Form 42a806 - Transmitter Report For Filing Kentucky W2/k2, 1099 And W2-G Statements Form

ADVERTISEMENT

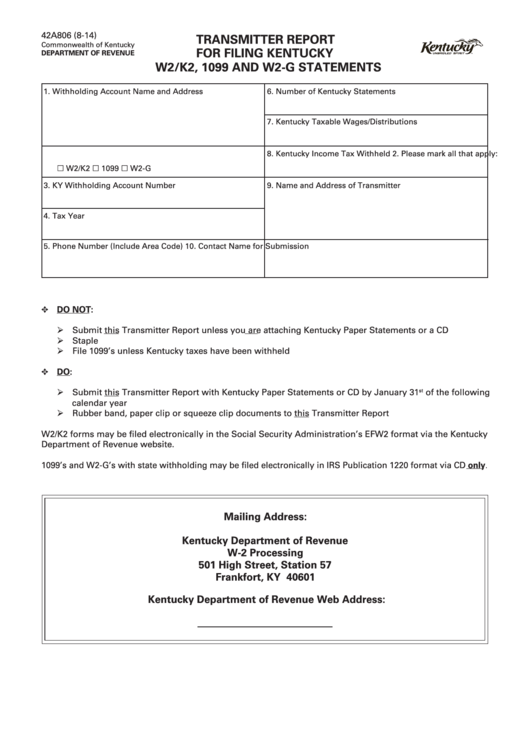

42A806 (8-14)

TRANSMITTER REPORT

Commonwealth of Kentucky

FOR FILING KENTUCKY

DEPARTMENT OF REVENUE

W2/K2, 1099 AND W2-G STATEMENTS

1. Withholding Account Name and Address

6. Number of Kentucky Statements

7. Kentucky Taxable Wages/Distributions

2. Please mark all that apply:

8. Kentucky Income Tax Withheld

£ W2/K2 £ 1099 £ W2-G

9. Name and Address of Transmitter

3. KY Withholding Account Number

4. Tax Year

5. Phone Number (Include Area Code)

10. Contact Name for Submission

E DO NOT:

Ø Submit this Transmitter Report unless you are attaching Kentucky Paper Statements or a CD

Ø Staple

Ø File 1099’s unless Kentucky taxes have been withheld

E DO:

Ø Submit this Transmitter Report with Kentucky Paper Statements or CD by January 31

of the following

st

calendar year

Ø Rubber band, paper clip or squeeze clip documents to this Transmitter Report

W2/K2 forms may be filed electronically in the Social Security Administration’s EFW2 format via the Kentucky

Department of Revenue website.

1099’s and W2-G’s with state withholding may be filed electronically in IRS Publication 1220 format via CD only.

Mailing Address:

Kentucky Department of Revenue

W-2 Processing

501 High Street, Station 57

Frankfort, KY 40601

Kentucky Department of Revenue Web Address:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1