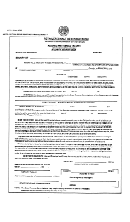

INSTRUCTIONS PRIVILEGE TAX SCHEDULE 1

All manufacturers and Importers of Malt Beverages must prepare this form.

All Malt Products received from outside of Oregon and all malt products received from outside

of the United States must be reported on this schedule, including consignment merchandise.

A copy of Each Invoice must be provided with this Schedule.

List each invoice Alphabetically by Company Name

Invoice Date- Invoice Date from the invoice

Invoice Number – Invoice Number from the invoice

OLCC License Number – The OLCC License number of the company you have received the

product from.

If the company is from outside the United States then enter FOREIGN for the license Number.

Purchased or Received from- Name of the company the Product was received from.

Malt Beverage Barrels- Total number of Barrels for that invoice. (See conversion chart below)

Total Number of Barrels- Add all invoices barrel amounts on this page, Carry forward this

amount to the Statement Line 1, Column A.

BARREL CONVERSION INFORMATION

31 Gallons = 1 Barrel

Barrelage Factors for Common Container Sizes

1/2 Barrel = .50

50 Liter Keg = .4261

1/4 Barrel = .25

30 Liter Keg = .2556

12 Gallon Keg = .3871

8 Liter Keg = .0682

13.2 Gallon Keg = .4258

12 bottles @ .750 Liters = .0767

12 bottles @ 11 oz. Case = .0333

12 bottles @ .375 liters = .0384

12 bottles @ 12 oz Case = .0363

12 bottles @ 22 oz Case = .0665

When reporting barrels, carry the decimal to two places,

12 bottles @ 25 oz Case = .0756

Decimals of .005 or larger should be rounded up.

12 bottles @ 25.4 oz Case = .0768

Example 12.387 would be reported as 12.39.

12 bottles @ 32 oz Case = .0968

Decimals of .004 and lower should be dropped.

12 bottles @ 40 oz Case = .1210

Example 12.384 would be 12.38.

15 bottles @ 12 oz Case = .0454

20 bottles @ 12 oz Case = .0605

24 bottles @ 11.2 oz Case = .0677

24 bottles @ 12 oz Case = .0726

The total amount of Barrels per invoice can be calculated by:

Multiplying the number of containers by factors shown below for that case size.

If other size containers are received, the factor can be calculated by

Number of bottles in case multiplied by number of ounces in each bottle = total ounces.

Divide the total ounces by 3968 to get the factor.

Factor multiplied by number of cases = Barrels

Converting Liters to Gallons:

Liters multiplied by .26417 = Gallons

This form should be prepared in triplicate: Two copies to OLCC. One copy for your records

1

1 2

2