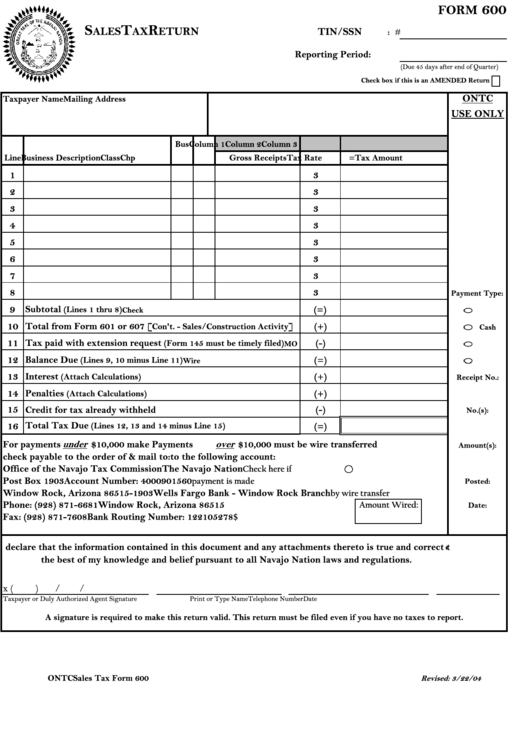

Form 600 - Sales Tax Return 2002

ADVERTISEMENT

600

FORM

S

T

R

ALES

AX

ETURN

TIN/SSN

: #

Reporting Period

:

(Due 45 days after end of Quarter)

Check box if this is an AMENDED Return

ONTC

Taxpayer Name

Mailing Address

USE ONLY

Bus

Column 1

Column 2

Column 3

Line

Business Description

Class Chp

Gross Receipts

Tax Rate

= Tax Amount

1

3%

2

3%

3

3%

4

3%

5

3%

6

3%

7

3%

8

3%

Payment Type:

9

Subtotal

(Lines 1 thru 8)

(=)

Check

10

Total from Form 601 or 607 [

]

Con't. - Sales/Construction Activity

(+)

Cash

11

Tax paid with extension request

(-)

(Form 145 must be timely filed)

MO

12

Balance Due

(=)

(Lines 9, 10 minus Line 11)

Wire

13

Interest

(+)

(Attach Calculations)

Receipt No.:

14

Penalties

(+)

(Attach Calculations)

15

Credit for tax already withheld

(-)

No.(s):

Total Tax Due

16

(Lines 12, 13 and 14 minus Line 15)

(=)

under $10,000 make

over $10,000 must be wire transferred

For payments

Payments

Amount(s):

check payable to the order of & mail to: to the following account:

Office of the Navajo Tax Commission

The Navajo Nation

Check here if

Post Box 1903

Account Number: 4000901560

Posted:

payment is made

Window Rock, Arizona 86515-1903

Wells Fargo Bank - Window Rock Branch

by wire transfer

Phone: (928) 871-6681

Window Rock, Arizona 86515

Amount Wired:

Date:

Fax: (928) 871-7608

Bank Routing Number: 122105278

$

I declare that the information contained in this document and any attachments thereto is true and correct to

the best of my knowledge and belief pursuant to all Navajo Nation laws and regulations.

x

(

)

/

/

Taxpayer or Duly Authorized Agent Signature

Print or Type Name

Telephone Number

Date

A signature is required to make this return valid. This return must be filed even if you have no taxes to report.

ONTC

Sales Tax Form 600

Revised: 3/22/04

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2