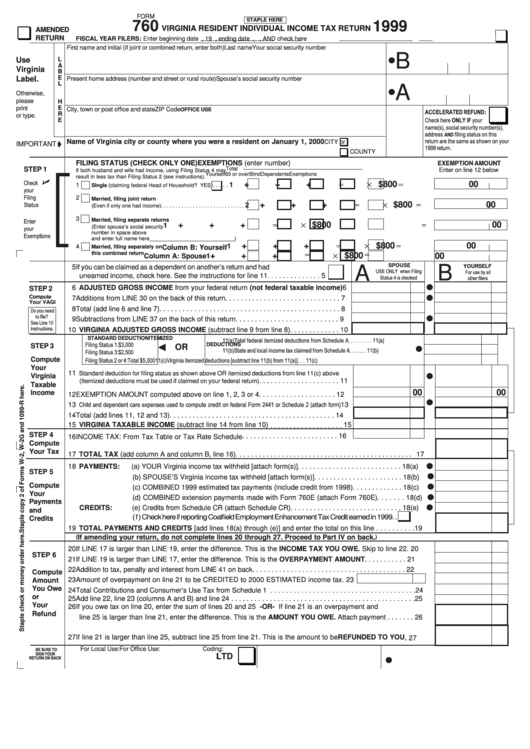

Form 760 - Virginia Resident Individual Income Tax Return - 1999

ADVERTISEMENT

FORM

STAPLE HERE

760

1999

VIRGINIA RESIDENT INDIVIDUAL INCOME TAX RETURN

AMENDED

RETURN

FISCAL YEAR FILERS: Enter beginning date

, 19

, ending date

,

, AND check here

First name and initial (if joint or combined return, enter both)

Last name

Your social security number

B

Use

L

A

Virginia

B

E

Label.

Present home address (number and street or rural route)

Spouse’s social security number

L

A

Otherwise,

please

H

E

print

City, town or post office and state

ZIP Code

OFFICE USE

:

R

or type.

E

Name of Virginia city or county where you were a resident on January 1, 2000

CITY or

IMPORTANT

COUNTY

FILING STATUS (CHECK ONLY ONE)

EXEMPTIONS (enter number)

EXEMPTION AMOUNT

STEP 1

Total

Enter on line 12 below

If both husband and wife had income, using Filing Status 4 may

Yourself

65 or over

Blind

Dependents Exemptions

result in less tax than Filing Status 2 (see instructions).

+

+

+

$800

00

1

1

) . . . . .

Single (claiming federal Head of Household? YES

2

Married, filing joint return

+

+

+

$800

00

2

(Even if only one had income) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

Married, filing separate returns

+

+

+

$800

00

1

(Enter spouse’s social security

number in space above

and enter full name here _____________________________ )

+

+

+

$800

00

1

4

Married, filing separately on

Column B: Yourself

this combined return

+

+

+

$800

00

Column A: Spouse

1

SPOUSE

5 If you can be claimed as a dependent on another’s return and had

B

YOURSELF

A

unearned income, check here. See the instructions for line 11 . . . . . . . . . . . . . .

5

6 ADJUSTED GROSS INCOME from your federal return (not federal taxable income) 6

STEP 2

Compute

7 Additions from LINE 30 on the back of this return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

Your VAGI

8 Total (add line 6 and line 7) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9 Subtractions from LINE 37 on the back of this return . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

10 VIRGINIA ADJUSTED GROSS INCOME (subtract line 9 from line 8) . . . . . . . . . . . . . 10

STANDARD DEDUCTION

ITEMIZED

DEDUCTIONS

STEP 3

OR

Compute

Your

11

Standard deduction for filing status as shown above OR itemized deductions from line 11(c) above

Virginia

. . . . . . . . . . . . . . . . . . . . . 11

(Itemized deductions must be used if claimed on your federal return)

Taxable

00

00

Income

12 EXEMPTION AMOUNT computed above on line 1, 2, 3 or 4 . . . . . . . . . . . . . . . . . . . . 12

13

13

14 Total (add lines 11, 12 and 13) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

15 VIRGINIA TAXABLE INCOME (subtract line 14 from line 10) . . . . . . . . . . . . . . . . . . . 15

STEP 4

16 INCOME TAX: From Tax Table or Tax Rate Schedule . . . . . . . . . . . . . . . . . . . . . . . . . 16

Compute

Your Tax

17 TOTAL TAX (add column A and column B, line 16) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

18 PAYMENTS:

(a) YOUR Virginia income tax withheld [attach form(s)] . . . . . . . . . . . . . . . . . . . . . . . . . . . 18(a)

STEP 5

(b) SPOUSE’S Virginia income tax withheld [attach form(s)] . . . . . . . . . . . . . . . . . . . . . . . 18(b)

Compute

(c) COMBINED 1999 estimated tax payments (include credit from 1998) . . . . . . . . . . . . . 18(c)

Your

(d) COMBINED extension payments made with Form 760E (attach Form 760E) . . . . . . . 18(d)

Payments

CREDITS:

(e) Credits from Schedule CR (attach Schedule CR) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18(e)

and

( f ) Check here if reporting Coalfield Employment Enhancement Tax Credit earned in 1999. .

Credits

19 TOTAL PAYMENTS AND CREDITS [add lines 18(a) through (e)] and enter the total on this line . . . . . . . . . . 19

If amending your return, do not complete lines 20 through 27. Proceed to Part IV on back.

(

)

20 If LINE 17 is larger than LINE 19, enter the difference. This is the INCOME TAX YOU OWE. Skip to line 22 . 20

STEP 6

21 If LINE 19 is larger than LINE 17, enter the difference. This is the OVERPAYMENT AMOUNT . . . . . . . . . . . 21

22 Addition to tax, penalty and interest from LINE 41 on back . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22

Compute

23 Amount of overpayment on line 21 to be CREDITED to 2000 ESTIMATED income tax. 23

Amount

You Owe

24 Total Contributions and Consumer’s Use Tax from Schedule 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24

or

25 Add line 22, line 23 (columns A and B) and line 24 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25

Your

26 If you owe tax on line 20, enter the sum of lines 20 and 25 -OR- If line 21 is an overpayment and

Refund

line 25 is larger than line 21, enter the difference. This is the AMOUNT YOU OWE. Attach payment . . . . . . . 26

27 If line 21 is larger than line 25, subtract line 25 from line 21. This is the amount to be REFUNDED TO YOU . 27

For Local Use:

For Office Use:

Coding:

LTD

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2