Form Rp-5217 - Sale Correction Form (County Director)

ADVERTISEMENT

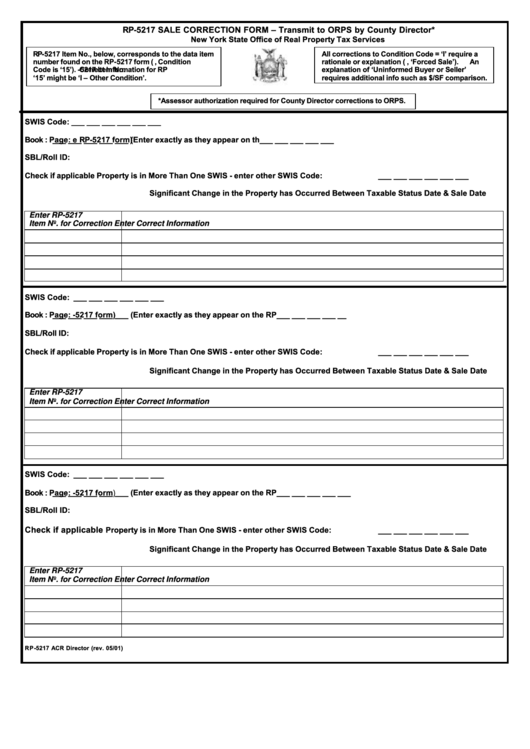

RP-5217 SALE CORRECTION FORM – Transmit to ORPS by County Director*

New York State Office of Real Property Tax Services

RP-5217 Item No., below, corresponds to the data item

All corrections to Condition Code = ‘I’ require a

number found on the RP-5217 form (i.e., Condition

rationale or explanation (i.e., ‘Forced Sale’).

An

Code is ‘15’).

Correct Information for RP

-5217 Item No.

explanation of ‘Uninformed Buyer or Seller’

‘15’ might be ‘I – Other Condition’.

requires additional info such as $/SF comparison.

*Assessor authorization required for County Director corrections to ORPS.

SWIS Code: ___ ___ ___ ___ ___ ___

Book :

___ ___ ___ ___ ___

Page:

___ ___ ___ ___ ___

(Enter exactly as they appear on th

e RP -5217 form)

SBL/Roll ID:

Check if applicable

Property is in More Than One SWIS - enter other SWIS Code:

___ ___ ___ ___ ___ ___

Significant Change in the Property has Occurred Between Taxable Status Date & Sale Date

Enter RP-5217

Item No. for Correction

Enter Correct Information

SWIS Code:

___ ___ ___ ___ ___ ___

Book :

___ ___ ___ ___ ___

Page:

___ ___ ___ ___ __

(Enter exactly as they appear on the RP

-5217 form)

SBL/Roll ID:

Check if applicable

Property is in More Than One SWIS - enter other SWIS Code:

___ ___ ___ ___ ___ ___

Significant Change in the Property has Occurred Between Taxable Status Date & Sal e Date

Enter RP-5217

Item No. for Correction

Enter Correct Information

SWIS Code:

___ ___ ___ ___ ___ ___

Book :

___ ___ ___ ___ ___

Page:

___ ___ ___ ___ ___

(Enter exactly as they appear on the RP

-5217 form)

SBL/Roll ID:

Check if applicable

Property is in More Than One SWIS - enter other SWIS Code:

___ ___ ___ ___ ___ ___

Significant Change in the Property has Occurred Between Taxable Status Date & Sale Date

Enter RP-5217

Item No. for Correction

Enter Correct Information

RP-5217 ACR Director (rev. 05/01)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1