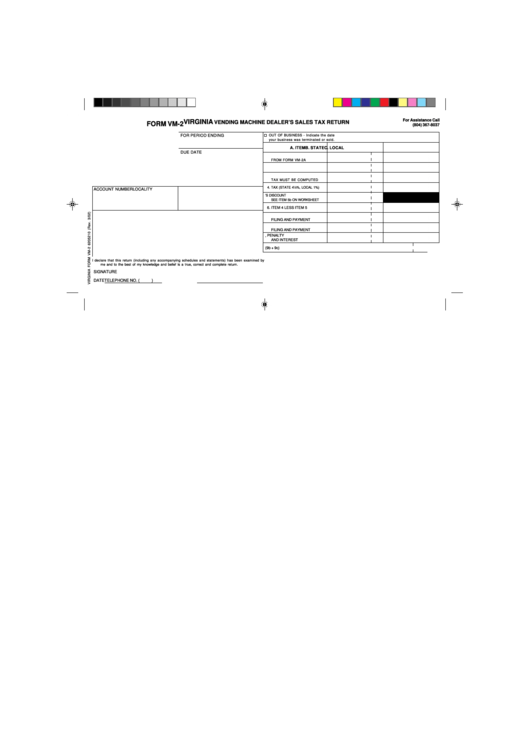

Form Vm-2 - Virginia Vending Machine Dealer'S Sales Tax Return - 2002

ADVERTISEMENT

For Assistance Call

VIRGINIA

VENDING MACHINE DEALER’S SALES TAX RETURN

FORM VM-2

(804) 367-8037

FOR PERIOD ENDING

OUT OF BUSINESS - Indicate the date

your business was terminated or sold.

A. ITEM

B. STATE

C. LOCAL

DUE DATE

1. AMOUNT OF ITEM 1

FROM FORM VM-2A

2d. TOTAL DEDUCTIONS

3. AMOUNT ON WHICH

TAX MUST BE COMPUTED

4. TAX (STATE 4½%, LOCAL 1%)

ACCOUNT NUMBER

LOCALITY

5. DEALER’S DISCOUNT

SEE ITEM 5b ON WORKSHEET

6. ITEM 4 LESS ITEM 5

7. PENALTY FOR LATE

FILING AND PAYMENT

8. INTEREST FOR LATE

FILING AND PAYMENT

9. TOTAL TAX, PENALTY

AND INTEREST

10. AMOUNT DUE (9b + 9c)

I declare that this return (including any accompanying schedules and statements) has been examined by

me and to the best of my knowledge and belief is a true, correct and complete return.

SIGNATURE

DATE

TELEPHONE NO. (

)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2