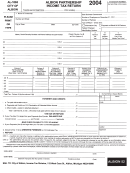

Form Al-1065 - Albion Partnership Income Tax Return - 2009 Page 4

ADVERTISEMENT

PARTNERSHIP NAME:

TAX ID:

SCHEDULE D – BUSINESS ALLOCATION FORMULA

Located

Located in

Everywhere

Albion

Percentage

A

B

B/A

Property Factor

$

$

1

Average net book value of real and tangible personal property----------------------------

a.

Gross annual rent paid for real property, multiplied by 8-----------------------------

%

b.

TOTAL. (add lines 1 and 1a) Divide Column B by Column A for percentage--

Payroll Factor

2.

Total wages, salaries, commissions and other compensation of all employees

%

(exclude partners). Divide Column B by Column A for percentage---------------

Sales Factor

3.

Gross receipts from sales made or services rendered.

%

Divide Column B by Column A for percentage------------------------------------------

4.

Total percentage - add the three percentages computed for lines 1b, 2 and 3 which you entered in the last

%

column (you must compute a percentage for each of lines 1b, 2 and 3)-----------------------------------------------------------

%

5.

Average percentages (Divide line 4 by 3) - enter here and on Sch. E., Col 4 (see note below)-----------------------------

NOTE:

In determining the average percentage (line 5), a factor shall be excluded from the computation only when the factor does not

apply. In such cases, the sum of the percentages on line 4 shall be divided by the number of factors actually used.

If the City of Albion authorized you to use a special formula, attach a copy of the approval letter and complete these lines:

a.

Numerator _____________________ C. Percentage (a/b) enter here __________________% and on Sch. E., Col. 4.

b.

Denominator___________________

2009 Albion 1065 Schedule D

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4