Seller'S Monthly Sales Tax Return Form - Alaska

ADVERTISEMENT

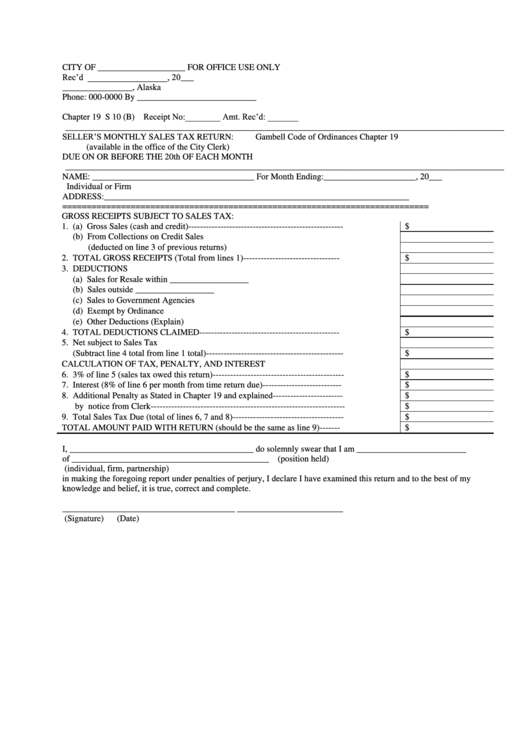

CITY OF ____________________

FOR OFFICE USE ONLY

Rec’d __________________, 20___

P.O. Box _____

________________, Alaska

Phone: 000-0000

By ___________________________

Receipt No:________ Amt. Rec’d: _______

Chapter 19

S 10 (B)

___________________________________________________________________________________________________

SELLER’S MONTHLY SALES TAX RETURN:

Gambell Code of Ordinances Chapter 19

(available in the office of the City Clerk)

DUE ON OR BEFORE THE 20th OF EACH MONTH

___________________________________________________________________________________________________

NAME: _____________________________________

For Month Ending:_____________________, 20___

Individual or Firm

ADDRESS:_____________________________________________________________________

===========================================================================

GROSS RECEIPTS SUBJECT TO SALES TAX:

1. (a) Gross Sales (cash and credit)-----------------------------------------------------

$

(b) From Collections on Credit Sales

(deducted on line 3 of previous returns)

2. TOTAL GROSS RECEIPTS (Total from lines 1)---------------------------------

$

3. DEDUCTIONS

(a) Sales for Resale within __________________

(b) Sales outside __________________

(c) Sales to Government Agencies

(d) Exempt by Ordinance

(e) Other Deductions (Explain)

4. TOTAL DEDUCTIONS CLAIMED------------------------------------------------

$

5. Net subject to Sales Tax

(Subtract line 4 total from line 1 total)-----------------------------------------------

$

CALCULATION OF TAX, PENALTY, AND INTEREST

6. 3% of line 5 (sales tax owed this return)---------------------------------------------

$

7. Interest (8% of line 6 per month from time return due)---------------------------

$

8. Additional Penalty as Stated in Chapter 19 and explained------------------------

$

by notice from Clerk------------------------------------------------------------------

$

9. Total Sales Tax Due (total of lines 6, 7 and 8)--------------------------------------

$

TOTAL AMOUNT PAID WITH RETURN (should be the same as line 9)-------

$

I, __________________________________________ do solemnly swear that I am _________________________

of _____________________________________________

(position held)

(individual, firm, partnership)

in making the foregoing report under penalties of perjury, I declare I have examined this return and to the best of my

knowledge and belief, it is true, correct and complete.

_______________________________________

________________________

(Signature)

(Date)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1