City Of Trotwood Individual Income Tax Return Form 2005

ADVERTISEMENT

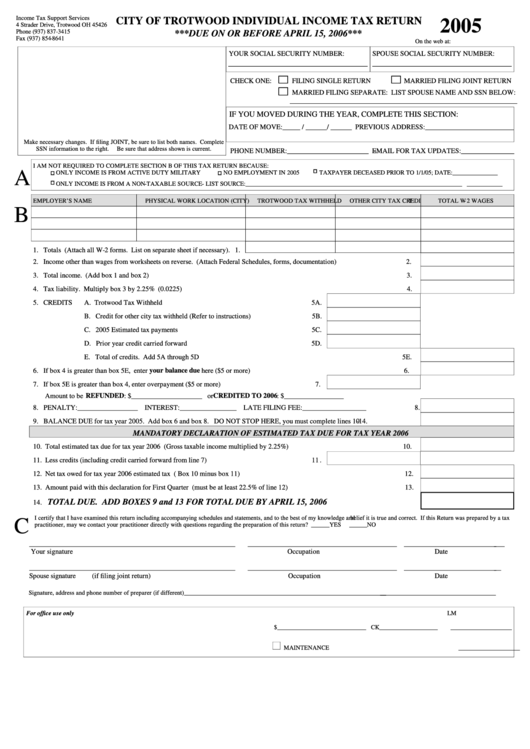

Income Tax Support Services

CITY OF TROTWOOD INDIVIDUAL INCOME TAX RETURN

2005

4 Strader Drive, Trotwood OH 45426

Phone (937) 837-3415

***DUE ON OR BEFORE APRIL 15, 2006***

Fax (937) 854-8641

On the web at:

YOUR SOCIAL SECURITY NUMBER:

SPOUSE SOCIAL SECURITY NUMBER:

________________________________

________________________________

CHECK ONE:

FILING SINGLE RETURN

MARRIED FILING JOINT RETURN

MARRIED FILING SEPARATE: LIST SPOUSE NAME AND SSN BELOW:

________________________________________________________________

IF YOU MOVED DURING THE YEAR, COMPLETE THIS SECTION:

DATE OF MOVE:_____ / ______/ ______ PREVIOUS ADDRESS:_________________________

Make necessary changes. If filing JOINT, be sure to list both names. Complete

SSN information to the right.

Be sure that address shown is current.

PHONE NUMBER:_______________________ E-MAIL FOR TAX UPDATES:_______________

I AM NOT REQUIRED TO COMPLETE SECTION B OF THIS TAX RETURN BECAUSE:

A

ONLY INCOME IS FROM ACTIVE DUTY MILITARY

NO EMPLOYMENT IN 2005

TAXPAYER DECEASED PRIOR TO 1/1/05; DATE:_______________

ONLY INCOME IS FROM A NON-TAXABLE SOURCE - LIST SOURCE:_____________________________________________________________________________________

EMPLOYER’S NAME

PHYSICAL WORK LOCATION (CITY)

TROTWOOD TAX WITHHELD

OTHER CITY TAX CREDIT

TOTAL W-2 WAGES

B

1. Totals (Attach all W-2 forms. List on separate sheet if necessary). 1.

2. Income other than wages from worksheets on reverse. (Attach Federal Schedules, forms, documentation)

2.

3. Total income. (Add box 1 and box 2)

3.

4. Tax liability. Multiply box 3 by 2.25% (0.0225)

4.

5. CREDITS

A. Trotwood Tax Withheld

5A.

B. Credit for other city tax withheld (Refer to instructions)

5B.

C. 2005 Estimated tax payments

5C.

D. Prior year credit carried forward

5D.

E. Total of credits. Add 5A through 5D

5E.

6. If box 4 is greater than box 5E, enter your balance due here ($5 or more)

6.

7. If box 5E is greater than box 4, enter overpayment ($5 or more)

7.

Amount to be REFUNDED: $____________________ or CREDITED TO 2006: $_________________

8. PENALTY:_________________ INTEREST:________________ LATE FILING FEE:__________________

8.

9. BALANCE DUE for tax year 2005. Add box 6 and box 8. DO NOT STOP HERE, you must complete lines 10-14.

MANDATORY DECLARATION OF ESTIMATED TAX DUE FOR TAX YEAR 2006

10. Total estimated tax due for tax year 2006 (Gross taxable income multiplied by 2.25%)

10.

11. Less credits (including credit carried forward from line 7)

11.

12. Net tax owed for tax year 2006 estimated tax ( Box 10 minus box 11)

12.

13. Amount paid with this declaration for First Quarter (must be at least 22.5% of line 12)

13.

TOTAL DUE. ADD BOXES 9 and 13 FOR TOTAL DUE BY APRIL 15, 2006

14.

I certify that I have examined this return including accompanying schedules and statements, and to the best of my knowledge and belief it is true and correct. If this Return was prepared by a tax

C

practitioner, may we contact your practitioner directly with questions regarding the preparation of this return? ______YES

______NO

__________________________________________________________

__________________________________________

_____________________________

Your signature

Occupation

Date

__________________________________________________________

__________________________________________

____________________________

Spouse signature

(if filing joint return)

Occupation

Date

Signature, address and phone number of preparer (if different)_________________________________________________________________________________________________________

For office use only

LM

$_____________________________ CK___________________

____________________

MAINTENANCE

____________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2