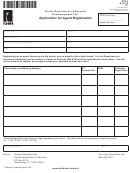

Form Ta-2 - Application For Additional Registration Page 2

ADVERTISEMENT

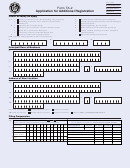

Tax Type Information

Withholding

Mo

Day

Yr

21. Date you were first required to withhold

22. Number of employees

taxes at this location.

in Massachusetts:

Sales/Use Tax on Goods

Mo

Day

Yr

23. Date you were first required to collect

sales/use tax at this location.

24. Check here if your business location is within the Convention Center Financing District:

(see pages 24–26 of instructions).

25. Check here if your business location is within a hotel, motel or other lodging establishment in Boston or Cambridge:

Sales/Use Tax on Telecommunications Services

Mo

Day

Yr

26. Date you were first required to collect sales/use tax

on telecommunications services at this location.

27. Check here if your business location is within the Convention Center Financing District:

(see pages 24–26 of instructions).

28. Check here if your business location is within a hotel, motel or other lodging establishment in Boston or Cambridge:

Meals Tax on Food and All Beverages

29. Check if you serve:

Food

Beer

Wine

Alc. Bev.

30. Check if food/beverage vending machine:

31. Date you were first required to collect

Mo

Day

Yr

meals tax.

32. Name and address

on liquor license

33. Seating capacity:

at this location.

34. Check here if your business location is within the Convention Center Financing District:

(see pages 24–26 of instructions).

35. Check here if your business location is within a hotel, motel or other lodging establishment in Boston or Cambridge:

Room Occupancy

Mo

Day

Yr

Locality code

36. Date you were first required to collect room occupancy tax.

37.

38. Number of rooms:

Use Tax Purchaser

Mo

Day

Yr

39. Date you were first required to pay use tax.

Convention Center Financing Surcharges

Mo

Day

Yr

40. Date you were first required to collect: a. Boston Sightseeing Tour Surcharge

Mo

Day

Yr

b. Boston Vehicular Rental Transaction Surcharge

Mo

Day

Yr

c. Parking Facilities Surcharge in Boston, Springfield and/or Worcester

Cigar and Smoking Tobacco Excise

Mo

Day

Yr

41. Date you were first required to collect cigar and smoking tobacco excise.

Mail to: Massachusetts Department of Revenue, Data Integration Bureau, PO Box 7022, Boston, MA 02204.

I hereby certify that the statements made herein have been examined by me and are, to the best of my knowledge and belief, true and correct. Signed

under the pains and penalties of perjury. The signing of this application is evidence that you may be individually and personally responsible for any sums

required to be paid to the Commonwealth, under MGL, Chapters 62B, Sec. 5; 64G, Sec. 7B; 64H, Sec. 16 and 64I, Sec. 17.

Your signature

Title

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2