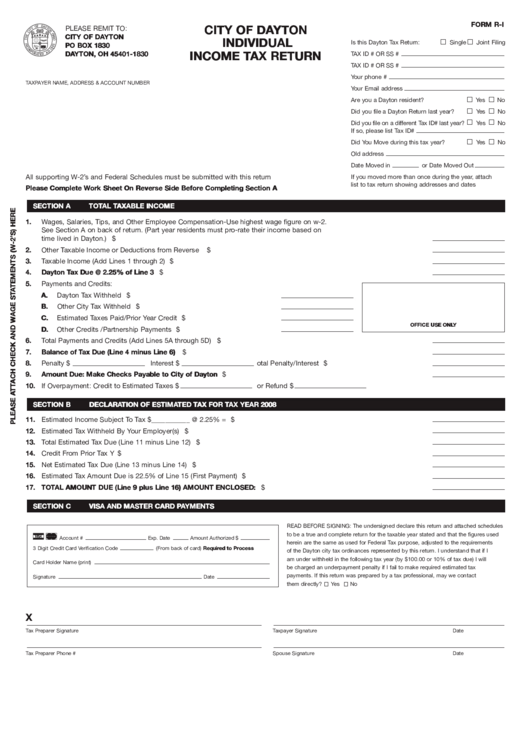

Form R-I - City Of Dayton Individual Income Tax Return

ADVERTISEMENT

FORM R-I

PLEASE REMIT TO:

CITY OF DAYTON

CITY OF DAYTON

INDIVIDUAL

Is this Dayton Tax Return:

Single

Joint Filing

PO BOX 1830

DAYTON, OH 45401-1830

INCOME TAX RETURN

TAX ID # OR SS #

TAX ID # OR SS #

Your phone #

TAXPAYER NAME, ADDRESS & ACCOUNT NUMBER

Your Email address

Are you a Dayton resident?

Yes

No

Did you file a Dayton Return last year?

Yes

No

Did you file on a different Tax ID# last year?

Yes

No

If so, please list Tax ID#

Did You Move during this tax year?

Yes

No

Old address

Date Moved in

or Date Moved Out

All supporting W-2’s and Federal Schedules must be submitted with this return

If you moved more than once during the year, attach

list to tax return showing addresses and dates

Please Complete Work Sheet On Reverse Side Before Completing Section A

SECTION A

TOTAL TAXABLE INCOME

1.

Wages, Salaries, Tips, and Other Employee Compensation-Use highest wage figure on w-2.

See Section A on back of return. (Part year residents must pro-rate their income based on

time lived in Dayton.) ....................................................................................................................................................................... $

2.

Other Taxable Income or Deductions from Reverse Side............................................................................................................... $

3.

Taxable Income (Add Lines 1 through 2)......................................................................................................................................... $

4.

Dayton Tax Due @ 2.25% of Line 3 .............................................................................................................................................. $

Payments and Credits:

5.

A.

Dayton Tax Withheld ............................................................................... $

B.

Other City Tax Withheld .......................................................................... $

C.

Estimated Taxes Paid/Prior Year Credit.................................................. $

OFFICE USE ONLY

Other Credits /Partnership Payments..................................................... $

D.

Total Payments and Credits (Add Lines 5A through 5D) ................................................................................................................ $

6.

7.

Balance of Tax Due (Line 4 minus Line 6) .................................................................................................................................. $

8.

Penalty $

Interest $

.................................................... Total Penalty/Interest $

9.

Amount Due: Make Checks Payable to City of Dayton............................................................................................................. $

10. If Overpayment: Credit to Estimated Taxes $

or Refund $

SECTION B

DECLARATION OF ESTIMATED TAX FOR TAX YEAR 2008

11. Estimated Income Subject To Tax $___________ @ 2.25% =......................................................................................................... $

12. Estimated Tax Withheld By Your Employer(s) ................................................................................................................................. $

13. Total Estimated Tax Due (Line 11 minus Line 12) ........................................................................................................................... $

14. Credit From Prior Tax Year............................................................................................................................................................... $

15. Net Estimated Tax Due (Line 13 minus Line 14) ............................................................................................................................. $

16. Estimated Tax Amount Due is 22.5% of Line 15 (First Payment)................................................................................................... $

17. TOTAL AMOUNT DUE (Line 9 plus Line 16) AMOUNT ENCLOSED: ........................................................................................ $

SECTION C

VISA AND MASTER CARD PAYMENTS

READ BEFORE SIGNING: The undersigned declare this return and attached schedules

i [

to be a true and complete return for the taxable year stated and that the figures used

Account #

Exp. Date

Amount Authorized $

herein are the same as used for Federal Tax purpose, adjusted to the requirements

3 Digit Credit Card Verification Code

(From back of card) Required to Process

of the Dayton city tax ordinances represented by this return. I understand that if I

am under withheld in the following tax year (by $100.00 or 10% of tax due) I will

Card Holder Name (print)

be charged an underpayment penalty if I fail to make required estimated tax

payments. If this return was prepared by a tax professional, may we contact

Signature

Date

them directly?

Yes

No

X

Tax Preparer Signature

Taxpayer Signature

Date

Tax Preparer Phone #

Spouse Signature

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2