Form Ct-W3 Draft - Connecticut Annual Reconciliation Of Withholding

ADVERTISEMENT

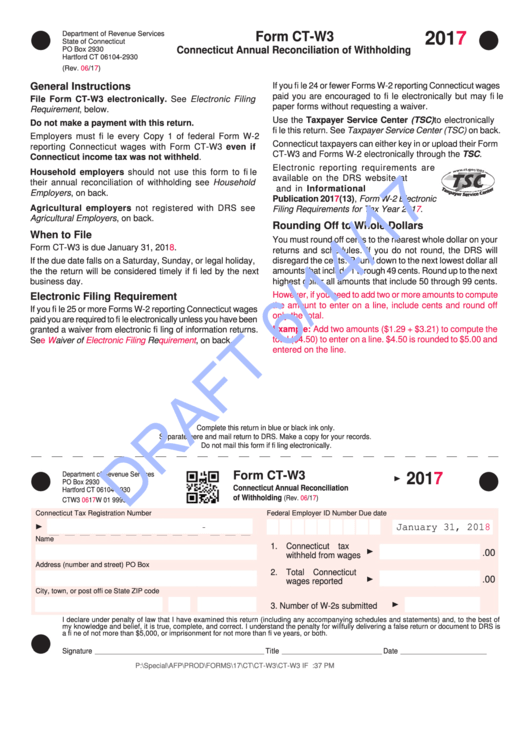

Department of Revenue Services

Form CT-W3

2017

State of Connecticut

Connecticut Annual Reconciliation of Withholding

PO Box 2930

Hartford CT 06104-2930

(Rev. 06/17)

General Instructions

If you fi le 24 or fewer Forms W-2 reporting Connecticut wages

paid you are encouraged to fi le electronically but may fi le

File Form CT-W3 electronically. See Electronic Filing

paper forms without requesting a waiver.

Requirement, below.

Use the Taxpayer Service Center (TSC) to electronically

Do not make a payment with this return.

fi le this return. See Taxpayer Service Center (TSC) on back.

Employers must fi le every Copy 1 of federal Form W-2

Connecticut taxpayers can either key in or upload their Form

reporting Connecticut wages with Form CT-W3 even if

CT-W3 and Forms W-2 electronically through the TSC.

Connecticut income tax was not withheld.

Electronic reporting requirements are

Household employers should not use this form to fi le

available on the DRS website at www.

their annual reconciliation of withholding see Household

ct.gov/DRS/ew2 and in Informational

Employers, on back.

Publication 2017(13), Form W-2 Electronic

Agricultural employers not registered with DRS see

Filing Requirements for Tax Year 2017.

Agricultural Employers, on back.

Rounding Off to Whole Dollars

When to File

You must round off cents to the nearest whole dollar on your

Form CT-W3 is due January 31, 2018.

returns and schedules. If you do not round, the DRS will

If the due date falls on a Saturday, Sunday, or legal holiday,

disregard the cents. Round down to the next lowest dollar all

amounts that include 1 through 49 cents. Round up to the next

the the return will be considered timely if fi led by the next

business day.

highest dollar all amounts that include 50 through 99 cents.

However, if you need to add two or more amounts to compute

Electronic Filing Requirement

the amount to enter on a line, include cents and round off

If you fi le 25 or more Forms W-2 reporting Connecticut wages

only the total.

paid you are required to fi le electronically unless you have been

Example: Add two amounts ($1.29 + $3.21) to compute the

granted a waiver from electronic fi ling of information returns.

total ($4.50) to enter on a line. $4.50 is rounded to $5.00 and

See

Waiver of

Electronic Filing

Requirement, on back.

entered on the line.

Complete this return in blue or black ink only.

Separate here and mail return to DRS. Make a copy for your records.

Do not mail this form if fi ling electronically.

Form CT-W3

Department of Revenue Services

2017

PO Box 2930

Connecticut Annual Reconciliation

Hartford CT 06104-2930

of Withholding

(Rev. 06/17)

CTW3 0617W 01 9999

Connecticut Tax Registration Number

Federal Employer ID Number

Due date

January 31,

2018

Name

1. Connecticut tax

.00

withheld from wages

Address (number and street)

PO Box

2. Total Connecticut

.00

wages reported

City, town, or post offi ce

State

ZIP code

3. Number of W-2s submitted

I declare under penalty of law that I have examined this return (including any accompanying schedules and statements) and, to the best of

my knowledge and belief, it is true, complete, and correct. I understand the penalty for willfully delivering a false return or document to DRS is

a fi ne of not more than $5,000, or imprisonment for not more than fi ve years, or both.

Signature

Title

Date

_____________________________________________________________

____________________________________

_______________________________

P:\Special\AFP\PROD\FORMS\17\CT\CT-W3\CT-W3 IF 20170605.indd

20170605

12:37 PM

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2