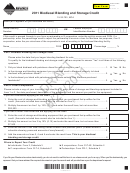

Form BBSC General Instructions

for blending during a tax year, no credit can be claimed for

What is “biodiesel”?

the tax year.

Biodiesel is a fuel produced from monoalkyl esters of long-

chain fatty acids derived from vegetable oils, renewable

Am I required to recapture my credit that I previously

lipids, animal fats, or any combination of these ingredients.

received if I cease operating my business?

This fuel must meet the requirements of ASTM D6751, also

Yes, you are. If you cease blending biodiesel with

known as the Standard Specifi cation for Biodiesel Fuel

petroleum diesel for sale for 12 continuous months, within

(B-100) Blend Stock for Distillate Fuels, as adopted by the

fi ve years from the year that you initially claimed the credit,

American Society for Testing and Materials.

or if your blended biodiesel sales were less than 2% of

your total diesel sales by the end of your third year, you

I purchased equipment to begin blending biodiesel

are required to recapture your credit in the year you cease

with petroleum diesel in a prior year but I have just

blending or at the end of your third year if your sales were

begun blending the fuel for sale this year. Am I eligible

less than 2% of total diesel sales.

for the biodiesel blending and storage credit?

Yes, you are. The credit is available in any year that you

How do I claim my credit when I am a partner or

blend biodiesel with petroleum diesel for the purpose of

shareholder in a partnership or an S corporation that

resale. If you purchased the equipment in the two tax years

invested in the depreciable property used for storing or

before you began blending the biodiesel and the petroleum

blending biodiesel with petroleum diesel?

diesel, you can use the costs from those years to calculate

Your partnership or S corporation will report the credit on its

your current tax year biodiesel blending and storage credit.

informational tax return and provide you with your share of

the credit on Montana Schedule K-1.

What costs do I use to calculate my biodiesel blending

and storage credit?

If you are a partner, your share of the credit is based on

The costs used to calculate your credit are the amounts

the same proportion used by you to report your income or

that you have invested in depreciable property that is used

loss from the partnership for Montana tax purposes unless

for storing or blending biodiesel with petroleum diesel for

the partners have an agreement providing for a different

sale.

allocation. If you are a shareholder, your share of the credit

is based on the pro rata share of the corporation’s cost of

If I am claiming the biodiesel blending and storage

investing in the biodiesel blending facility.

credit, can I also deduct the annual depreciation on my

For example, if your business is an S corporation with

investment?

four shareholders with equal ownership interest, each

Yes, you can. This credit is not in lieu of any depreciation

shareholder would be entitled to 25% of the total credit.

or amortization deduction that you are allowed for your

investment.

What information do I have to include with my tax

return when I claim this credit?

What requirements do I have to meet in order to qualify

Individuals and C corporations fi ling paper returns must

for the biodiesel blending and storage credit?

include a completed Form BBSC. Partnerships and S

In order for you to qualify for this credit, the following

corporations fi ling paper information returns must include

requirements have to be met:

a separate statement identifying each owner and his or

• Your investment is for depreciable property that is used

her proportionate share, in addition to a completed Form

primarily to blend biodiesel that is made entirely from

BBSC.

Montana-produced feedstocks.

Questions? Please call us toll free at (866) 859-2254 (in

• You blended biodiesel with petroleum diesel for sale

Helena, 444-6900).

during the current tax year.

• Your storage and blending equipment purchased is used

in Montana primarily to blend biodiesel for sale.

• You anticipate that your sales of biodiesel will be at least

2% of your total diesel sales by the end of the third year

following the initial year you claim the credit.

• You are an owner, contract purchaser, or lessee who has

a benefi cial interest in a business that blends biodiesel.

If the credit exceeds my tax liability, can I carry any

excess credit to another tax year?

Yes, you can carry forward unused credit for up to seven

years. However, if you are not blending or storing biodiesel

1

1 2

2