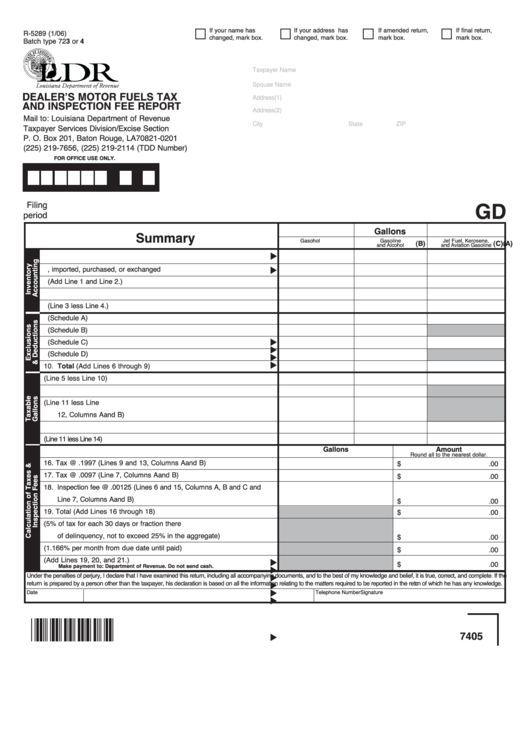

If your name has

If your address has

If amended return,

If final return,

R-5289 (1/06)

changed, mark box.

changed, mark box.

mark box.

mark box.

Batch type 723 or 4

Taxpayer Name

Spouse Name

DEALER’S MOTOR FUELS TAX

Address(1)

AND INSPECTION FEE REPORT

Address(2)

Mail to: Louisiana Department of Revenue

City

State

ZIP

Taxpayer Services Division/Excise Section

P. O. Box 201, Baton Rouge, LA 70821-0201

(225) 219-7656, (225) 219-2114 (TDD Number)

FOR OFFICE USE ONLY.

Filing

GD

period

Gallons

Summary

Gasohol

Gasoline

Jet Fuel, Kerosene,

(A)

(B)

(C)

and Alcohol

and Aviation Gasoline

1. Actual inventory at beginning of month

2. Manufactured, imported, purchased, or exchanged

3. Total (Add Line 1 and Line 2.)

4. Actual inventory at end of month

5. Gross gallonage to be accounted for (Line 3 less Line 4.)

6. Motor fuel tax exempt sales subject to inspection fee (Schedule A)

7. Motor fuel partial taxable sales subject to inspection fee (Schedule B)

8. Motor fuel tax and inspection fee exempt sales (Schedule C)

9. Motor fuel taxable sales not subject to inspection fee (Schedule D)

10. Total (Add Lines 6 through 9)

11. Gross gallons including own use (Line 5 less Line 10)

12. Gallons of tax paid motor fuel

13. Net taxable gallons subject to motor fuel tax (Line 11 less Line

12, Columns A and B)

14. Gallons of inspection fee paid

15. Net taxable gallons subject to inspection fee (Line 11 less Line 14)

Gallons

Amount

Round all to the nearest dollar.

16. Tax @ .1997 (Lines 9 and 13, Columns A and B)

$

.00

17. Tax @ .0097 (Line 7, Columns A and B)

$

.00

18. Inspection fee @ .00125 (Lines 6 and 15, Columns A, B and C and

Line 7, Columns A and B)

$

.00

19. Total (Add Lines 16 through 18)

$

.00

20. Delinquent penalty (5% of tax for each 30 days or fraction there

of delinquency, not to exceed 25% in the aggregate)

$

.00

21. Interest (1.166% per month from due date until paid)

$

.00

22. Total amount due (Add Lines 19, 20, and 21.)

$

.00

Make payment to: Department of Revenue.

Do not send cash.

Under the penalties of perjury, I declare that I have examined this return, including all accompanying documents, and to the best of my knowledge and belief, it is true, correct, and complete. If the

return is prepared by a person other than the taxpayer, his declaration is based on all the information relating to the matters required to be reported in the return of which he has any knowledge.

Date

Signature

Telephone Number

7405

1

1 2

2 3

3 4

4