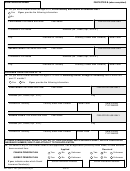

PROTECTED B (when completed)

Social Insurance Number

DECLARATION AND SIGNATURE

PART 1

The information you provide is collected under the authority of the Canada Pension Plan to determine your eligibility for

a Canada Pension Plan (CPP) Disability benefit.

The Social Insurance Number (SIN) is collected under the authority of the Canada Pension Plan and in accordance

with the Treasury Board Secretariat Directive on the Social Insurance Number which lists the Canada Pension Plan

Regulations as an authorized user of the SIN. The SIN will be used as a file identifier, and to ensure your exact

identification so that contributory earnings can be correctly applied to your record to allow benefits and entitlements to

be accurately calculated.

While submitting this application is voluntary, all of the information requested is required in order to determine your

eligibility for CPP Disability. If you do not provide your personal information, the Department of Employment and Social

Development Canada (ESDC) may not be able to process your application or may make a decision based on the

information available.

The information you provide may be shared within ESDC, with any federal institution, provincial authority or public

body created under provincial law with which the Minister of ESDC may have entered into an agreement, and/or with

non-governmental third parties for the purpose of administering the Canada Pension Plan, other acts of Parliament,

and federal and provincial law as well as for policy analysis, research and/or evaluation purposes. The information may

be shared with the government of other countries in accordance with agreements for the reciprocal administration or

operation of that country's law and of the Canada Pension Plan.

The information you provide may be used and/or disclosed for policy analysis, research and/or evaluation purposes. In

order to conduct these activities, various sources of information under the custody and control of ESDC may be linked.

However, these additional uses and/or disclosures of your personal information will never result in an administrative

decision being made about you.

Your personal information is administered in accordance with the Department of Employment and Social Development

Act, the Canada Pension Plan and the Privacy Act. You have the right to the protection of, and access to, your

personal information. It will be retained in Personal Information Bank ESDC PPU 140, 146 and 380. Instructions for

obtaining this information are outlined in the government publication entitled Info Source, which is available at the

following web site address: Info Source may also be accessed online at any Service Canada

Centre.

PART 2 - TO BE COMPLETED BY THE APPLICANT

I hereby apply for a disability and, if applicable, a child benefit under the Canada Pension Plan and declare that to the

best of my knowledge and belief, all of the information herein is true and complete.

I agree to notify the Canada Pension Plan of any changes that may affect my eligibility for benefits. This

includes: an improvement in my medical condition; a return to work (full, part-time, volunteer, or trial period);

attendance at school or university; trade or technical training; or any rehabilitation.

NOTE: If you make a false or misleading statement, you may be subject to an administrative monetary penalty and

interest, if any, under the Canada Pension Plan, or may be charged with an offence. Any benefits you received

or obtained to which there was no entitlement would have to be repaid.

Signature of Applicant

Date

(YYYY-MM-DD)

X

IF YOU CHANGE YOUR ADDRESS, YOU MUST NOTIFY YOUR NEAREST SERVICE CANADA OFFICE.

SC ISP-1151 (2015-02-23) E

4 of 5

1

1 2

2 3

3 4

4 5

5 6

6