A Homeowner'S Guide To Property Tax In Kansas (Form Pv-Ec-153)

ADVERTISEMENT

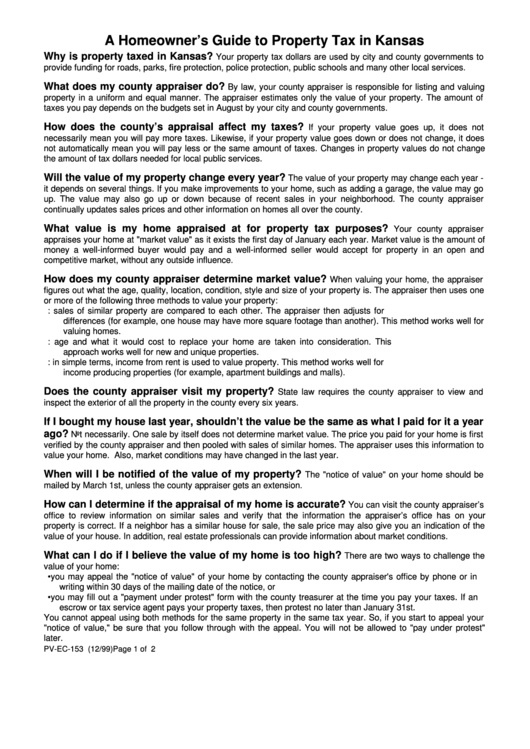

A Homeowner’s Guide to Property Tax in Kansas

Why is property taxed in Kansas?

Your property tax dollars are used by city and county governments to

provide funding for roads, parks, fire protection, police protection, public schools and many other local services.

What does my county appraiser do?

By law, your county appraiser is responsible for listing and valuing

property in a uniform and equal manner. The appraiser estimates only the value of your property. The amount of

taxes you pay depends on the budgets set in August by your city and county governments.

How does the county’s appraisal affect my taxes?

If your property value goes up, it does not

necessarily mean you will pay more taxes. Likewise, if your property value goes down or does not change, it does

not automatically mean you will pay less or the same amount of taxes. Changes in property values do not change

the amount of tax dollars needed for local public services.

Will the value of my property change every year?

The value of your property may change each year -

it depends on several things. If you make improvements to your home, such as adding a garage, the value may go

up. The value may also go up or down because of recent sales in your neighborhood. The county appraiser

continually updates sales prices and other information on homes all over the county.

What value is my home appraised at for property tax purposes?

Your county appraiser

appraises your home at "market value" as it exists the first day of January each year. Market value is the amount of

money a well-informed buyer would pay and a well-informed seller would accept for property in an open and

competitive market, without any outside influence.

How does my county appraiser determine market value?

When valuing your home, the appraiser

figures out what the age, quality, location, condition, style and size of your property is. The appraiser then uses one

or more of the following three methods to value your property:

1. The Market Approach: sales of similar property are compared to each other. The appraiser then adjusts for

differences (for example, one house may have more square footage than another). This method works well for

valuing homes.

2. The Cost Approach: age and what it would cost to replace your home are taken into consideration. This

approach works well for new and unique properties.

3. The Income Approach: in simple terms, income from rent is used to value property. This method works well for

income producing properties (for example, apartment buildings and malls).

Does the county appraiser visit my property?

State law requires the county appraiser to view and

inspect the exterior of all the property in the county every six years.

If I bought my house last year, shouldn’t the value be the same as what I paid for it a year

ago?

Not necessarily. One sale by itself does not determine market value. The price you paid for your home is first

verified by the county appraiser and then pooled with sales of similar homes. The appraiser uses this information to

value your home. Also, market conditions may have changed in the last year.

When will I be notified of the value of my property?

The "notice of value" on your home should be

mailed by March 1st, unless the county appraiser gets an extension.

How can I determine if the appraisal of my home is accurate?

You can visit the county appraiser’s

office to review information on similar sales and verify that the information the appraiser’s office has on your

property is correct. If a neighbor has a similar house for sale, the sale price may also give you an indication of the

value of your house. In addition, real estate professionals can provide information about market conditions.

What can I do if I believe the value of my home is too high?

There are two ways to challenge the

value of your home:

•

you may appeal the "notice of value" of your home by contacting the county appraiser's office by phone or in

writing within 30 days of the mailing date of the notice, or

•

you may fill out a "payment under protest" form with the county treasurer at the time you pay your taxes. If an

escrow or tax service agent pays your property taxes, then protest no later than January 31st.

You cannot appeal using both methods for the same property in the same tax year. So, if you start to appeal your

"notice of value," be sure that you follow through with the appeal. You will not be allowed to "pay under protest"

later.

PV-EC-153 (12/99)

Page 1 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2