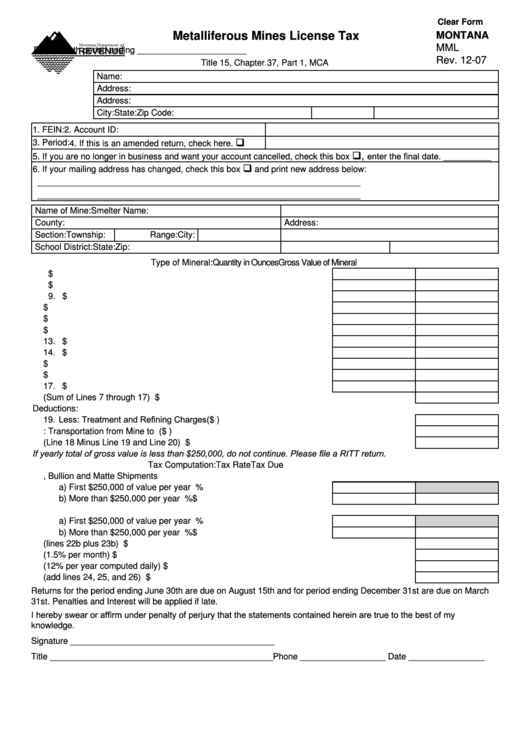

Clear Form

Metalliferous Mines License Tax

MONTANA

MML

For 6-month period ending _______________________

Rev. 12-07

Title 15, Chapter 37, Part 1, MCA

Name:

Address:

Address:

City:

State:

Zip Code:

1. FEIN:

2. Account ID:

q

3. Period:

4. If this is an amended return, check here.

q,

enter the final date. __________

5. If you are no longer in business and want your account cancelled, check this box

q

6. If your mailing address has changed, check this box

and print new address below:

____________________________________________________________________

____________________________________________________________________

Name of Mine:

Smelter Name:

County:

Address:

Section:

Township:

Range:

City:

School District:

State:

Zip:

Type of Mineral:

Quantity in Ounces

Gross Value of Mineral

7. Copper .................................................................................................7.

oz $

8. Gold .....................................................................................................8.

oz $

9. Lead.....................................................................................................9.

oz $

10. Molybdenum ......................................................................................10.

oz $

11. Nickel ................................................................................................. 11.

oz $

12. Palladium ...........................................................................................12.

oz $

13. Platinum.............................................................................................13.

oz $

14. Silver..................................................................................................14.

oz $

15. Zinc ....................................................................................................15.

oz $

16. Rhodium ............................................................................................16.

oz $

17. Other..................................................................................................17.

oz $

18. Total Gross Value (Sum of Lines 7 through 17) ................................................................... 18. $

Deductions:

19. Less: Treatment and Refining Charges ............................................................................... 19. ($

)

20. Less: Transportation from Mine to Smelter.......................................................................... 20. ($

)

21. Merchantable Value (Line 18 Minus Line 19 and Line 20) .................................................. 21. $

If yearly total of gross value is less than $250,000, do not continue. Please file a RITT return.

Tax Computation:

Tax Rate

Tax Due

22. Dore, Bullion and Matte Shipments

a) First $250,000 of value per year .................................................22a.

0%

b) More than $250,000 per year ......................................................22b.

1.6%

$

23. Concentrate or Crude Ore Shipments

a) First $250,000 of value per year .................................................23a.

0%

b) More than $250,000 per year ......................................................23b.

1.81%

$

24. Tax Due (lines 22b plus 23b) ............................................................................................... 24. $

25. Late Pay Penalty (1.5% per month)..................................................................................... 25. $

26. Interest (12% per year computed daily)............................................................................... 26. $

27. Total Amount Due (add lines 24, 25, and 26) ...................................................................... 27. $

Returns for the period ending June 30th are due on August 15th and for period ending December 31st are due on March

31st. Penalties and Interest will be applied if late.

I hereby swear or affirm under penalty of perjury that the statements contained herein are true to the best of my

knowledge.

Signature ___________________________________________

Title _______________________________________________ Phone __________________ Date ________________

1

1 2

2 3

3