Wv Business & Occupation Tax Return-Gross Income-Quarterly Report Form

ADVERTISEMENT

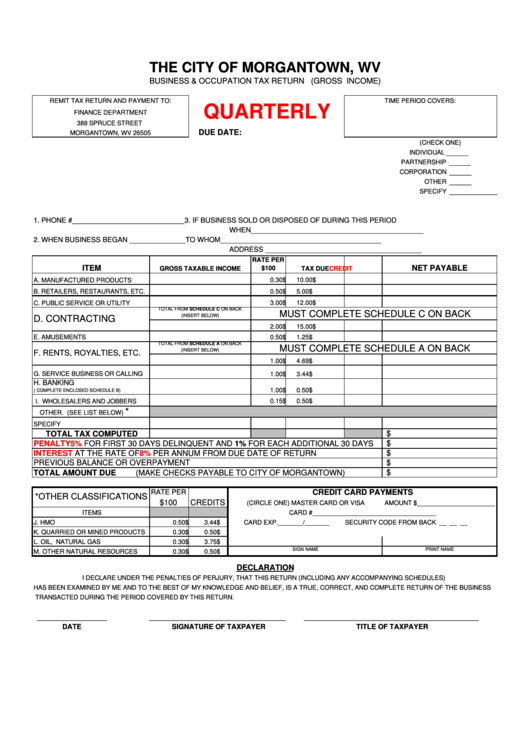

THE CITY OF MORGANTOWN, WV

BUSINESS & OCCUPATION TAX RETURN (GROSS INCOME)

REMIT TAX RETURN AND PAYMENT TO:

TIME PERIOD COVERS:

QUARTERLY

FINANCE DEPARTMENT

389 SPRUCE STREET

DUE DATE:

MORGANTOWN, WV 26505

(CHECK ONE)

_____

INDIVIDUAL

_____

PARTNERSHIP

_____

CORPORATION

_____

OTHER

___________

SPECIFY

1. PHONE #____________________________

3. IF BUSINESS SOLD OR DISPOSED OF DURING THIS PERIOD

WHEN___________________________________________

2. WHEN BUSINESS BEGAN ______________

TO WHOM________________________________________

ADDRESS _______________________________________

RATE PER

ITEM

NET PAYABLE

$100

GROSS TAXABLE INCOME

TAX DUE

CREDIT

A. MANUFACTURED PRODUCTS

$

0.30

$

10.00

B. RETAILERS, RESTAURANTS, ETC.

$

0.50

$

5.00

C. PUBLIC SERVICE OR UTILITY

$

3.00

$

12.00

TOTAL FROM SCHEDULE C ON BACK

MUST COMPLETE SCHEDULE C ON BACK

(INSERT BELOW)

D. CONTRACTING

$

2.00

$

15.00

E. AMUSEMENTS

$

0.50

$

1.25

TOTAL FROM SCHEDULE A ON BACK

MUST COMPLETE SCHEDULE A ON BACK

(INSERT BELOW)

F. RENTS, ROYALTIES, ETC.

$

1.00

$

4.69

G. SERVICE BUSINESS OR CALLING

$

1.00

$

3.44

H. BANKING

$

1.00

$

0.50

( COMPLETE ENCLOSED SCHEDULE B)

I. WHOLESALERS AND JOBBERS

$

0.15

$

0.50

*

OTHER. (SEE LIST BELOW)

SPECIFY

TOTAL TAX COMPUTED

$

PENALTY 5%

FOR FIRST 30 DAYS DELINQUENT AND 1% FOR EACH ADDITIONAL 30 DAYS

$

INTEREST

AT THE RATE OF

8%

PER ANNUM FROM DUE DATE OF RETURN

$

PREVIOUS BALANCE OR OVERPAYMENT

$

TOTAL AMOUNT DUE

(MAKE CHECKS PAYABLE TO CITY OF MORGANTOWN)

$

CREDIT CARD PAYMENTS

RATE PER

*OTHER CLASSIFICATIONS

$100

CREDITS

(CIRCLE ONE) MASTER CARD OR VISA

AMOUNT $______________________

ITEMS

CARD #___________________________________

J. HMO

$

0.50

$

3.44

CARD EXP._______/_______

SECURITY CODE FROM BACK __ __ __

K. QUARRIED OR MINED PRODUCTS

$

0.30

$

0.50

L. OIL, NATURAL GAS

$

0.30

$

3.75

SIGN NAME

PRINT NAME

M. OTHER NATURAL RESOURCES

$

0.30

$

0.50

DECLARATION

I DECLARE UNDER THE PENALTIES OF PERJURY, THAT THIS RETURN (INCLUDING ANY ACCOMPANYING SCHEDULES)

HAS BEEN EXAMINED BY ME AND TO THE BEST OF MY KNOWLEDGE AND BELIEF, IS A TRUE, CORRECT, AND COMPLETE RETURN OF THE BUSINESS

TRANSACTED DURING THE PERIOD COVERED BY THIS RETURN.

________________

________________________________

________________________________________

DATE

SIGNATURE OF TAXPAYER

TITLE OF TAXPAYER

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4