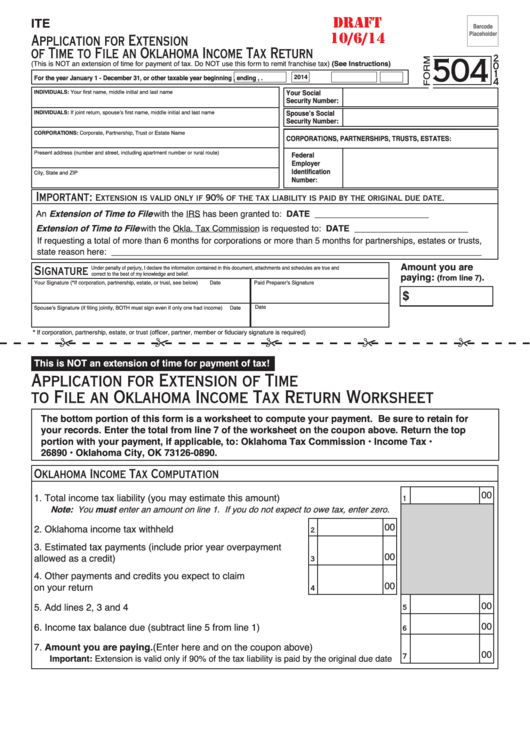

Form 504 Draft - Application For Extension Of Time To File An Oklahoma Income Tax Return - 2014

ADVERTISEMENT

ITE

Draft

Barcode

Placeholder

10/6/14

Application for Extension

of Time to File an Oklahoma Income Tax Return

504

2

(This is NOT an extension of time for payment of tax. Do NOT use this form to remit franchise tax) (See Instructions)

0

1

2014

For the year January 1 - December 31, or other taxable year beginning

,

ending

,

.

4

Your Social

INDIVIDUALS: Your first name, middle initial and last name

Security Number:

Spouse’s Social

INDIVIDUALS: If joint return, spouse’s first name, middle initial and last name

Security Number:

CORPORATIONS: Corporate, Partnership, Trust or Estate Name

CORPORATIONS, PARTNERSHIPS, TRUSTS, ESTATES:

Present address (number and street, including apartment number or rural route)

Federal

Employer

Identification

City, State and ZIP

Number:

Important:

Extension is valid only if 90% of the tax liability is paid by the original due date.

An Extension of Time to File with the IRS has been granted to:

DATE ________________________

Extension of Time to File with the Okla. Tax Commission is requested to:

DATE ________________________

If requesting a total of more than 6 months for corporations or more than 5 months for partnerships, estates or trusts,

state reason here: ______________________________________________________________________________

Amount you are

Signature

Under penalty of perjury, I declare the information contained in this document, attachments and schedules are true and

correct to the best of my knowledge and belief.

paying:

.

(from line 7)

Your Signature (*If corporation, partnership, estate, or trust, see below)

Date

Paid Preparer’s Signature

$

Date

Spouse’s Signature (if filing jointly, BOTH must sign even if only one had income)

Date

* If corporation, partnership, estate, or trust (officer, partner, member or fiduciary signature is required)

This is NOT an extension of time for payment of tax!

Application for Extension of Time

to File an Oklahoma Income Tax Return Worksheet

The bottom portion of this form is a worksheet to compute your payment. Be sure to retain for

your records. Enter the total from line 7 of the worksheet on the coupon above. Return the top

portion with your payment, if applicable, to: Oklahoma Tax Commission • Income Tax • P.O. Box

26890 • Oklahoma City, OK 73126-0890.

Oklahoma Income Tax Computation

00

1. Total income tax liability (you may estimate this amount) .........................................

1

Note: You must enter an amount on line 1. If you do not expect to owe tax, enter zero.

00

2. Oklahoma income tax withheld ...............................................

2

3. Estimated tax payments (include prior year overpayment

00

allowed as a credit) .................................................................

3

4. Other payments and credits you expect to claim

00

on your return .........................................................................

4

00

5. Add lines 2, 3 and 4 ..................................................................................................

5

00

6. Income tax balance due (subtract line 5 from line 1) ................................................

6

7. Amount you are paying. (Enter here and on the coupon above) ...........................

00

Important: Extension is valid only if 90% of the tax liability is paid by the original due date

7

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2