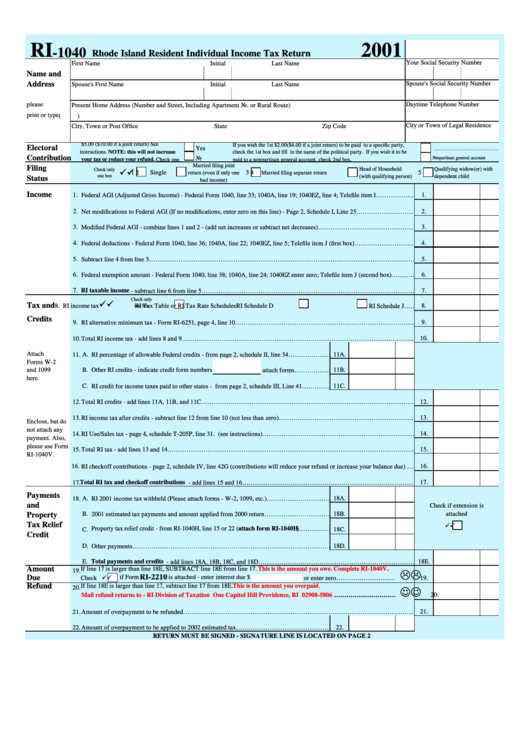

Form Ri-1040 - Rhode Island Resident Individual Income Tax Return 2001

ADVERTISEMENT

RI

2001

-1040

Rhode Island Resident Individual Income Tax Return

Your Social Security Number

First Name

Initial

Last Name

Name and

Address

Spouse's Social Security Number

Spouse's First Name

Initial

Last Name

please

Daytime Telephone Number

Present Home Address (Number and Street, Including Apartment No. or Rural Route)

print or type

(

)

City or Town of Legal Residence

City, Town or Post Office

State

Zip Code

$5.00 ($10.00 if a joint return) See

If you wish the 1st $2.00($4.00 if a joint return) to be paid to a specific party,

Electoral

Yes

…………………………………………………

instructions. NOTE: this will not increase

check the 1st box and fill in the name of the political party. If you wish it to be

Contribution

No

Nonpartisan general account

your tax or reduce your refund. Check one.

paid to a nonpartisan general account, check 2nd box.

Married filing joint

Filing

ü ü

Head of Household

Qualifying widow(er) with

Check only

1

Single

2

3

4

5

return (even if only one

Married filing separate return

one box

(with qualifying person)

dependent child

Status

had income)

Income

1. Federal AGI (Adjusted Gross Income) - Federal Form 1040, line 33; 1040A, line 19; 1040EZ, line 4; Telefile item I…………………

1.

2. Net modifications to Federal AGI (If no modifications, enter zero on this line) - Page 2, Schedule I, Line 25……………………………….

2.

3. Modified Federal AGI - combine lines 1 and 2 - (add net increases or subtract net decreases)…………………………………………………………………………………………

3.

4. Federal deductions - Federal Form 1040, line 36; 1040A, line 22; 1040EZ, line 5; Telefile item J (first box)…………………………………

4.

5. Subtract line 4 from line 3…………………………………………………………………………………………………………………………………….

5.

6. Federal exemption amount - Federal Form 1040, line 38; 1040A, line 24; 1040EZ enter zero; Telefile item J (second box)…………………

6.

7. RI taxable income - subtract line 6 from line 5………………………………………………………………………………………………………………

7.

Check only

ü ü

Tax and

8. RI income tax

RI Tax Table or RI Tax Rate Schedules

RI Schedule D

RI Schedule J………….

8.

one box

Credits

9. RI alternative minimum tax - Form RI-6251, page 4, line 10…………………………………………………………………………………………

9.

10. Total RI income tax - add lines 8 and 9…………………………………………………………………………………………………………………………

10.

Attach

11. A. RI percentage of allowable Federal credits - from page 2, schedule II, line 34…………………………………………

11A.

Forms W-2

B. Other RI credits - indicate credit form numbers

attach forms…………………………………………………..

11B.

and 1099

here.

C. RI credit for income taxes paid to other states - from page 2, schedule III, Line 41………………………..

11C.

12. Total RI credits - add lines 11A, 11B, and 11C………………………………………………………………………………………………………….

12.

13. RI income tax after credits - subtract line 12 from line 10 (not less than zero)………………………………………………………………………….

13.

Enclose, but do

not attach any

14. RI Use/Sales tax - page 4, schedule T-205P, line 31. (see instructions)……………………………………………………………………………

……………………………

14.

payment. Also,

please use Form

15. Total RI tax - add lines 13 and 14………………………………………………………………………………………………………………………………………..

15.

RI-1040V.

16.

RI checkoff contributions - page 2, schedule IV, line 42G (contributions will reduce your refund or increase your balance due) …………………………………….

16.

17. Total RI tax and checkoff contributions - add lines 15 and 16…………………………………………………………………………………………….

17.

Payments

18. A. RI 2001 income tax withheld (Please attach forms - W-2, 1099, etc.)……………………………………….

18A.

and

Check if extension is

B. 2001 estimated tax payments and amount applied from 2000 return……………………………………………

18B.

attached

Property

Tax Relief

ü ü

C. Property tax relief credit - from RI-1040H, line 15 or 22 (attach form RI-1040H)…………………………..

18C.

Credit

D. Other payments……………………………………………………………………………………………………….

18D.

E. Total payments and credits - add lines 18A, 18B, 18C, and 18D………………………………………………………………………………………..

18E.

Amount

19. If line 17 is larger than line 18E, SUBTRACT line 18E from line 17.

This is the amount you owe. Complete RI-1040V.

L L

RI-2210

Due

Check ü ü

if Form

is attached - enter interest due $

or enter zero…………………………………………………..

19.

Refund

20. If line 18E is larger than line 17, subtract line 17 from 18E.

This is the amount you

overpaid.

J J

20.

Mail refund returns to - RI Division of Taxation One Capitol Hill Providence, RI

02908-5806……………………………………………………………..

21. Amount of overpayment to be refunded……………………………………………………………………………………………………………………….

21.

22. Amount of overpayment to be applied to 2002 estimated tax…………………………………………………………

22.

RETURN MUST BE SIGNED - SIGNATURE LINE IS LOCATED ON PAGE 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5