Application for Green Jobs Creation Tax Credit

Instructions

General Information

When to Submit Application

For taxable years beginning on and after January 1, 2010, but before

Form GJC and any supporting documentation must be completed

January 1, 2018, a $500 income tax credit is allowed for the creation

and mailed at least 90 days prior to the due date of your return. You

of “green” jobs paying an annual salary in excess of $50,000. Each

must apply each year you are eligible to earn credit for each job that

taxpayer is allowed a credit for up to 350 new green jobs. In order

is continuously filled (not to exceed 5 years).

to qualify for the tax credits, the taxpayer must have created the

Where to Submit Application

green job and filled it during the taxable year in which the credit is

Submit Form GJC and attachments to the Department of Taxation,

claimed. The credit is allowed for the taxable year in which the job

ATTN: Tax Credit Unit, P.O. Box 715, Richmond, VA 23218-0715

has been filled for at least 1 year and for each of the 4 succeeding

or fax it to (804) 774-3902.

taxable years provided that the job is continuously filled during the

respective taxable year. Any unused tax credits may be carried over

What Does the Taxpayer Need to Do

for 5 taxable years.

Upon receiving notification of the allowable credit amount, taxpayers

In order to qualify for the tax credit, the taxpayer must demonstrate

may claim the allowable credit amount on the applicable Virginia

that the green job was created by the taxpayer and the job was

income tax return and compute any carryover credit amount.

filled for the taxable year in which the credit is claimed.

IMPORTANT

“Green job” means employment in industries relating to the field

of renewable, alternative energies, including the manufacture

All business taxpayers should be registered with the Department

and operation of products used to generate electricity and other

before completing Form GJC. If you are not registered, complete

forms of energy from alternative sources that include hydrogen

Form R-1.

and fuel cell technology, landfill gas, geothermal heating

Taxpayers who do not receive notification of allowable credit amounts

systems, solar heating systems, hydropower systems, wind

before their Virginia income tax return due date may file during the

systems, and biomass and biofuel systems. The Secretary of

extension period or file their regular return without the credit and

Commerce and Trade is required to develop a detailed definition

then file an amended tax return after receipt of notification of the

and list of jobs that qualify for the credit. This information is

allowable credit amount to claim the tax credit.

available on the Secretary of Commerce and Trade’s website at

Pass-Through Entities

Each pass-through entity must file Form PTE with the Department

“Job” means employment of an indefinite duration of an individual

within 30 days after the credit is granted. This information should

whose primary work activity is related directly to the field of

be sent to: Department of Taxation, ATTN: Tax Credit Unit,

renewable, alternative energies and for which the standard fringe

P.O. Box 715, Richmond, VA 23218-0715 or you may fax it to

benefits are paid by the taxpayer, requiring a minimum of either

(804) 786-2800. Please do not do both.

(i) 35 hours of an employee’s time per week for the entire normal

year of such taxpayer’s operations, which “normal year” must

Credit must be allocated among owners in proportion to each owner’s

consist of at least 48 weeks, or (ii) 1,680 hours per year. Positions

percentage of ownership or participation in the pass-through entity.

created when a job function is shifted from an existing location in

All pass-through entities distributing this credit to their owners,

the Commonwealth do not qualify as a job.

shareholders, partners, or members must give each a Schedule VK-

Any credits granted to a partnership, limited liability company,

1, Owner’s Share of Income and Virginia Modifications and Credits.

or electing small business corporation (S corporation) must be

Where to Get Help

allocated to the individual partners, members, or shareholders,

respectively, in proportion to their ownership or interest in such

Write to the Virginia Department of Taxation, ATTN: Tax

business entities.

Credit Unit, P.O. Box 715, Richmond, VA 23218-0715 or call

(804) 786-2992.

If the taxpayer is eligible for the Green Jobs Creation Tax Credit and

creates green jobs in an enterprise zone, the taxpayer may also

qualify for the benefits under the Enterprise Zone Grant Program.

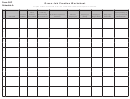

What to Enclose

Provide a copy of the W-2 for each eligible employee.

Guaranteed payments – provide a copy of the Schedule K-1

(Form 1065) and a statement indicating if the payments were for

services or the use of capital.

1

1 2

2 3

3