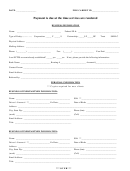

Client Information Sheet Page 2

Download a blank fillable Client Information Sheet in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Client Information Sheet with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

Rex L.

Crandell

Certified Public Accountant

Thank you for selecting us to prepare your income tax returns or for consulting services. This letter confirms the arrangements

for our services. Please read this form and sign below.

STANDARD ENGAGEMENT LETTER FOR TAX OR CONSULTING SERVICES

W

e will prepare your federal and state income tax returns from information you will furnish to us. We may process the returns through

an outside computer service. We will not audit or otherwise verify the data you submit, although we may ask you to clarify some of it.

We will be available to assist and guide you in gathering the necessary information, by furnishing you with questionnaires or worksheets

and by answering your questions. It is your responsibility to provide all the information necessary to complete your tax returns.

T

here are substantial penalties for claiming items on tax returns that you may not be able to prove clearly with written documentation

during an audit examination. You represent to us that all information you furnish to us will be true, complete and accurate, and, in

addition, that you have retained all necessary written support and documentation should it be required by an IRS or state audit examination

at a later date. Since you have final responsibility for the information on the income tax returns, we highly recommend that you review

the tax returns carefully before signing and filing them.

Y

ou agree to provide us with copies of any government correspondence that you receive regarding tax returns that we prepare for you.

If a question arises interpreting tax law, and a conflict exists between the taxing authorities’ interpretation of the law and other supportable

positions, we will use our professional judgment in resolving these issues. Whenever possible, we will resolve the issues in your favor.

We do not offer legal services, however attorney referrals are available.

T

he returns are prepared solely for presentation to the appropriate tax authorities. You agree not to utilize the returns for any other

purpose (such as bank loans, etc.) without first obtaining our express written consent.

W

e will be available to answer your inquiries on specific tax and financial matters, and to consult with you or assist you on financial,

tax, accounting, retirement, computer, and estate planning matters. We may analyze proposed investments in terms of your financial

position and goals, as well as their tax aspects, but we will offer no recommendations as to the quality of any specific investment nor an

evaluation of any potential business risks or opportunities presented by the investment. You must independently evaluate all the other

facts of the investment.

O

ur fees are based on the time required by the individuals assigned to the engagement, plus out-of-pocket costs (including computer

processing charges), according to our minimum fee schedule. Telephone or e-mail consultations, including mid-year consulting after

the tax returns are done, are billed at the same standard rate as office visits. A service charge will apply to missed appointments and

less than 24 hour notice of cancellations. Our invoices are due upon presentation. Tax returns are paid for in advance. The undersigned

agrees to pay reasonable past due collection costs including: attorney’s fees, collection agency fees, and preparer’s time spent in

collection at standard billing rates. Claims for reimbursement cannot exceed the cost for that service. No guarantee is made by preparer

regarding allowance of any refund, credit or item as reflected on the returns.

I

f the foregoing is in accordance with your understanding of the terms and conditions of our engagement, please sign below.

Each client is important to us! We are pleased to have you as a client and look forward to serving you now and for many years

to come.

Very truly yours,

Rex L. Crandell, C.P.A.

Read and accepted by:

Client’s Name (please print) _____________________________ Signature ___________________________ Date __________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2