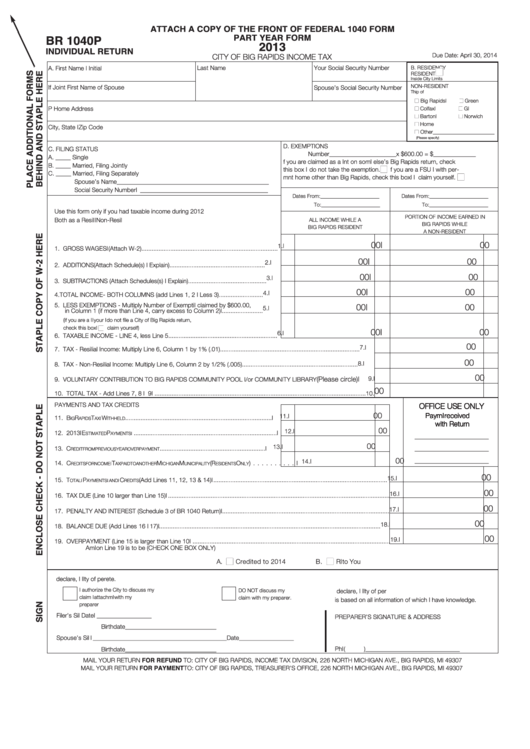

Form Br 1040p - Individual Return - City Of Big Rapids Income Tax - 2013

ADVERTISEMENT

ATTACH A COPY OF THE FRONT OF FEDERAL 1040 FORM

PART YEAR FORM

BR 1040P

2013

INDIVIDUAL RETURN

Due Date: April 30, 2014

ciTy Of BiG RAPiDs incOMe TAX

last name

your social security number

A. first name and initial

B. ResiDency

ResiDenT

inside city limits

nOn-ResiDenT

if Joint first name of spouse

spouse’s social security number

Township of

Big Rapids

Green

Present home Address

colfax

Grant

Barton

norwich

home

city, state and Zip code

Other_______________________

(Please specify)

D. eXeMPTiOns

c. filinG sTATUs

number______________________x $600.00 = $______________

A. _____ single

if you are claimed as a dependent on someone else’s Big Rapids return, check

B. _____ Married, filing Jointly

this box and do not take the exemption.

if you are a fsU student with per-

c. _____ Married, filing separately

manent home other than Big Rapids, check this box and claim yourself.

spouse’s name__________________________________________________

social security number __________________________________________

Dates from:______________________

Dates from:______________________

To:______________________

To:______________________

Use this form only if you had taxable income during 2012

PORTiOn Of incOMe eARneD in

Both as a Resident and non-Resident

All incOMe While A

BiG RAPiDs While

BiG RAPiDs ResiDenT

A nOn-ResiDenT

00

00

1.

1. GROss WAGes (Attach W-2)................................................................................

00

00

2.

2. ADDiTiOns (Attach schedule(s) and explain) ........................................................

00

00

3.

3. sUBTRAcTiOns (Attach schedules(s) and explain) ..............................................

00

00

4.

4. TOTAl incOMe - BOTh cOlUMns (add lines 1, 2 and less 3) ..........................

5. less eXeMPTiOns - Multiply number of exemptions claimed by $600.00,

00

00

5.

enter in column 1 (if more than line 4, carry excess to column 2) ........................

(if you are a student and your parents do not file a city of Big Rapids return,

check this box

and claim yourself)

00

00

6.

6. TAXABle incOMe - line 4, less line 5 ................................................................

00

7.

7. TAX - Residential income: Multiply line 6, column 1 by 1% (.01) ..................................................................................

00

8.

8. TAX - non-Residential income: Multiply line 6, column 2 by 1/2% (.005) ....................................................................

00

(Please circle)

9.

9. VOlUnTARy cOnTRiBUTiOn TO BiG RAPiDs cOMMUniTy POOl and/or cOMMUniTy liBRARy

00

10. TOTAl TAX - Add lines 7, 8 and 9 ............................................................................................................................

10.

PAyMenTs AnD TAX cReDiTs

Office Use Only

00

Payment received

11.

11. B

R

T

W

......................................................................................

iG

APiDs

AX

iThhelD

with Return

00

12.

12. 2013 e

P

....................................................................................

sTiMATeD

AyMenTs

_____________________

00

13.

_____________________

13. c

..............................................................

ReDiT fROM PReViOUs yeAR OVeR PAyMenT

00

_____________________

14.

14. c

i

T

M

M

(R

O

) ..........

ReDiTs fOR

ncOMe

AX PAiD TO AnOTheR

ichiGAn

UniciPAliTy

esiDenTs

nly

00

(Add lines 11, 12, 13 & 14) ...................................................................................................... 15.

15. T

P

c

OTAl

AyMenTs AnD

ReDiTs

00

16. TAX DUe (line 10 larger than line 15) .................................................................................................................................. 16.

00

17. PenAlTy AnD inTeResT (schedule 3 of BR 1040 Return) .................................................................................................. 17.

00

18. BAlAnce DUe (Add lines 16 and 17) .................................................................................................................................. 18.

00

19. OVeRPAyMenT (line 15 is larger than line 10 .................................................................................................................... 19.

Amount on line 19 is to be (checK One BOX Only)

A.

credited to 2014

B.

Refunded to you

i declare, under penalty of perjury, that the information on this return and attachments is true and complete.

i authorize the city to discuss my

DO nOT discuss my

i declare, under penalty of perjury, that this return

claim and attachments with my

claim with my preparer.

is based on all information of which i have knowledge.

preparer

filer’s signature ______________________________________________ Date __________________

PRePAReR’s siGnATURe & ADDRess

Birthdate ______________________________

spouse’s signature ____________________________________________ Date __________________

Phone (

)_______________________________

Birthdate ______________________________

MAil yOUR ReTURn FOR REFUND TO: ciTy Of BiG RAPiDs, incOMe TAX DiVisiOn, 226 nORTh MichiGAn AVe., BiG RAPiDs, Mi 49307

MAil yOUR ReTURn FOR PAYMENT TO: ciTy Of BiG RAPiDs, TReAsUReR’s Office, 226 nORTh MichiGAn AVe., BiG RAPiDs, Mi 49307

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2