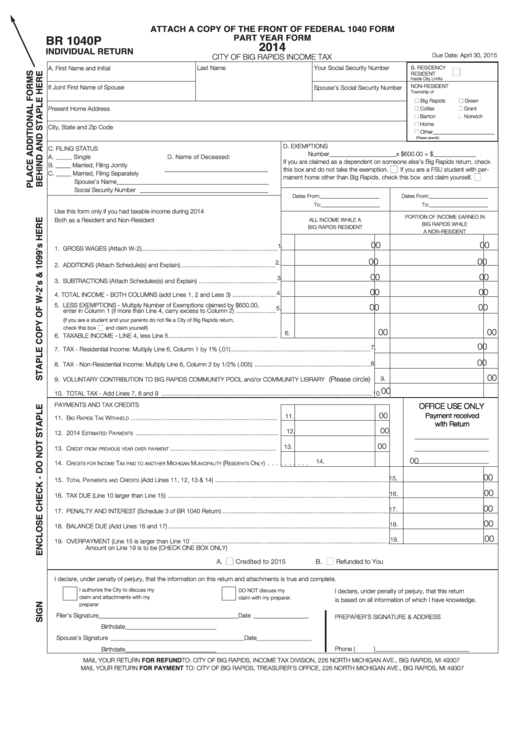

Form Br 1040p - Individual Return - City Of Big Rapids Income Tax - 2014

ADVERTISEMENT

ATTACH A COPY OF THE FRONT OF FEDERAL 1040 FORM

PART YEAR FORM

BR 1040P

2014

INDIVIDUAL RETURN

Due Date: april 30, 2015

City OF Big RaPiDS inCOMe taX

last name

your Social Security number

a. First name and initial

B. ReSiDenCy

I

ReSiDent

inside City limits

nOn-ReSiDent

if Joint First name of Spouse

Spouse’s Social Security number

township of

Big Rapids

green

I

I

Present home address

Colfax

grant

I

I

Barton

norwich

I

I

home

I

City, State and Zip Code

Other_______________________

I

(Please specify)

D. eXeMPtiOnS

C. Filing StatuS

number______________________x $600.00 = $______________

a. _____ Single

D. name of Deceased:

if you are claimed as a dependent on someone else’s Big Rapids return, check

B. _____ Married, Filing Jointly

__________________________________

this box and do not take the exemption.

I

if you are a FSu student with per-

C. _____ Married, Filing Separately

manent home other than Big Rapids, check this box and claim yourself.

I

Spouse’s name__________________________________________________

Social Security number __________________________________________

Dates From:______________________

Dates From:______________________

to:______________________

to:______________________

use this form only if you had taxable income during 2014

PORtiOn OF inCOMe eaRneD in

Both as a Resident and non-Resident

all inCOMe While a

Big RaPiDS While

Big RaPiDS ReSiDent

a nOn-ReSiDent

00

00

1.

1. gROSS WageS (attach W-2)................................................................................

00

00

2.

2. aDDitiOnS (attach Schedule(s) and explain) ........................................................

00

00

3.

3. SuBtRaCtiOnS (attach Schedules(s) and explain) ..............................................

00

00

4.

4. tOtal inCOMe - BOth COluMnS (add lines 1, 2 and less 3) ..........................

5. leSS eXeMPtiOnS - Multiply number of exemptions claimed by $600.00,

00

00

5.

enter in Column 1 (if more than line 4, carry excess to Column 2) ........................

(if you are a student and your parents do not file a City of Big Rapids return,

check this box

and claim yourself)

I

00

00

6.

6. taXaBle inCOMe - line 4, less line 5 ................................................................

00

7.

7. taX - Residential income: Multiply line 6, Column 1 by 1% (.01) ..................................................................................

00

8.

8. taX - non-Residential income: Multiply line 6, Column 2 by 1/2% (.005) ....................................................................

00

(Please circle)

9.

9. VOluntaRy COntRiButiOn tO Big RaPiDS COMMunity POOl and/or COMMunity liBRaRy

00

10. tOtal taX - add lines 7, 8 and 9 ............................................................................................................................

10.

PayMentS anD taX CReDitS

OFFiCe uSe Only

00

Payment received

11.

11. B

R

t

W

......................................................................................

ig

aPiDS

aX

ithhelD

with Return

00

12.

12. 2014 e

P

....................................................................................

StiMateD

ayMentS

_____________________

00

13.

_____________________

13. C

..............................................................

ReDit FROM PReViOuS yeaR OVeR PayMent

00

_____________________

14.

14. C

i

t

M

M

(R

O

) ..........

ReDitS FOR

nCOMe

aX PaiD tO anOtheR

iChigan

uniCiPality

eSiDentS

nly

00

(add lines 11, 12, 13 & 14) ...................................................................................................... 15.

15. t

P

C

Otal

ayMentS anD

ReDitS

00

16. taX Due (line 10 larger than line 15) .................................................................................................................................. 16.

00

17. Penalty anD inteReSt (Schedule 3 of BR 1040 Return) .................................................................................................. 17.

00

18. BalanCe Due (add lines 16 and 17) .................................................................................................................................. 18.

00

19. OVeRPayMent (line 15 is larger than line 10 .................................................................................................................... 19.

amount on line 19 is to be (CheCK One BOX Only)

a.

Credited to 2015

B.

Refunded to you

I

I

i declare, under penalty of perjury, that the information on this return and attachments is true and complete.

i authorize the City to discuss my

DO nOt discuss my

i declare, under penalty of perjury, that this return

claim and attachments with my

claim with my preparer.

is based on all information of which i have knowledge.

preparer

Filer’s Signature ______________________________________________ Date __________________

PRePaReR’S SignatuRe & aDDReSS

Birthdate ______________________________

Spouse’s Signature ____________________________________________ Date __________________

Phone (

)_______________________________

Birthdate ______________________________

Mail yOuR RetuRn FOR REFUND tO: City OF Big RaPiDS, inCOMe taX DiViSiOn, 226 nORth MiChigan aVe., Big RaPiDS, Mi 49307

Mail yOuR RetuRn FOR PAYMENT tO: City OF Big RaPiDS, tReaSuReR’S OFFiCe, 226 nORth MiChigan aVe., Big RaPiDS, Mi 49307

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2