Form 1040ns - Amended Nebraska Individual Income Tax Return - 2009

ADVERTISEMENT

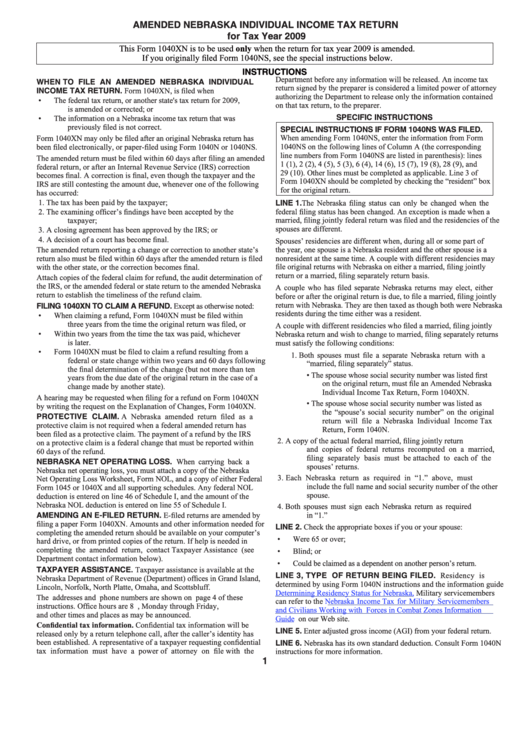

AMENDED NEBRASKA INDIVIDUAL INCOME TAX RETURN

for Tax Year 2009

This Form 1040XN is to be used only when the return for tax year 2009 is amended.

If you originally filed Form 1040NS, see the special instructions below.

INSTRUCTIONS

Department before any information will be released. An income tax

WHEN TO FILE AN AMENDED NEBRASKA INDIVIDUAL

return signed by the preparer is considered a limited power of attorney

INCOME TAX RETURN. Form 1040XN, is filed when

authorizing the Department to release only the information contained

•

The federal tax return, or another state's tax return for 2009,

on that tax return, to the preparer.

is amended or corrected; or

SPECIFIC INSTRUCTIONS

•

The information on a Nebraska income tax return that was

previously filed is not correct.

SPECIAL INSTRUCTIONS IF FORM 1040NS WAS FILED.

Form 1040XN may only be filed after an original Nebraska return has

When amending Form 1040NS, enter the information from Form

been filed electronically, or paper-filed using Form 1040N or 1040NS.

1040NS on the following lines of Column A (the corresponding

line numbers from Form 1040NS are listed in parenthesis): lines

The amended return must be filed within 60 days after filing an amended

1 (1), 2 (2), 4 (5), 5 (3), 6 (4), 14 (6), 15 (7), 19 (8), 28 (9), and

federal return, or after an Internal Revenue Service (IRS) correction

29 (10). Other lines must be completed as applicable. Line 3 of

becomes final. A correction is final, even though the taxpayer and the

Form 1040XN should be completed by checking the “resident” box

IRS are still contesting the amount due, whenever one of the following

for the original return.

has occurred:

1.

The tax has been paid by the taxpayer;

LINE 1. The Nebraska filing status can only be changed when the

federal filing status has been changed. An exception is made when a

2.

The examining officer’s findings have been accepted by the

married, filing jointly federal return was filed and the residencies of the

taxpayer;

spouses are different.

3.

A closing agreement has been approved by the IRS; or

4.

A decision of a court has become final.

Spouses’ residencies are different when, during all or some part of

the year, one spouse is a Nebraska resident and the other spouse is a

The amended return reporting a change or correction to another state’s

nonresident at the same time. A couple with different residencies may

return also must be filed within 60 days after the amended return is filed

file original returns with Nebraska on either a married, filing jointly

with the other state, or the correction becomes final.

return or a married, filing separately return basis.

Attach copies of the federal claim for refund, the audit determination of

the IRS, or the amended federal or state return to the amended Nebraska

A couple who has filed separate Nebraska returns may elect, either

return to establish the timeliness of the refund claim.

before or after the original return is due, to file a married, filing jointly

return with Nebraska.They are then taxed as though both were Nebraska

FILING 1040XN TO CLAIM A REFUND. Except as otherwise noted:

residents during the time either was a resident.

•

When claiming a refund, Form 1040XN must be filed within

three years from the time the original return was filed, or

A couple with different residencies who filed a married, filing jointly

•

Within two years from the time the tax was paid, whichever

Nebraska return and wish to change to married, filing separately returns

is later.

must satisfy the following conditions:

•

Form 1040XN must be filed to claim a refund resulting from a

1.

Both spouses must file a separate Nebraska return with a

federal or state change within two years and 60 days following

“married, filing separately” status.

the final determination of the change (but not more than ten

•

The spouse whose social security number was listed first

years from the due date of the original return in the case of a

on the original return, must file an Amended Nebraska

change made by another state).

Individual Income Tax Return, Form 1040XN.

A hearing may be requested when filing for a refund on Form 1040XN

•

The spouse whose social security number was listed as

by writing the request on the Explanation of Changes, Form 1040XN.

the “spouse’s social security number” on the original

PROTECTIVE CLAIM. A Nebraska amended return filed as a

return will file a Nebraska Individual Income Tax

protective claim is not required when a federal amended return has

Return, Form 1040N.

been filed as a protective claim. The payment of a refund by the IRS

2.

A copy of the actual federal married, filing jointly return

on a protective claim is a federal change that must be reported within

and copies of federal returns recomputed on a married,

60 days of the refund.

filing separately basis must be attached to each of the

NEBRASKA NET OPERATING LOSS. When carrying back a

spouses’ returns.

Nebraska net operating loss, you must attach a copy of the Nebraska

3.

Each Nebraska return as required in “1.” above, must

Net Operating Loss Worksheet, Form NOL, and a copy of either Federal

include the full name and social security number of the other

Form 1045 or 1040X and all supporting schedules. Any federal NOL

spouse.

deduction is entered on line 46 of Schedule I, and the amount of the

Nebraska NOL deduction is entered on line 55 of Schedule I.

4.

Both spouses must sign each Nebraska return as required

AMENDING AN E-FILED RETURN. E-filed returns are amended by

in “1.”

filing a paper Form 1040XN. Amounts and other information needed for

LINE 2. Check the appropriate boxes if you or your spouse:

completing the amended return should be available on your computer’s

•

Were 65 or over;

hard drive, or from printed copies of the return. If help is needed in

completing the amended return, contact Taxpayer Assistance (see

•

Blind; or

Department contact information below).

•

Could be claimed as a dependent on another person’s return.

TAXPAYER ASSISTANCE. Taxpayer assistance is available at the

LINE 3, TYPE OF RETURN BEING FILED. Residency is

Nebraska Department of Revenue (Department) offices in Grand Island,

determined by using Form 1040N instructions and the information guide

Lincoln, Norfolk, North Platte, Omaha, and Scottsbluff.

Determining Residency Status for Nebraska,

Military servicemembers

The addresses and phone numbers are shown on page 4 of these

can refer to the

Nebraska Income Tax for Military Servicemembers

instructions. Office hours are 8 a.m. to 5 p.m., Monday through Friday,

and Civilians Working with U.S. Forces in Combat Zones Information

and other times and places as may be announced.

Guide

on our Web site.

Confidential tax information. Confidential tax information will be

LINE 5. Enter adjusted gross income (AGI) from your federal return.

released only by a return telephone call, after the caller’s identity has

been established. A representative of a taxpayer requesting confidential

LINE 6. Nebraska has its own standard deduction. Consult Form 1040N

tax information must have a power of attorney on file with the

instructions for more information.

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4