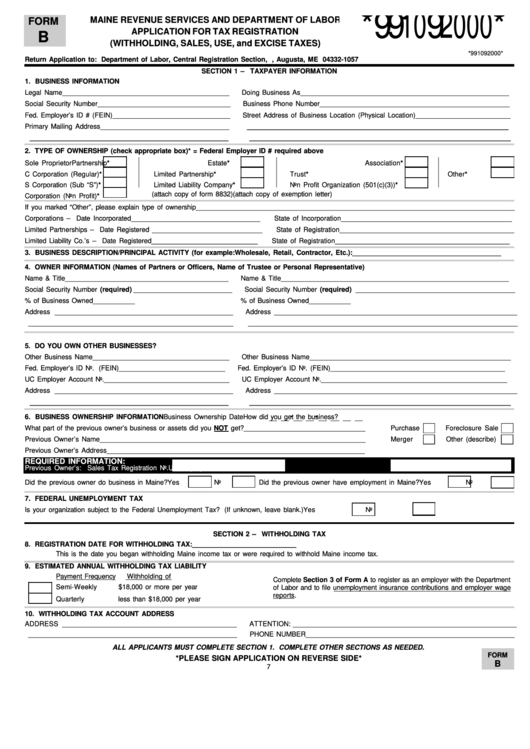

Form B - Application For Tax Registration (Withholding, Sales, Use, And Excise Taxes)

ADVERTISEMENT

*991092000*

MAINE REVENUE SERVICES AND DEPARTMENT OF LABOR

FORM

APPLICATION FOR TAX REGISTRATION

B

(WITHHOLDING, SALES, USE, and EXCISE TAXES)

*991092000*

Return Application to: Department of Labor, Central Registration Section, P.O. Box 1057, Augusta, ME 04332-1057

SECTION 1 — TAXPAYER INFORMATION

1. BUSINESS INFORMATION

Legal Name ____________________________________________

Doing Business As _______________________________________________________

Social Security Number ___________________________________

Business Phone Number __________________________________________________

Fed. Employer’ s ID # (FEIN) _______________________________

Street Address of Business Location (Physical Location) _________________________

__________________________________________________

Primary Mailing Address __________________________________

______________________________________

__________________________________________________

2. TYPE OF OWNERSHIP (check appropriate box)

* = Federal Employer ID # required above

Sole Proprietor

Partnership*

Estate*

Association*

C Corporation (Regular)*

Limited Partnership*

Trust*

Other*

S Corporation (Sub “ S” )*

Limited Liability Company*

Non Profit Organization (501(c)(3))*

(attach copy of form 8832)

(attach copy of exemption letter)

Corporation (Non Profit)*

If you marked “ Other” , please explain type of ownership ____________________________________________________________________________________

Corporations — Date Incorporated __________________________________

State of Incorporation _____________________________________________

Limited Partnerships — Date Registered _____________________________

State of Registration ______________________________________________

Limited Liability Co.’ s — Date Registered ____________________________

State of Registration ______________________________________________

3. BUSINESS DESCRIPTION/PRINCIPAL ACTIVITY (for example: Wholesale, Retail, Contractor, Etc.): ________________________________________

4. OWNER INFORMATION (Names of Partners or Officers, Name of Trustee or Personal Representative)

Name & Title ___________________________________________

Name & Title ____________________________________________________________

Social Security Number (required) __________________________

Social Security Number (required) __________________________________________

% of Business Owned ___________

% of Business Owned ___________

Address _______________________________________________

Address ________________________________________________________________

______________________________________________________

_______________________________________________________________________

5. DO YOU OWN OTHER BUSINESSES?

Other Business Name ____________________________________

Other Business Name _____________________________________________________

Fed. Employer’ s ID No. (FEIN) ____________________________

Fed. Employer’ s ID No. (FEIN) ______________________________________________

UC Employer Account No. _________________________________

UC Employer Account No. _________________________________________________

Address _______________________________________________

Address ________________________________________________________________

______________________________________

__________________________________________________

-

-

6. BUSINESS OWNERSHIP INFORMATION

Business Ownership Date

How did you get the business?

What part of the previous owner’ s business or assets did you NOT get? ________________________________

Purchase

Foreclosure Sale

Previous Owner’ s Name ______________________________________________________________________

Merger

Other (describe)

Previous Owner’ s Address ____________________________________________________________________

REQUIRED INFORMATION:

Previous Owner’ s: Sales Tax Registration No.

UC Employer Account No.

Did the previous owner do business in Maine? Yes

No

Did the previous owner have employment in Maine? Yes

No

7. FEDERAL UNEMPLOYMENT TAX

Is your organization subject to the Federal Unemployment Tax? (If unknown, leave blank.)

Yes

No

SECTION 2 — WITHHOLDING TAX

8. REGISTRATION DATE FOR WITHHOLDING TAX: ____________________________

This is the date you began withholding Maine income tax or were required to withhold Maine income tax.

9. ESTIMATED ANNUAL WITHHOLDING TAX LIABILITY

Payment Frequency

Withholding of

Complete Section 3 of Form A to register as an employer with the Department

Semi-Weekly

$18,000 or more per year

of Labor and to file unemployment insurance contributions and employer wage

reports.

Quarterly

less than $18,000 per year

10. WITHHOLDING TAX ACCOUNT ADDRESS

ADDRESS ______________________________________________

ATTENTION: ___________________________________________________________

_______________________________________________________

PHONE NUMBER _______________________________________________________

ALL APPLICANTS MUST COMPLETE SECTION 1. COMPLETE OTHER SECTIONS AS NEEDED.

FORM

*PLEASE SIGN APPLICATION ON REVERSE SIDE*

B

7

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4