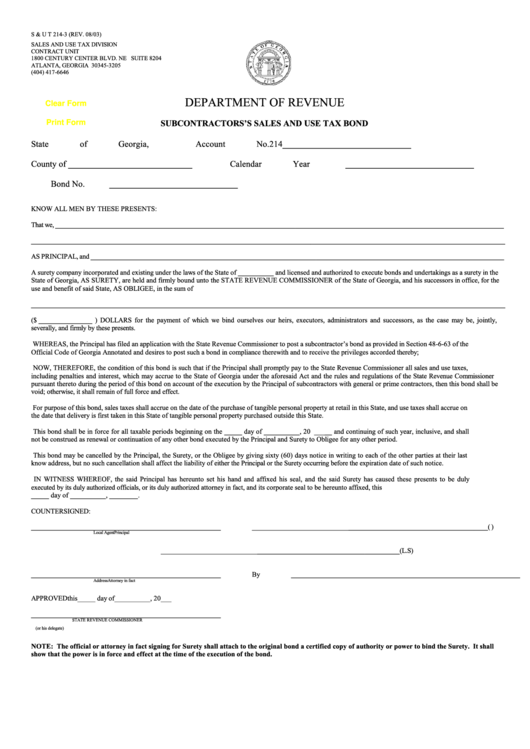

S & U T 214-3 (REV. 08/03)

SALES AND USE TAX DIVISION

CONTRACT UNIT

1800 CENTURY CENTER BLVD. NE SUITE 8204

ATLANTA, GEORGIA 30345-3205

(404) 417-6646

DEPARTMENT OF REVENUE

Clear Form

Print Form

SUBCONTRACTORS’S SALES AND USE TAX BOND

State of Georgia,

Account No.214_____________________________

County of ____________________________

Calendar Year _____________________________

Bond No.

_____________________________

KNOW ALL MEN BY THESE PRESENTS:

That we, _______________________________________________________________________________________________________________________________

______________________________________________________________________________________________________________________________________

AS PRINCIPAL, and _____________________________________________________________________________________________________________________

A surety company incorporated and existing under the laws of the State of __________ and licensed and authorized to execute bonds and undertakings as a surety in the

State of Georgia, AS SURETY, are held and firmly bound unto the STATE REVENUE COMMISSIONER of the State of Georgia, and his successors in office, for the

use and benefit of said State, AS OBLIGEE, in the sum of

_______________________________________________________________________________________________________________________________________

($ _______________ ) DOLLARS for the payment of which we bind ourselves our heirs, executors, administrators and successors, as the case may be, jointly,

severally, and firmly by these presents.

WHEREAS, the Principal has filed an application with the State Revenue Commissioner to post a subcontractor’s bond as provided in Section 48-6-63 of the

Official Code of Georgia Annotated and desires to post such a bond in compliance therewith and to receive the privileges accorded thereby;

NOW, THEREFORE, the condition of this bond is such that if the Principal shall promptly pay to the State Revenue Commissioner all sales and use taxes,

including penalties and interest, which may accrue to the State of Georgia under the aforesaid Act and the rules and regulations of the State Revenue Commissioner

pursuant thereto during the period of this bond on account of the execution by the Principal of subcontractors with general or prime contractors, then this bond shall be

void; otherwise, it shall remain of full force and effect.

For purpose of this bond, sales taxes shall accrue on the date of the purchase of tangible personal property at retail in this State, and use taxes shall accrue on

the date that delivery is first taken in this State of tangible personal property purchased outside this State.

This bond shall be in force for all taxable periods beginning on the _____ day of __________, 20 _____ and continuing of such year, inclusive, and shall

not be construed as renewal or continuation of any other bond executed by the Principal and Surety to Obligee for any other period.

This bond may be cancelled by the Principal, the Surety, or the Obligee by giving sixty (60) days notice in writing to each of the other parties at their last

know address, but no such cancellation shall affect the liability of either the Principal or the Surety occurring before the expiration date of such notice.

IN WITNESS WHEREOF, the said Principal has hereunto set his hand and affixed his seal, and the said Surety has caused these presents to be duly

executed by its duly authorized officials, or its duly authorized attorney in fact, and its corporate seal to be hereunto affixed, this

_____ day of __________, ________.

COUNTERSIGNED:

_____________________________________________________

__________________________________________________________________ (L.S.)

Local Agent

Principal

___________________________________________________________________(L.S)

_____________________________________________________

By ________________________________________________________________

Address

Attorney in fact

APPROVED this _____

day of __________, 20___

_____________________________________________________

STATE REVENUE COMMISSIONER

(or his delegate)

NOTE: The official or attorney in fact signing for Surety shall attach to the original bond a certified copy of authority or power to bind the Surety. It shall

show that the power is in force and effect at the time of the execution of the bond.

1

1