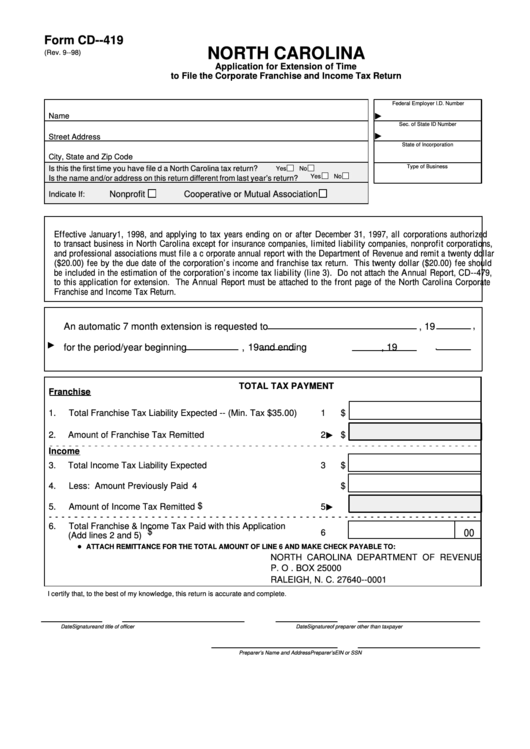

Form CD--419

NORTH CAROLINA

(Rev. 9--98)

Application for Extension of Time

to File the Corporate Franchise and Income Tax Return

Federal Employer I.D. Number

Name

"

Sec. of State ID Number

Street Address

"

State of Incorporation

City, State and Zip Code

Type of Business

Is this the first time you have filed a North Carolina tax return?

Yes

No

Yes

No

Is the name and/or address on this return different from last year’ s return?

Nonprofit

Cooperative or Mutual Association

Indicate If:

Effective January 1, 1998, and applying to tax years ending on or after December 31, 1997, all corporations authorized

to transact business in North Carolina except for insurance companies, limited liability companies, nonprofit corporations,

and professional associations must file a corporate annual report with the Department of Revenue and remit a twenty dollar

($20.00) fee by the due date of the corporation’ s income and franchise tax return. This twenty dollar ($20.00) fee should

be included in the estimation of the corporation’ s income tax liability (line 3). Do not attach the Annual Report, CD--479,

to this application for extension. The Annual Report must be attached to the front page of the North Carolina Corporate

Franchise and Income Tax Return.

,

An automatic 7 month extension is requested to

, 19

.

"

for the period/year beginning

, 19

and ending

, 19

TOTAL TAX PAYMENT

Franchise

1.

Total Franchise Tax Liability Expected -- (Min. Tax $35.00) . . . . .

1

$

2.

Amount of Franchise Tax Remitted . . . . . . . . . . . . . . . . . . . . . . . . .

2

$

"

Income

3.

Total Income Tax Liability Expected . . . . . . . . . . . . . . . . . . . . . . . . .

3

$

4.

Less: Amount Previously Paid . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

$

$

5.

Amount of Income Tax Remitted . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

"

6.

Total Franchise & Income Tax Paid with this Application

$

6

00

(Add lines 2 and 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

D ATTACH REMITTANCE FOR THE TOTAL AMOUNT OF LINE 6 AND MAKE CHECK PAYABLE TO:

NORTH CAROLINA DEPARTMENT OF REVENUE

P. O. BOX 25000

RALEIGH, N. C. 27640--0001

I certify that, to the best of my knowledge, this return is accurate and complete.

Date

Signature and title of officer

Date

Signature of preparer other than taxpayer

Preparer’ s Name and Address

Preparer’ s EIN or SSN

1

1