Form 504 Draft - Application For Extension Of Time To File An Oklahoma Income Tax Return - 2011

ADVERTISEMENT

ITE

Barcode Placement

#1695#

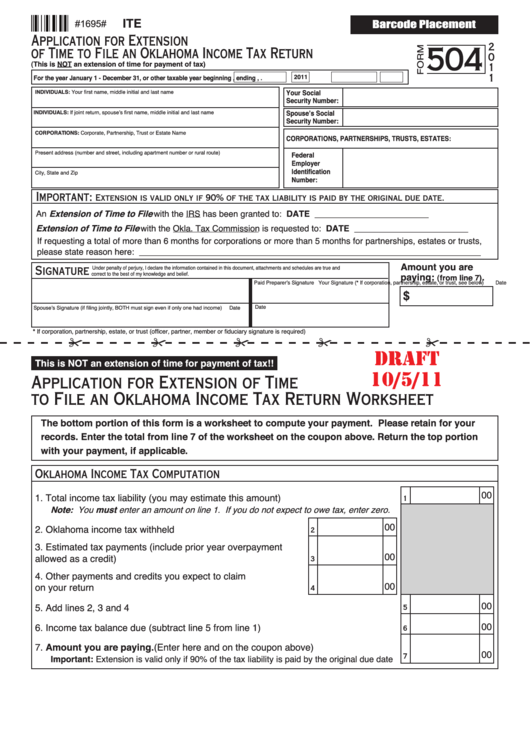

Application for Extension

504

2

of Time to File an Oklahoma Income Tax Return

0

(This is NOT an extension of time for payment of tax)

1

1

2011

For the year January 1 - December 31, or other taxable year beginning

,

ending

,

.

Your Social

INDIVIDUALS: Your first name, middle initial and last name

Security Number:

INDIVIDUALS: If joint return, spouse’s first name, middle initial and last name

Spouse’s Social

Security Number:

CORPORATIONS: Corporate, Partnership, Trust or Estate Name

CORPORATIONS, PARTNERSHIPS, TRUSTS, ESTATES:

Present address (number and street, including apartment number or rural route)

Federal

Employer

Identification

City, State and Zip

Number:

Important:

Extension is valid only if 90% of the tax liability is paid by the original due date.

An Extension of Time to File with the IRS has been granted to:

DATE ________________________

Extension of Time to File with the Okla. Tax Commission is requested to:

DATE ________________________

If requesting a total of more than 6 months for corporations or more than 5 months for partnerships, estates or trusts,

please state reason here: ________________________________________________________________________

Amount you are

Signature

Under penalty of perjury, I declare the information contained in this document, attachments and schedules are true and

correct to the best of my knowledge and belief.

paying:

.

(from line 7)

Your Signature (* If corporation, partnership, estate, or trust, see below)

Date

Paid Preparer’s Signature

$

Date

Spouse’s Signature (if filing jointly, BOTH must sign even if only one had income)

Date

* If corporation, partnership, estate, or trust (officer, partner, member or fiduciary signature is required)

draft

This is NOT an extension of time for payment of tax!!

10/5/11

Application for Extension of Time

to File an Oklahoma Income Tax Return Worksheet

The bottom portion of this form is a worksheet to compute your payment. Please retain for your

records. Enter the total from line 7 of the worksheet on the coupon above. Return the top portion

with your payment, if applicable.

Oklahoma Income Tax Computation

00

1. Total income tax liability (you may estimate this amount) . ........................................

1

Note: You must enter an amount on line 1. If you do not expect to owe tax, enter zero.

00

2. Oklahoma income tax withheld . ..............................................

2

3. Estimated tax payments (include prior year overpayment

00

allowed as a credit) . ................................................................

3

4. Other payments and credits you expect to claim

00

on your return .........................................................................

4

00

5. Add lines 2, 3 and 4 . .................................................................................................

5

00

6. Income tax balance due (subtract line 5 from line 1) . ...............................................

6

7. Amount you are paying. (Enter here and on the coupon above) . ..........................

00

7

Important: Extension is valid only if 90% of the tax liability is paid by the original due date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2