City Of Danville Meals Tax Return Form - Virginia - City Of Danville Tax Division

ADVERTISEMENT

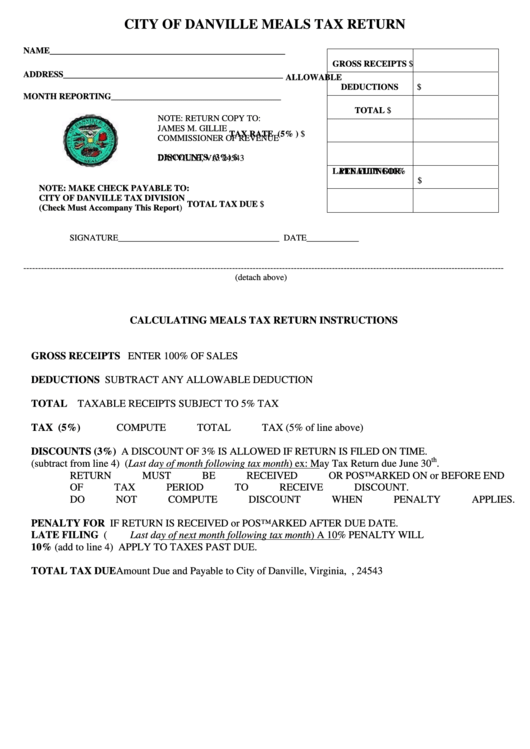

CITY OF DANVILLE MEALS TAX RETURN

_____________________________________________

NAME

$

GROSS RECEIPTS

__________________________________________

ADDRESS

ALLOWABLE

DEDUCTIONS

$

MONTH REPORTING_______________________________________

TOTAL

$

NOTE: RETURN COPY TO:

JAMES M. GILLIE

$

TAX RATE (5% )

COMMISSIONER OF REVENUE

P.O. BOX 480

DISCOUNTS (3%)

$

DANVILLE, VA. 24543

PENALTY FOR

LATE FILING 10%

$

NOTE: MAKE CHECK PAYABLE TO:

CITY OF DANVILLE TAX DIVISION

$

TOTAL TAX DUE

(Check Must Accompany This Report)

SIGNATURE_____________________________________ DATE____________

--------------------------------------------------------------------------------------------------------------------------------------------------------------------

(detach above)

CALCULATING MEALS TAX RETURN INSTRUCTIONS

GROSS RECEIPTS

ENTER 100% OF SALES

DEDUCTIONS

SUBTRACT ANY ALLOWABLE DEDUCTION

TOTAL

TAXABLE RECEIPTS SUBJECT TO 5% TAX

TAX (5%)

COMPUTE TOTAL TAX (5% of line above)

DISCOUNTS (3%)

A DISCOUNT OF 3% IS ALLOWED IF RETURN IS FILED ON TIME.

th

(subtract from line 4)

(Last day of month following tax month) ex: May Tax Return due June 30

.

RETURN MUST BE RECEIVED OR POSTMARKED ON or BEFORE END

OF TAX PERIOD TO RECEIVE DISCOUNT.

DO NOT COMPUTE DISCOUNT WHEN PENALTY APPLIES.

PENALTY FOR

IF RETURN IS RECEIVED or POSTMARKED AFTER DUE DATE.

LATE FILING

(Last day of next month following tax month) A 10% PENALTY WILL

10% (add to line 4)

APPLY TO TAXES PAST DUE.

TOTAL TAX DUE

Amount Due and Payable to City of Danville, Virginia, P.O. Box 480, 24543

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1