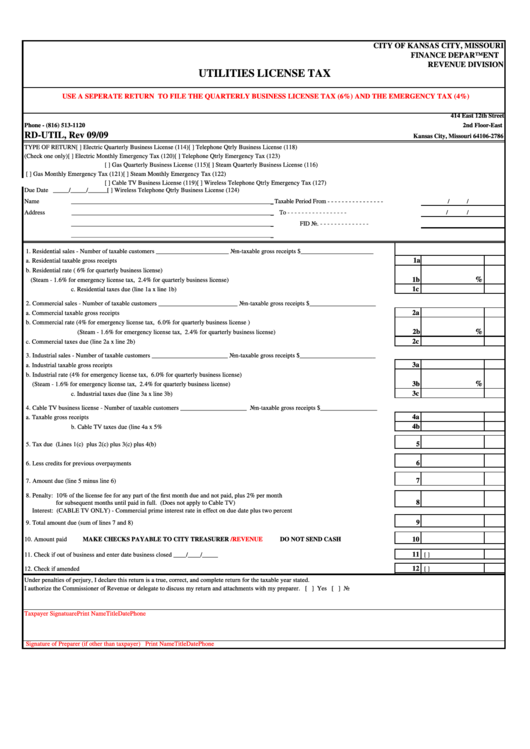

Form Rd-Util Utilities License Tax

ADVERTISEMENT

CITY OF KANSAS CITY, MISSOURI

FINANCE DEPARTMENT

REVENUE DIVISION

UTILITIES LICENSE TAX

USE A SEPERATE RETURN TO FILE THE QUARTERLY BUSINESS LICENSE TAX (6%) AND THE EMERGENCY TAX (4%)

414 East 12th Street

Phone - (816) 513-1120

2nd Floor-East

RD-UTIL, Rev 09/09

Kansas City, Missouri 64106-2786

TYPE OF RETURN

[ ] Electric Quarterly Business License (114)

[ ] Telephone Qtrly Business License (118)

(Check one only)

[ ] Electric Monthly Emergency Tax (120)

[ ] Telephone Qtrly Emergency Tax (123)

[ ] Gas Quarterly Business License (115)

[ ] Steam Quarterly Business License (116)

[ ] Gas Monthly Emergency Tax (121)

[ ] Steam Monthly Emergency Tax (122)

[ ] Cable TV Business License (119)

[ ] Wireless Telephone Qtrly Emergency Tax (127)

Due Date _____/_____/______

[ ] Wireless Telephone Qtrly Business License (124)

Name

_________________________________________________________________ Taxable Period

From - - - - - - - - - - - - - - - -

/

/

Address

_________________________________________________________________

To - - - - - - - - - - - - - - - - -

/

/

_________________________________________________________________

FID No. - - - - - - - - - - - - - -

_________________________________________________________________

1. Residential sales - Number of taxable customers _______________________ Non-taxable gross receipts $_______________________

1a

a. Residential taxable gross receipts

b. Residential rate ( 6% for quarterly business license)

%

1b

(Steam - 1.6% for emergency license tax, 2.4% for quarterly business license)

1c

c. Residential taxes due (line 1a x line 1b)

2. Commercial sales - Number of taxable customers _________________________ Non-taxable gross receipts $_____________________

2a

a. Commercial taxable gross receipts

b. Commercial rate (4% for emergency license tax, 6.0% for quarterly business license )

%

2b

(Steam - 1.6% for emergency license tax, 2.4% for quarterly business license)

2c

c. Commercial taxes due (line 2a x line 2b)

3. Industrial sales - Number of taxable customers ________________________ Non-taxable gross receipts $________________________

3a

a. Industrial taxable gross receipts

b. Industrial rate (4% for emergency license tax, 6.0% for quarterly business license)

%

3b

(Steam - 1.6% for emergency license tax, 2.4% for quarterly business license)

3c

c. Industrial taxes due (line 3a x line 3b)

4. Cable TV business license - Number of taxable customers _____________________ Non-taxable gross receipts $__________________

4a

a. Taxable gross receipts

4b

b. Cable TV taxes due (line 4a x 5%

5

5. Tax due (Lines 1(c) plus 2(c) plus 3(c) plus 4(b)

6

6. Less credits for previous overpayments

7

7. Amount due (line 5 minus line 6)

8. Penalty: 10% of the license fee for any part of the first month due and not paid, plus 2% per month

8

for subsequent months until paid in full. (Does not apply to Cable TV)

Interest: (CABLE TV ONLY) - Commercial prime interest rate in effect on due date plus two percent

9

9. Total amount due (sum of lines 7 and 8)

10

10. Amount paid

MAKE CHECKS PAYABLE TO CITY TREASURER

/REVENUE

DO NOT SEND CASH

11

11. Check if out of business and enter date business closed ____/____/_____

[ ]

12

12. Check if amended

[ ]

Under penalties of perjury, I declare this return is a true, correct, and complete return for the taxable year stated.

I authorize the Commissioner of Revenue or delegate to discuss my return and attachments with my preparer. [ ] Yes [ ] No

Taxpayer Signatuare

Print Name

Title

Date

Phone

Signature of Preparer (if other than taxpayer)

Print Name

Title

Date

Phone

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1