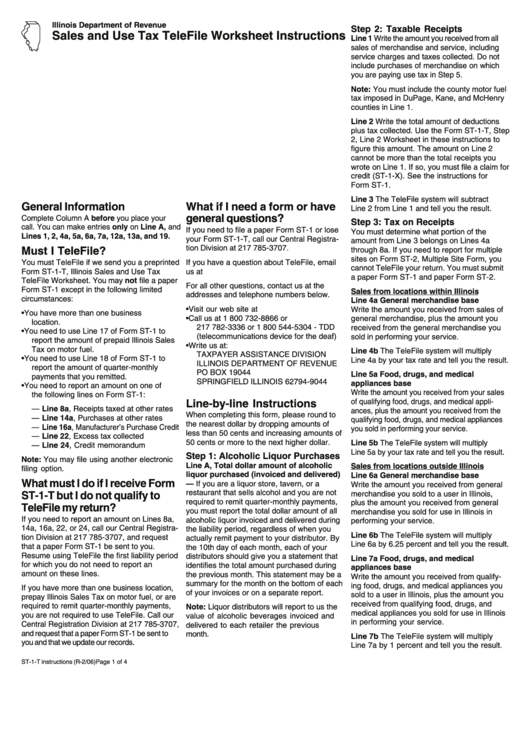

Form St-1-T, Line 2 Deductions Worksheet Sales And Use Tax Telefile Worksheet Instructions

ADVERTISEMENT

Illinois Department of Revenue

Step 2: Taxable Receipts

Sales and Use Tax TeleFile Worksheet Instructions

Line 1 Write the amount you received from all

sales of merchandise and service, including

service charges and taxes collected. Do not

include purchases of merchandise on which

you are paying use tax in Step 5.

Note: You must include the county motor fuel

tax imposed in DuPage, Kane, and McHenry

counties in Line 1.

Line 2 Write the total amount of deductions

plus tax collected. Use the Form ST-1-T, Step

2, Line 2 Worksheet in these instructions to

figure this amount. The amount on Line 2

cannot be more than the total receipts you

wrote on Line 1. If so, you must file a claim for

credit (ST-1-X). See the instructions for

Form ST-1.

Line 3 The TeleFile system will subtract

General Information

What if I need a form or have

Line 2 from Line 1 and tell you the result.

general questions?

Complete Column A before you place your

Step 3: Tax on Receipts

call. You can make entries only on Line A, and

If you need to file a paper Form ST-1 or lose

You must determine what portion of the

Lines 1, 2, 4a, 5a, 6a, 7a, 12a, 13a, and 19.

your Form ST-1-T, call our Central Registra-

amount from Line 3 belongs on Lines 4a

tion Division at 217 785-3707.

Must I TeleFile?

through 8a. If you need to report for multiple

sites on Form ST-2, Multiple Site Form, you

You must TeleFile if we send you a preprinted

If you have a question about TeleFile, email

cannot TeleFile your return. You must submit

Form ST-1-T, Illinois Sales and Use Tax

us at sttelefile@revenue.state.il.us.

a paper Form ST-1 and paper Form ST-2.

TeleFile Worksheet. You may not file a paper

For all other questions, contact us at the

Form ST-1 except in the following limited

Sales from locations within Illinois

addresses and telephone numbers below.

circumstances:

Line 4a General merchandise base

• Visit our web site at tax.illinois.gov

Write the amount you received from sales of

• You have more than one business

• Call us at 1 800 732-8866 or

general merchandise, plus the amount you

location.

217 782-3336 or 1 800 544-5304 - TDD

received from the general merchandise you

• You need to use Line 17 of Form ST-1 to

(telecommunications device for the deaf)

sold in performing your service.

report the amount of prepaid Illinois Sales

• Write us at:

Tax on motor fuel.

Line 4b The TeleFile system will multiply

TAXPAYER ASSISTANCE DIVISION

• You need to use Line 18 of Form ST-1 to

Line 4a by your tax rate and tell you the result.

ILLINOIS DEPARTMENT OF REVENUE

report the amount of quarter-monthly

PO BOX 19044

Line 5a Food, drugs, and medical

payments that you remitted.

SPRINGFIELD ILLINOIS 62794-9044

appliances base

• You need to report an amount on one of

Write the amount you received from your sales

the following lines on Form ST-1:

of qualifying food, drugs, and medical appli-

Line-by-line Instructions

— Line 8a, Receipts taxed at other rates

ances, plus the amount you received from the

When completing this form, please round to

— Line 14a, Purchases at other rates

qualifying food, drugs, and medical appliances

the nearest dollar by dropping amounts of

— Line 16a, Manufacturer’s Purchase Credit

you sold in performing your service.

less than 50 cents and increasing amounts of

— Line 22, Excess tax collected

50 cents or more to the next higher dollar.

Line 5b The TeleFile system will multiply

— Line 24, Credit memorandum

Line 5a by your tax rate and tell you the result.

Step 1: Alcoholic Liquor Purchases

Note: You may file using another electronic

Line A, Total dollar amount of alcoholic

Sales from locations outside Illinois

filing option.

liquor purchased (invoiced and delivered)

Line 6a General merchandise base

What must I do if I receive Form

— If you are a liquor store, tavern, or a

Write the amount you received from general

restaurant that sells alcohol and you are not

merchandise you sold to a user in Illinois,

ST-1-T but I do not qualify to

required to remit quarter-monthly payments,

plus the amount you received from general

TeleFile my return?

you must report the total dollar amount of all

merchandise you sold for use in Illinois in

If you need to report an amount on Lines 8a,

alcoholic liquor invoiced and delivered during

performing your service.

14a, 16a, 22, or 24, call our Central Registra-

the liability period, regardless of when you

Line 6b The TeleFile system will multiply

tion Division at 217 785-3707, and request

actually remit payment to your distributor. By

Line 6a by 6.25 percent and tell you the result.

that a paper Form ST-1 be sent to you.

the 10th day of each month, each of your

Resume using TeleFile the first liability period

distributors should give you a statement that

Line 7a Food, drugs, and medical

for which you do not need to report an

identifies the total amount purchased during

appliances base

amount on these lines.

the previous month. This statement may be a

Write the amount you received from qualify-

summary for the month on the bottom of each

ing food, drugs, and medical appliances you

If you have more than one business location,

of your invoices or on a separate report.

sold to a user in Illinois, plus the amount you

prepay Illinois Sales Tax on motor fuel, or are

received from qualifying food, drugs, and

required to remit quarter-monthly payments,

Note: Liquor distributors will report to us the

medical appliances you sold for use in Illinois

you are not required to use TeleFile. Call our

value of alcoholic beverages invoiced and

in performing your service.

Central Registration Division at 217 785-3707,

delivered to each retailer the previous

and request that a paper Form ST-1 be sent to

month.

Line 7b The TeleFile system will multiply

you and that we update our records.

Line 7a by 1 percent and tell you the result.

ST-1-T instructions (R-2/06)

Page 1 of 4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4