G 4 State Of Georgia Employee'S Withholding Allowance Certificate

ADVERTISEMENT

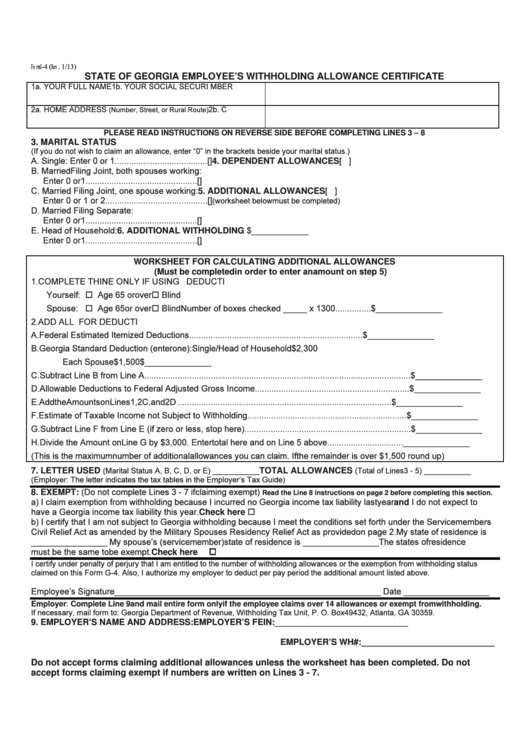

STATE OF GEORGIA EMPLOYEE’S WITHHOLDING ALLOWANCE CERTIFICATE

PLEASE READ INSTRUCTIONS ON REVERSE SIDE BEFORE COMPLETING LINES 3 – 8

3. MARITAL STATUS

4. DEPENDENT ALLOWANCES

5. ADDITIONAL ALLOWANCES

6. ADDITIONAL WITHHOLDING

WORKSHEET FOR CALCULATING ADDITIONAL ALLOWANCES

(Must be completed

step 5)

7. LETTER USED

TOTAL ALLOWANCES

8. EXEMPT:

Read the Line 8 instructions on page 2 before completing this section.

and

Check here

Check here

Employer Complete Line 9 and mail entire form only if the employee claims over 14 allowances or exempt from withholding.

9. EMPLOYER’S NAME AND ADDRESS:

EMPLOYER’S FEIN:____________________________

EMPLOYER’S WH#:____________________________

Do not accept forms claiming additional allowances unless the worksheet has been completed. Do not

accept forms claiming exempt if numbers are written on Lines 3 - 7.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2