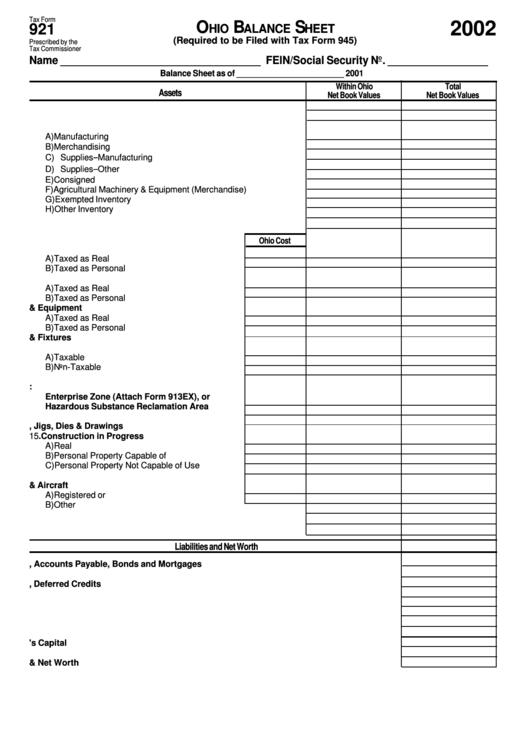

Tax Form

O

B

S

2002

921

HIO

ALANCE

HEET

(Required to be Filed with Tax Form 945)

Prescribed by the

Tax Commissioner

Name __________________________________ FEIN/Social Security No. _________________

Balance Sheet as of ________________________ 2001

Within Ohio

Total

Assets

Net Book Values

Net Book Values

1. Cash and Deposits .........................................................................

2. Notes and Accounts Receivable ...................................................

3. Inventories

A) Manufacturing ............................................................................

B) Merchandising ...........................................................................

–

C) Supplies

Manufacturing ............................................................

–

D) Supplies

Other ..........................................................................

E) Consigned .................................................................................

F) Agricultural Machinery & Equipment (Merchandise) ..................

G) Exempted Inventory ...................................................................

H) Other Inventory ..........................................................................

4. Investments ....................................................................................

5. Land ................................................................................................

Ohio Cost

6. Buildings

A) Taxed as Real Estate .........................................

B) Taxed as Personal Property ...............................

7. Leasehold Improvements

A) Taxed as Real Estate .........................................

B) Taxed as Personal Property ...............................

8. Machinery & Equipment

A) Taxed as Real Estate .........................................

B) Taxed as Personal Property ...............................

9. Furniture & Fixtures ...............................................

10. Personal Property Leased to Others

A) Taxable ..............................................................

B) Non-Taxable ......................................................

11. Capitalized Leases .................................................

12. Exempt Personal Property located in an:

Enterprise Zone (Attach Form 913EX), or

Hazardous Substance Reclamation Area .............

13. Certified Exempt Facilities ....................................

14. Patterns, Jigs, Dies & Drawings ...........................

15. Construction in Progress

A) Real Property .....................................................

B) Personal Property Capable of Use .....................

C) Personal Property Not Capable of Use ..............

16. Small Tools .............................................................

17. Vehicles & Aircraft

A) Registered or Licensed ......................................

B) Other .................................................................

18. Other Assets ...................................................................................

..................................................................................................

19. Total Assets ....................................................................................

Liabilities and Net Worth

20. Notes, Accounts Payable, Bonds and Mortgages ...............................................................

21. Accrued Expenses .................................................................................................................

22. Other Liabilities, Deferred Credits ........................................................................................

23. Preferred Stock ......................................................................................................................

24. Common Stock ......................................................................................................................

25. Additional Paid-In Capital ......................................................................................................

26. Retained Earnings .................................................................................................................

27. Appropriated Earnings ..........................................................................................................

28. Owner's Capital ......................................................................................................................

29. Other .......................................................................................................................................

30. Total Liabilities & Net Worth .................................................................................................

1

1 2

2