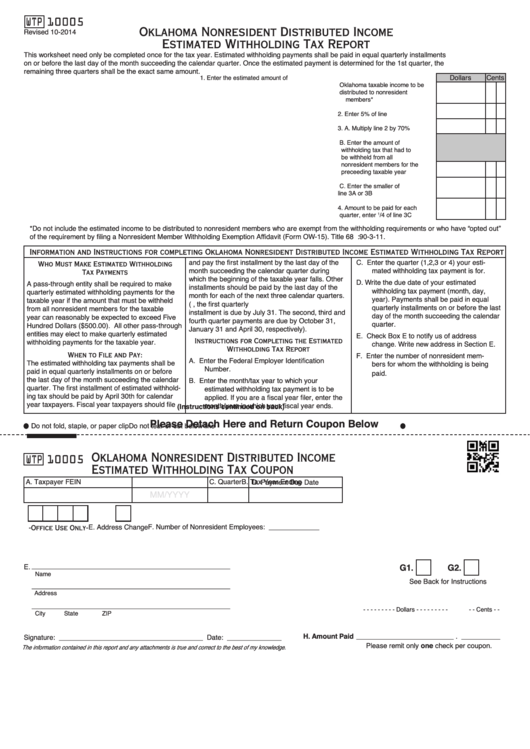

10005

WTP

Oklahoma Nonresident Distributed Income

Revised 10-2014

Estimated Withholding Tax Report

This worksheet need only be completed once for the tax year. Estimated withholding payments shall be paid in equal quarterly installments

on or before the last day of the month succeeding the calendar quarter. Once the estimated payment is determined for the 1st quarter, the

remaining three quarters shall be the exact same amount.

Dollars

Cents

1. Enter the estimated amount of

Oklahoma taxable income to be

distributed to nonresident

members*....................................

2. Enter 5% of line 1........................

3. A. Multiply line 2 by 70% .............

B. Enter the amount of

withholding tax that had to

be withheld from all

nonresident members for the

preceeding taxable year ........

C. Enter the smaller of

line 3A or 3B ..........................

4. Amount to be paid for each

quarter, enter

/4 of line 3C .........

1

*Do not include the estimated income to be distributed to nonresident members who are exempt from the withholding requirements or who have “opted out”

of the requirement by filing a Nonresident Member Withholding Exemption Affidavit (Form OW-15). Title 68 O.S. Section 2385.30 or Rule 710:90-3-11.

Information and Instructions for completing Oklahoma Nonresident Distributed Income Estimated Withholding Tax Report

and pay the first installment by the last day of the

C.

Enter the quarter (1,2,3 or 4) your esti-

Who Must Make Estimated Withholding

month succeeding the calendar quarter during

mated withholding tax payment is for.

Tax Payments

which the beginning of the taxable year falls. Other

D.

Write the due date of your estimated

A pass-through entity shall be required to make

installments should be paid by the last day of the

withholding tax payment (month, day,

quarterly estimated withholding payments for the

month for each of the next three calendar quarters.

year). Payments shall be paid in equal

taxable year if the amount that must be withheld

(i.e. Fiscal year begins in May, the first quarterly

quarterly installments on or before the last

from all nonresident members for the taxable

installment is due by July 31. The second, third and

day of the month succeeding the calendar

year can reasonably be expected to exceed Five

fourth quarter payments are due by October 31,

quarter.

Hundred Dollars ($500.00). All other pass-through

January 31 and April 30, respectively).

entities may elect to make quarterly estimated

E.

Check Box E to notify us of address

withholding payments for the taxable year.

Instructions for Completing the Estimated

change. Write new address in Section E.

Withholding Tax Report

When to File and Pay:

F.

Enter the number of nonresident mem-

A.

Enter the Federal Employer Identification

The estimated withholding tax payments shall be

bers for whom the withholding is being

Number.

paid in equal quarterly installments on or before

paid.

the last day of the month succeeding the calendar

B.

Enter the month/tax year to which your

quarter. The first installment of estimated withhold-

estimated withholding tax payment is to be

ing tax should be paid by April 30th for calendar

applied. If you are a fiscal year filer, enter the

year taxpayers. Fiscal year taxpayers should file

month/year in which your fiscal year ends.

(Instructions continued on back)

Please Detach Here and Return Coupon Below

Do not fold, staple, or paper clip

Do not tear or cut below line

Oklahoma Nonresident Distributed Income

WTP

10005

Estimated Withholding Tax Coupon

A. Taxpayer FEIN

B. Tax Year Ending

C. Quarter

D. Payment Due Date

MM/YYYY

E. Address Change

F. Number of Nonresident Employees: _____________

-Office Use Only-

___________________________________________________

G1.

G2.

E.

Name

See Back for Instructions

___________________________________________________

Address

___________________________________________________

- - - - - - - - - Dollars - - - - - - - - -

- - Cents - -

City

State

ZIP

H. Amount Paid _________________________ . __________

Signature: _____________________________________

Date: ______________

Please remit only one check per coupon.

The information contained in this report and any attachments is true and correct to the best of my knowledge.

1

1 2

2