Form Oa - Domestic Form - 2002

ADVERTISEMENT

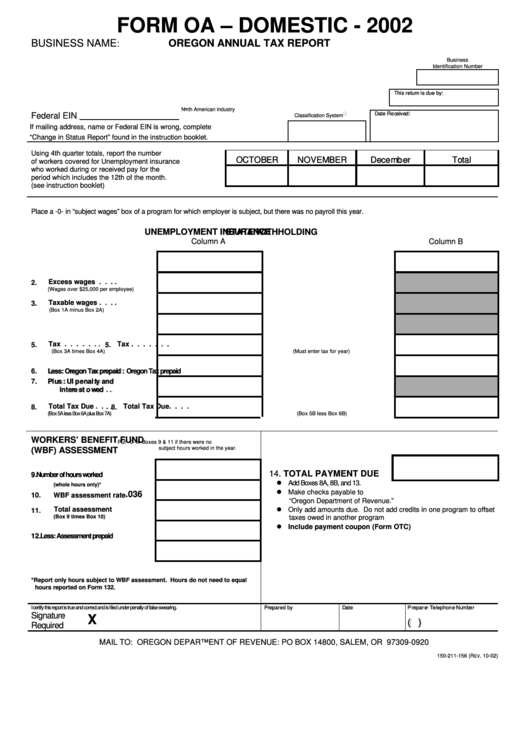

FORM OA – DOMESTIC - 2002

BUSINESS NAME

OREGON ANNUAL TAX REPORT

:

Business

Identification Number

T

h

i

s

r

e

t

u

r

n

i

s

d

u

e

b

y

:

T

h

i

s

r

e

t

u

r

n

i

s

d

u

e

b

y

:

North American Industry

D

D

a

a

t

t

e

e

R

R

e

e

c

c

e

e

i

i

v

v

e

e

d

d

:

:

Federal EIN

Classification System

If mailing address, name or Federal EIN is wrong, complete

“Change in Status Report” found in the instruction booklet.

Using 4th quarter totals, report the number

O

O

C

C

T

T

O

O

B

B

E

E

R

R

N

N

O

O

V

V

E

E

M

M

B

B

E

E

R

R

D

D

e

e

c

c

e

e

m

m

b

b

e

e

r

r

T

T

o

o

t

t

a

a

l

l

of workers covered for Unemployment insurance

who worked during or received pay for the

period which includes the 12th of the month.

(see instruction booklet)

Place a -0- in “subject wages” box of a program for which employer is subject, but there was no payroll this year.

UNEMPLOYMENT INSURANCE

STATE WITHHOLDING

Column A

Column B

1.

Subject wages . . . .

1. Subject wages . . .

Excess wages . . . .

2.

(Wages over $25,000 per employee)

Taxable wages . . . .

3.

(Box 1A minus Box 2A)

4.

Tax rate. . . . . .

Tax . . . . . . .

5. Tax . . . . . . .

5.

(Box 3A times Box 4A)

(Must enter tax for year)

6.

L

e

s

s

:

O

r

e

g

o

n

T

a

x

p

r

e

p

a

i

d

.

6. Less: Oregon Tax prepaid

L

e

s

s

:

O

r

e

g

o

n

T

a

x

p

r

e

p

a

i

d

.

7.

P

l

u

s

:

U

I

p

e

n

a

l

t

y

a

n

d

P

l

u

s

:

U

I

p

e

n

a

l

t

y

a

n

d

i

i

n

n

t

t

e

e

r

r

e

e

s

s

t

t

o

o

w

w

e

e

d

d

.

.

.

.

Total Tax Due . .

.

.

8. Total Tax Due. . . .

.

.

8.

(Box 5A less Box 6A plus Box 7A)

(Box 5B less Box 6B)

WORKERS’ BENEFIT FUND

Put –0- in Boxes 9 & 11 if there were no

subject hours worked in the year.

(WBF) ASSESSMENT

14. TOTAL PAYMENT DUE

9

9

.

.

Number of hours worked

Add Boxes 8A, 8B, and 13.

(whole hours only)*

Make checks payable to

.036

10.

WBF assessment rate

“Oregon Department of Revenue.”

Total assessment

Only add amounts due. Do not add credits in one program to offset

11.

(Box 9 times Box 10)

taxes owed in another program

Include payment coupon (Form OTC)

1

2

.

Less: Assessment prepaid

1

2

.

13.

Total Assessment Due

*Report only hours subject to WBF assessment. Hours do not need to equal

hours reported on Form 132.

I certify this report is true and correct and is filed under penalty of false swearing.

P

r

e

p

a

r

e

d

b

y

D

a

t

e

P

r

e

p

a

r

e

r

T

e

l

e

p

h

o

n

e

N

u

m

b

e

r

P

r

e

p

a

r

e

d

b

y

D

a

t

e

P

r

e

p

a

r

e

r

T

e

l

e

p

h

o

n

e

N

u

m

b

e

r

Signature

X

(

)

(

)

Required

MAIL TO: OREGON DEPARTMENT OF REVENUE: PO BOX 14800, SALEM, OR 97309-0920

150-211-156 (R

. 10-02)

EV

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2