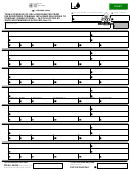

This form is to be used when remitting delinquent tax that was previously reported as uncollectible and credit was issued by

the Missouri Department of Revenue.

Complete this form and remit payment for any delinquent tax and fees collected from an eligible purchaser previously

reported as uncollectible and credit has been received. Remit payment by the last day of the month in which the delinquent

tax and fees was received from the eligible purchaser. Make check or money order payable to the Missouri

Department of Revenue. Mail the report to Missouri Department of Revenue, Taxation Division, P.O. Box 300, Jefferson

City, MO 65105-0300. If you pay by check, you authorize the Department of Revenue to process the check electronically.

Any returned check may be presented again electronically.

If you have questions or need assistance in completing this form, please call (573) 751-2611 or e-mail excise@dor.mo.gov.

You may also access the Department’s website at

to obtain this form.

Complete each line on the top portion of the schedule. Provide all requested information for supplier and eligible purchaser.

You must round to whole gallons and dollars.

Delinquent Tax Collected

1. Provide the document number, date, number of gallons and the tax rate.

2. Multiply the gallons times the tax rate.

3. Calculate the penalty due by multiplying the tax due times 5 percent per month up to a maximum of 25 percent.

4. Calculate the interest due by multiplying the tax due times the annual interest rate. Divide this number by 365 (366 for

leap years) and multiply the result by the number of days payment is late. The annual interest rate is subject to change

each year. You may access the annual interest rate on our website at

5. Enter the total for tax, penalty and interest collected.

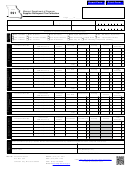

Delinquent Inspection Fee

1. Provide the document number, date, number of gallons and the fee rate. The inspection fee is 0.025 cents per 50

gallons (.0005 per gallon).

2. Multiply the gallons times the fee rate.

3. Calculate the penalty due by multiplying the inspection fee due times 5 percent per month up to a maximum of 25 percent.

4. Calculate the interest due by multiplying the inspection fee due times the annual interest rate. Divide this number by 365

(366 for leap years) and multiply the result by the number of days payment is late. The annual interest rate is subject

to change each year. You may access the annual interest rate on our website at

5. Enter the total for inspection fee, penalty and interest collected.

Delinquent Transport Load Fee

1. Provide the document number, date, number of gallons and the fee rate. The transport load fee is $20.00 per 8,000

gallons (.0025 per gallon).

2. Multiply the gallons times the fee rate.

3. Calculate the penalty due by multiplying the transport load fee due times 5 percent per month up to a maximum of 25 percent.

4. Calculate the interest due by multiplying the transport load fee due times the annual interest rate. Divide this number

by 365 (366 for leap years) and multiply the result by the number of days payment is late. The annual interest rate is subject

to change each year. You may access the annual interest rate on our website at

5. Enter the total for transport load fee, penalty and interest collected.

Delinquent Pool Bond Collected

1. Provide the document number, date, number of gallons and the pool bond rate. The pool bond rate for motor fuel is

.0024 per gallon. The pool bond rate for aviation fuel is .0013 per gallon.

2. Multiply the gallons times the fee rate.

3. Enter the total for pool bond fee.

Form 591 (Revised 01-2016)

1

1 2

2