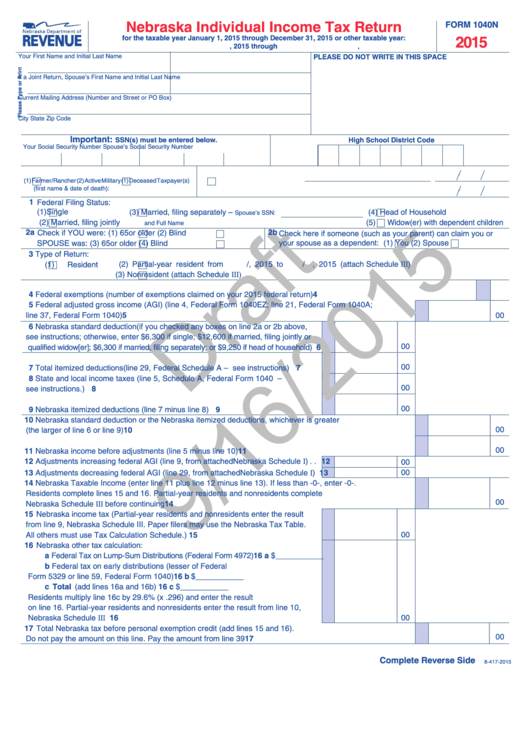

Form 1040n Draft - Nebraska Individual Income Tax Return - 2015

ADVERTISEMENT

Nebraska Individual Income Tax Return

FORM 1040N

2015

for the taxable year January 1, 2015 through December 31, 2015 or other taxable year:

, 2015 through

,

Your First Name and Initial

Last Name

PLEASE DO NOT WRITE IN THIS SPACE

If a Joint Return, Spouse’s First Name and Initial

Last Name

Current Mailing Address (Number and Street or PO Box)

City

State

Zip Code

Important:

SSN(s) must be entered below.

High School District Code

Your Social Security Number

Spouse’s Social Security Number

(1)

Farmer/Rancher

(2)

Active Military

(1)

Deceased Taxpayer(s)

(first name & date of death):

1

Federal Filing Status:

(1)

Single

(3)

Married, filing separately –

(4)

Head of Household

Spouse’s SSN:

(2)

Married, filing jointly

(5)

Widow(er) with dependent children

and Full Name

2a Check if YOU were:

2b

(1)

65 or older

(2)

Blind

Check here if someone (such as your parent) can claim you or

SPOUSE was:

(3)

65 or older

(4)

Blind

your spouse as a dependent: (1)

You

(2)

Spouse

3 Type of Return:

, 2015 (attach Schedule III)

(2)

Partial-year resident from

/

, 2015 to

/

(1)

Resident

Nonresident (attach Schedule III)

(3)

4 Federal exemptions (number of exemptions claimed on your 2015 federal return) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

5 Federal adjusted gross income (AGI) (line 4, Federal Form 1040EZ; line 21, Federal Form 1040A;

5

line 37, Federal Form 1040) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

6 Nebraska standard deduction (if you checked any boxes on line 2a or 2b above,

see instructions; otherwise, enter $6,300 if single; $12,600 if married, filing jointly or

00

qualified widow[er]; $6,300 if married, filing separately; or $9,250 if head of household) 6

00

7 Total itemized deductions (line 29, Federal Schedule A – see instructions) . . . . . . .

7

8 State and local income taxes (line 5, Schedule A, Federal Form 1040 –

00

see instructions .) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

00

9 Nebraska itemized deductions (line 7 minus line 8) . . . . . . . . . . . . . . . . . . . . . . . . .

9

10 Nebraska standard deduction or the Nebraska itemized deductions, whichever is greater

00

(the larger of line 6 or line 9) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

00

11 Nebraska income before adjustments (line 5 minus line 10) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

12 Adjustments increasing federal AGI (line 9, from attached Nebraska Schedule I) . . 12

00

13 Adjustments decreasing federal AGI (line 29, from attached Nebraska Schedule I) 13

00

14 Nebraska Taxable Income (enter line 11 plus line 12 minus line 13) . If less than -0-, enter -0- .

Residents complete lines 15 and 16 . Partial-year residents and nonresidents complete

00

Nebraska Schedule III before continuing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

15 Nebraska income tax (Partial-year residents and nonresidents enter the result

from line 9, Nebraska Schedule III . Paper filers may use the Nebraska Tax Table .

All others must use Tax Calculation Schedule .) . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

00

16 Nebraska other tax calculation:

a Federal Tax on Lump-Sum Distributions (Federal Form 4972) 16 a $ ___________

b Federal tax on early distributions (lesser of Federal

Form 5329 or line 59, Federal Form 1040) . . . . . . . . . . . . . . 16 b $ ___________

c Total (add lines 16a and 16b) . . . . . . . . . . . . . . . . . . . . . . . 16 c $ ___________

Residents multiply line 16c by 29 .6% (x .296) and enter the result

on line 16 . Partial-year residents and nonresidents enter the result from line 10,

Nebraska Schedule III . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

00

17 Total Nebraska tax before personal exemption credit (add lines 15 and 16) .

00

Do not pay the amount on this line . Pay the amount from line 39 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

Complete Reverse Side

8-417-2015

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2