1

1

2

1 2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

84

85

3

3

MONTANA

4

4

Clear Form

BBSC

5

5

Rev 04 14

6

6

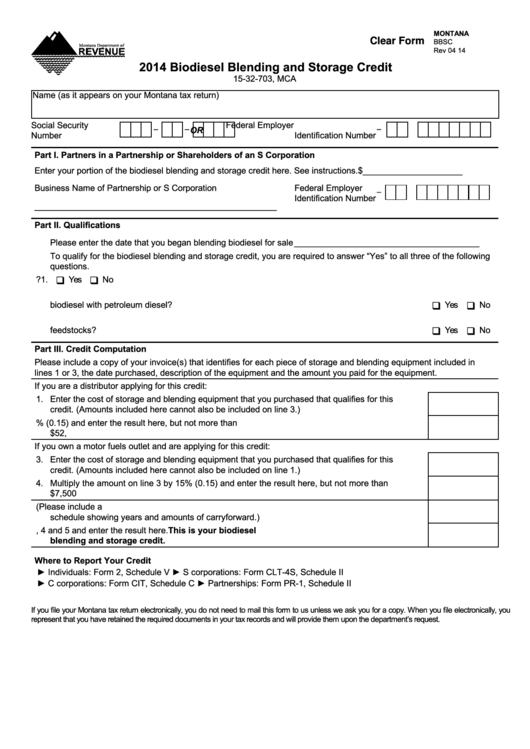

2014 Biodiesel Blending and Storage Credit

7

7

8

8

15-32-703, MCA

9

9

Name (as it appears on your Montana tax return)

10

10

100

11

11

12

12

Social Security

Federal Employer

-

-

-

110

120

13

X X X X X X X X X

X X X X X X X X X

13

OR

Number

Identification Number

14

14

15

15

Part I. Partners in a Partnership or Shareholders of an S Corporation

16

16

150

17

Enter your portion of the biodiesel blending and storage credit here. See instructions.

$_____________________

17

18

18

Business Name of Partnership or S Corporation

Federal Employer

140

-

19

19

Identification Number

130

20

20

___________________________________________________

21

21

22

22

Part II. Qualifications

23

23

160

Please enter the date that you began blending biodiesel for sale _______________________________________

24

24

25

25

To qualify for the biodiesel blending and storage credit, you are required to answer “Yes” to all three of the following

26

26

questions.

170

27

27

1. Did you blend biodiesel with petroleum diesel for sale during this year? ....................................... 1.

Yes

No

q

q

28

28

2. Is the storage and blending equipment you purchased used in Montana primarily to blend

29

29

180

biodiesel with petroleum diesel?..................................................................................................... 2.

Yes

No

30

30

q

q

31

31

3. Is the biodiesel you blend with petroleum diesel made entirely from Montana-produced

190

32

32

feedstocks? .................................................................................................................................... 3.

Yes

No

q

q

33

33

34

34

Part III. Credit Computation

35

35

Please include a copy of your invoice(s) that identifies for each piece of storage and blending equipment included in

36

36

lines 1 or 3, the date purchased, description of the equipment and the amount you paid for the equipment.

37

37

If you are a distributor applying for this credit:

38

38

39

39

1. Enter the cost of storage and blending equipment that you purchased that qualifies for this

200

40

40

credit. (Amounts included here cannot also be included on line 3.) ............................................... 1.

41

41

2. Multiply the amount on line 1 by 15% (0.15) and enter the result here, but not more than

210

42

42

$52,500........................................................................................................................................... 2.

43

43

If you own a motor fuels outlet and are applying for this credit:

44

44

3. Enter the cost of storage and blending equipment that you purchased that qualifies for this

45

45

credit. (Amounts included here cannot also be included on line 1.) ............................................... 3.

220

46

46

47

47

4. Multiply the amount on line 3 by 15% (0.15) and enter the result here, but not more than

230

48

48

$7,500 ............................................................................................................................................ 4.

49

49

5. Enter the amount of tax credit being carried forward from previous years. (Please include a

240

50

50

schedule showing years and amounts of carryforward.) ................................................................ 5.

51

51

6. Add the amounts on lines 2, 4 and 5 and enter the result here. This is your biodiesel

52

52

250

blending and storage credit. ....................................................................................................... 6.

53

53

54

54

Where to Report Your Credit

55

55

► Individuals: Form 2, Schedule V

► S corporations: Form CLT-4S, Schedule II

56

56

► C corporations: Form CIT, Schedule C

► Partnerships: Form PR-1, Schedule II

57

57

58

58

59

59

If you file your Montana tax return electronically, you do not need to mail this form to us unless we ask you for a copy. When you file electronically, you

60

60

represent that you have retained the required documents in your tax records and will provide them upon the department’s request.

61

61

62

62

63

63

64

64

65

1

2

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

82

83

84 85

66

66

1

1 2

2