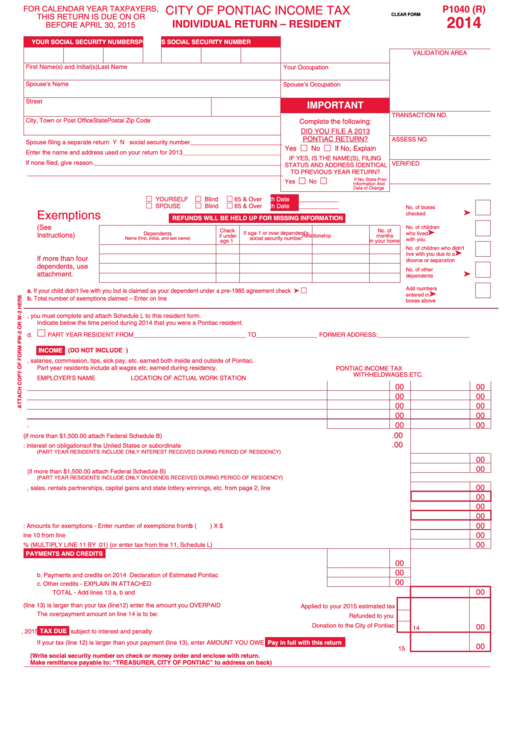

CITY OF PONTIAC INCOME TAX

P1040 (R)

FOR CALENDAR YEAR TAXPAYERS,

THIS RETURN IS DUE ON OR

CLEAR FORM

2014

INDIVIDUAL RETURN – RESIDENT

BEFORE APRIL 30, 2015

YOUR SOCIAL SECURITY NUMBER

SPOUSE'S SOCIAL SECURITY NUMBER

VALIDATION AREA

First Name(s) and Initial(s)

Last Name

Your Occupation

Spouse's Name

Spouse’s Occupation

Street Address

P.O. Box

IMPORTANT

TRANSACTION NO.

City, Town or Post Office

State

Postal Zip Code

Complete the following:

DID YOU FILE A 2013

PONTIAC RETURN?

ASSESS NO.

Spouse filing a separate return Y N social security number ___________________________

Yes □ No □ If No, Explain

Enter the name and address used on your return for 2013 _____________________________

IF YES, IS THE NAME(S), FILING

If none filed, give reason. _______________________________________________________

VERIFIED

STATUS AND ADDRESS IDENTICAL

TO PREVIOUS YEAR RETURN?

___________________________________________________________________________

If No, State Prior

□

□

Yes

No

Information And

Date of Change

□ YOURSELF

□ Blind

□ 65 & Over

Birth Date

______________

□ SPOUSE

□ Blind

□ 65 & Over

Birth Date

______________

No. of boxes

Exemptions

®

checked

REFUNDS WILL BE HELD UP FOR MISSING INFORMATION

(See

No. of children

Check

No. of

®

Dependents

If age 1 or over dependent's

who lived

Instructions)

if under

Relationship

months

social security number

Name (first, initial, and last name)

with you

age 1

in your home

No. of children who didn't

®

live with you due to a

If more than four

divorce or separation

dependents, use

No. of other

attachment.

®

dependents

Add numbers

a. If your child didn't live with you but is claimed as your dependent under a pre-1985 agreement check here .......................................................® □

®

entered in

b. Total number of exemptions claimed – Enter on line 10................................................................................................................................................

boxes above

c. If during 2014 you had income subject to the Pontiac tax both as a resident and as a nonresident, you must complete and attach Schedule L to this resident form.

Indicate below the time period during 2014 that you were a Pontiac resident.

□

d.

PART YEAR RESIDENT FROM _________________________________ TO __________________ FORMER ADDRESS: ___________________________

INCOME

(DO NOT INCLUDE S.U.B. PAY)

1. Enter gross wages, salaries, commission, tips, sick pay, etc. earned both inside and outside of Pontiac.

Part year residents include all wages etc. earned during residency.

PONTIAC INCOME TAX

WITHHELD

WAGES ETC.

EMPLOYER'S NAME

LOCATION OF ACTUAL WORK STATION

00

00

00

00

00

00

00

00

00

00

2. Total Withholding and Wages, Etc.............................................................................................................

2a

2b

.00

3a. Total interest income from federal return (if more than $1,500.00 attach Federal Schedule B) ................ 3a _______________________

.00

3b. LESS: interest on obligations of the United States or subordinate units.................................................... 3b _______________________

(PART YEAR RESIDENTS INCLUDE ONLY INTEREST RECEIVED DURING PERIOD OF RESIDENCY)

00

4. Pontiac Taxable Interest SUBTRACT line 3b from line 3a ................................................................................................................ Interest 4

00

5. Income from dividends from your federal return (if more than $1,500.00 attach Federal Schedule B) ......................................... Dividends 5

(PART YEAR RESIDENTS INCLUDE ONLY DIVIDENDS RECEIVED DURING PERIOD OF RESIDENCY)

00

6. Income or loss from business, sales, rentals partnerships, capital gains and state lottery winnings, etc. from page 2, line 23........... Other 6

00

7.

TOTAL - ADD LINES 2b through 6 ......................................................................................................................................... Subtotal 7

00

8. Deductions Allowed - From page 2 line 25.................................................................................................................................. Deductions 8

00

9.

TOTAL - SUBTRACT line 8 from line 7................................................................................................................................................. 9

00

10. LESS: Amounts for exemptions - Enter number of exemptions from b (

) X $600.00 ....................................................... Exemptions 10

00

11.

TOTAL - income subject to tax - SUBTRACT line 10 from line 9 .......................................................................................... Taxable 11

00

12. City of Pontiac Tax 1% (MULTIPLY LINE 11 BY .01) (or enter tax from line 11, Schedule L) .............................................................. Tax 12

PAYMENTS AND CREDITS

00

13. a. Pontiac Income Tax withheld by your employer from line 2a above - Attach PW-2 or W-2 ................. 13a

00

b. Payments and credits on 2014 Declaration of Estimated Pontiac Tax.................................................... b

00

c. Other credits - EXPLAIN IN ATTACHED STATEMENT ........................................................................... c

00

TOTAL - Add lines 13 a, b and c .........................................................................................................................................................13

14. If your payment (line 13) is larger than your tax (line12) enter the amount you OVERPAID

Applied to your 2015 estimated tax

The overpayment amount on line 14 is to be:

Refunded to you

Donation to the City of Pontiac

00

14

TAX DUE

15.

Amounts due must be paid by April 30, 2015 or it will be subject to interest and penalty

Pay in full with this return

If your tax (line 12) is larger than your payment (line 13), enter AMOUNT YOU OWE

00

15

(Write social security number on check or money order and enclose with return.

Make remittance payable to: “TREASURER, CITY OF PONTIAC” to address on back)

1

1 2

2