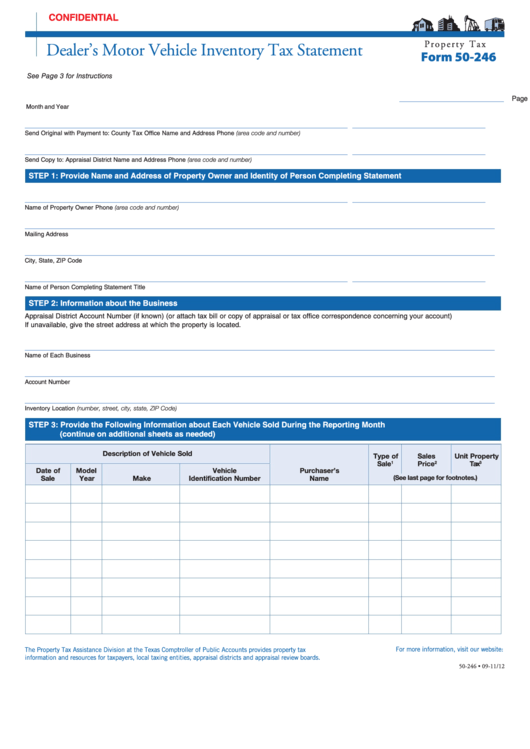

CONFIDENTIAL

P r o p e r t y T a x

Dealer’s Motor Vehicle Inventory Tax Statement

Form 50-246

See Page 3 for Instructions

______________________

________

_______

Page

of pages

Month and Year

____________________________________________________________________

____________________________

Send Original with Payment to: County Tax Office Name and Address

Phone (area code and number)

____________________________________________________________________

____________________________

Phone (area code and number)

Send Copy to: Appraisal District Name and Address

STEP 1: Provide Name and Address of Property Owner and Identity of Person Completing Statement

____________________________________________________________________

____________________________

Name of Property Owner

Phone (area code and number)

___________________________________________________________________________________________________

Mailing Address

___________________________________________________________________________________________________

City, State, ZIP Code

____________________________________________________________________

____________________________

Name of Person Completing Statement

Title

STEP 2: Information about the Business

Appraisal District Account Number (if known) (or attach tax bill or copy of appraisal or tax office correspondence concerning your account)

If unavailable, give the street address at which the property is located.

___________________________________________________________________________________________________

Name of Each Business

___________________________________________________________________________________________________

Account Number

___________________________________________________________________________________________________

Inventory Location (number, street, city, state, ZIP Code)

STEP 3: Provide the Following Information about Each Vehicle Sold During the Reporting Month

(continue on additional sheets as needed)

Description of Vehicle Sold

Type of

Sales

Unit Property

Sale

Price

Tax

1

2

3

Date of

Model

Vehicle

Purchaser’s

(See last page for footnotes.)

Sale

Year

Make

Identification Number

Name

The Property Tax Assistance Division at the Texas Comptroller of Public Accounts provides property tax

For more information, visit our website:

information and resources for taxpayers, local taxing entities, appraisal districts and appraisal review boards.

50-246 • 09-11/12

1

1 2

2 3

3