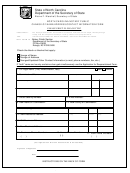

Section E.

Employer, please review the employee's work record for benefits eligibility.

1

1

What was the last day the employee physically worked in the usual occupation?

2

2

How many days of unused sick leave did the employee have as of the date of Question 1?

3

3

How many days of unused other leave did the employee have as of the date of Question 1?

Eligible leave includes vacation, bonus, shared, compensatory, or other leave accumulated according to a personnel policy.

4

What was the date that the member became unable to perform his/her job, according to the medical

4

professional's certification (Question 4 on the Form 703 or Question 4 on the Form 7A)?

5

If date in Question 4 was after the date in Question 1, what was the employee receiving from the date in Question 1 through

the date in Question 4? Check all that may apply.

Compensation on the basis of using accumulated leave

Salary continuation per the employer's regular policy

Temporary Total Workers' Compensation benefit (66 2/3% of salary)

None of the above

6

6

If the employee is still using accumulated leave, what is the day last expected to use leave?

Section F.

Employer, please determine the employee's effective date of disability.

7

7a

What is the date following the date of Question 1 (the last day the employee physically worked)?

7b

What is date of Question 4 from above (the date of illness certified by the physician)?

This question is only applicable to employees who have one year of contributing membership credit

but have not been employed at least 365 days as of date 1 (last day physically worked) or date 4

(medically certified date of illness): What was or will be the 366th day of employment, using all

7c

calendar days?

8

8

Please compare the dates 7a, 7b, and 7c (if applicable) and give the latter date here.

The date of Question 8 is the first day of the 60-day waiting period.

Section G.

Employer, please certify your answers with your signature.

I hereby certify that the information in Sections C through F for the employee named in Section A is true and correct to the best of

my knowledge. I will notify the Retirement Systems Division of changes with a revised Form 701.

Employer Contact Signature________________________________________________________ Date___________________

EMPLOYER CONTACT FIRST NAME LAST NAME

EMPLOYER CONTACT JOB TITLE

TELEPHONE NO.

E-MAIL ADDRESS

Section H.

Please submit this form by mail or fax together with other required documents.

This form is one part of an application for benefits. All forms are available online at For your records,

place a check by each form listed when you have received it. Submit all forms together, and see the Form 711 for further

instructions. An application package should be submitted as soon as possible to prevent a lapse in benefits or health coverage.

A complete application always includes the following:

NOT SUBMITTING ALL

Form 701 (this form)

FORMS TOGETHER MAY

A job description which is provided by the employer and identifies the employee.

CAUSE A DELAY IN

PROCESSING

A complete application also includes the following medical reports:

Form 703 when:

• the employer is making the determination (the box a is checked in Section C)

• the employee's medical professional completed a Form 703 prior to completing a Form 7A.

Form 7A when:

• the employer is requesting a Medical Board determination (the boxes b or c is checked in Section C)

• the employee is submitting this form directly (the box in Section B is checked)

Please mail all forms to the address below or fax to (919) 508-5350

REV 20071009

N.C. Department of State Treasurer, Retirement Systems Division

701

325 North Salisbury Street, Raleigh, North Carolina 27603-1385

(919) 807-3050 in the Raleigh area or (877) 627-3287 toll free

Page 2 of 2

1

1 2

2 3

3 4

4