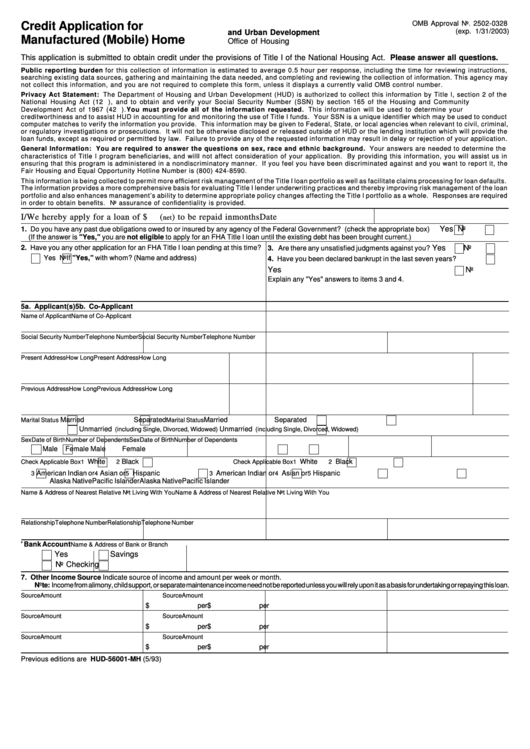

U.S. Department of Housing

Credit Application for

OMB Approval No. 2502-0328

(exp. 1/31/2003)

and Urban Development

Manufactured (Mobile) Home

Office of Housing

This application is submitted to obtain credit under the provisions of Title I of the National Housing Act. Please answer all questions.

Public reporting burden for this collection of information is estimated to average 0.5 hour per response, including the time for reviewing instructions,

searching existing data sources, gathering and maintaining the data needed, and completing and reviewing the collection of information. This agency may

not collect this information, and you are not required to complete this form, unless it displays a currently valid OMB control number.

Privacy Act Statement: The Department of Housing and Urban Development (HUD) is authorized to collect this information by Title I, section 2 of the

National Housing Act (12 U.S.C. 1703), and to obtain and verify your Social Security Number (SSN) by section 165 of the Housing and Community

Development Act of 1967 (42 U.S.C. 3543). You must provide all of the information requested. This information will be used to determine your

creditworthiness and to assist HUD in accounting for and monitoring the use of Title I funds. Your SSN is a unique identifier which may be used to conduct

computer matches to verify the information you provide. This information may be given to Federal, State, or local agencies when relevant to civil, criminal,

or regulatory investigations or prosecutions. It will not be otherwise disclosed or released outside of HUD or the lending institution which will provide the

loan funds, except as required or permitted by law. Failure to provide any of the requested information may result in delay or rejection of your application.

General Information: You are required to answer the questions on sex, race and ethnic background. Your answers are needed to determine the

characteristics of Title I program beneficiaries, and willl not affect consideration of your application. By providing this information, you will assist us in

ensuring that this program is administered in a nondiscriminatory manner. If you feel you have been discriminated against and you want to report it, the

Fair Housing and Equal Opportunity Hotline Number is (800) 424-8590.

This information is being collected to permit more efficient risk management of the Title I loan portfolio as well as facilitate claims processing for loan defaults.

The information provides a more comprehensive basis for evaluating Title I lender underwriting practices and thereby improving risk management of the loan

portfolio and also enhances management’s ability to determine appropriate policy changes affecting the Title I portfolio as a whole. Responses are required

in order to obtain benefits. No assurance of confidentiality is provided.

I/We hereby apply for a loan of $

(

) to be repaid in

months Date

net

Yes

No

1. Do you have any past due obligations owed to or insured by any agency of the Federal Government? (check the appropriate box)

(If the answer is "Yes," you are not eligible to apply for an FHA Title I loan until the existing debt has been brought current.)

2. Have you any other application for an FHA Title I loan pending at this time?

Yes

No

3. Are there any unsatisfied judgments against you?

Yes

No

If "Yes," with whom? (Name and address)

4. Have you been declared bankrupt in the last seven years?

Yes

No

Explain any "Yes" answers to items 3 and 4.

5a. Applicant(s)

5b. Co-Applicant

Name of Applicant

Name of Co-Applicant

Social Security Number

Telephone Number

Social Security Number

Telephone Number

Present Address

How Long

Present Address

How Long

Previous Address

How Long

Previous Address

How Long

Married

Separated

Married

Separated

Marital Status

Marital Status

Unmarried

Unmarried

(including Single, Divorced, Widowed)

(including Single, Divorced, Widowed)

Sex

Date of Birth

Number of Dependents

Sex

Date of Birth

Number of Dependents

Male

Female

Male

Female

White

Black

White

Black

Check Applicable Box

1

2

Check Applicable Box

1

2

American Indian or

Asian or

Hispanic

American Indian or

Asian or

Hispanic

3

4

5

3

4

5

Alaska Native

Pacific Islander

Alaska Native

Pacific Islander

Name & Address of Nearest Relative Not Living With You

Name & Address of Nearest Relative Not Living With You

Relationship

Telephone Number

Relationship

Telephone Number

6. Applicants' Bank Account

Name & Address of Bank or Branch

Yes

Savings

No

Checking

7. Other Income Source Indicate source of income and amount per week or month.

Note: Income from alimony, child support, or separate maintenance income need not be reported unless you will rely upon it as a basis for undertaking or repaying this loan.

Source

Amount

Source

Amount

$

per

$

per

Source

Amount

Source

Amount

$

per

$

per

Source

Amount

Source

Amount

$

per

$

per

Previous editions are obsolete.

Page 1 of 2

ref Handbook 4700.1

form HUD-56001-MH (5/93)

1

1 2

2