Form Met 1e Draft - Application For Extension Of Time To File The Maryland Estate Tax Return With Instructions Page 2

ADVERTISEMENT

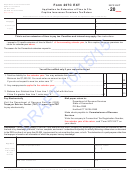

WORKSHEET TO CALCULATE ESTIMATED CREDIT

Form MET 1E

Rev. 07/11

FOR STATE DEATH TAXES

1.

Estimated taxable estate (line 3 from Section II) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ __________________

2.

Less $60,000 adjustment. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ __________________

(60,000.00)

3.

Estimated Adjusted Taxable Estate. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ __________________

Use Table B and lines 4 through 8 below to compute estimated Maximum Credit for State Death Taxes

From the Estimated Adjusted Taxable Estate

Table B – Computation of Maximum Credit for State Death Taxes

(1)

(2)

(3)

(4)

(1)

(2)

(3)

(4)

Adjusted taxable

Adjusted taxable

Credit on amount

Rate of credit on

Adjusted taxable

Adjusted taxable

Credit on amount

Rate of credit on

estate equal to or

estate less

in column (1)

excess over

estate equal to or

estate less than

in column (1)

excess over

more than –

than –

amount in

more than

amount in

column (1)

column (1)

(Percent)

0

$40,000

0

None

2,040,000

2,540,000

106,800

8.0

$40,000

90,000

0

0.8

2,540,000

3,040,000

146,800

8.8

90,000

140,000

$400

1.6

3,040,000

3,540,000

190,800

9.6

140,000

240,000

1,200

2.4

3,540,000

4,040,000

238,800

10.4

240,000

440,000

3,600

3.2

4,040,000

5,040,000

290,800

11.2

440,000

640,000

10,000

4.0

5,040,000

6,040,000

402,800

12.0

640,000

840,000

18,000

4.8

6,040,000

7,040,000

522,800

12.8

840,000

1,040,000

27,600

5.6

7,040,000

8,040,000

650,800

13.6

1,040,000

1,540,000

38,800

6.4

8,040,000

9,040,000

786,800

14.4

1,540,000

2,040,000

70,800

7.2

9,040,000

10,040,000

930,800

15.2

10,040,000

- - - - - - -

1,082,800

16.0

4.

Estimated gross federal tax using the estimated taxable estate including

gifts and Table A from the federal Form 706 instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ __________________

(

)

5.

Unified Credit of $345,800 less estimated adjustments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ __________________

6.

Subtract line 5 from line 4 (do not enter less than zero) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ __________________

If line 6 is zero, STOP here. The estimated Maryland estate tax is zero.

Otherwise, continue to line 7.

7.

Estimated state death tax credit. Calculate the credit using Table B above

and the Estimated Adjusted Taxable Estate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ __________________

8.

Enter the lesser of line 6 or line 7. This is the estimated allowable federal credit

for state death taxes. Enter on line 7 in Section II of this application. . . . . . . . . . . . . . . . . . . .

$ __________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4