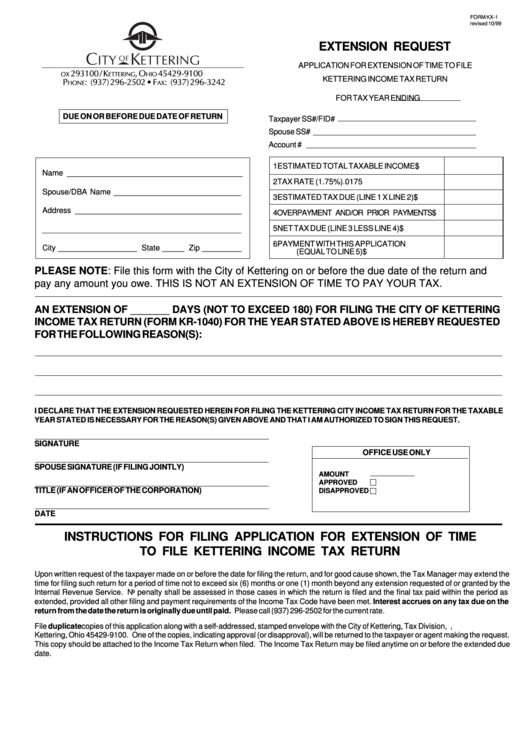

Form Kx-1- Extension Request

ADVERTISEMENT

FORM KX-1

revised 10/99

EXTENSION REQUEST

APPLICATION FOR EXTENSION OF TIME TO FILE

P.O. B

293100 / K

, O

45429-9100

OX

ETTERING

HIO

KETTERING INCOME TAX RETURN

P

: (937) 296-2502 • F

: (937) 296-3242

HONE

AX

FOR TAX YEAR ENDING

DUE ON OR BEFORE DUE DATE OF RETURN

Taxpayer SS#/FID#

Spouse SS#

Account #

1 ESTIMATED TOTAL TAXABLE INCOME

$

Name ________________________________________

2 TAX RATE (1.75%)

.0175

Spouse/DBA Name _____________________________

3 ESTIMATED TAX DUE (LINE 1 X LINE 2)

$

Address ______________________________________

4 OVERPAYMENT AND/OR PRIOR PAYMENTS $

5 NET TAX DUE (LINE 3 LESS LINE 4)

$

_____________________________________________

6 PAYMENT WITH THIS APPLICATION

City __________________ State _____ Zip _________

(EQUAL TO LINE 5)

$

PLEASE NOTE: File this form with the City of Kettering on or before the due date of the return and

pay any amount you owe. THIS IS NOT AN EXTENSION OF TIME TO PAY YOUR TAX.

AN EXTENSION OF _______ DAYS (NOT TO EXCEED 180) FOR FILING THE CITY OF KETTERING

INCOME TAX RETURN (FORM KR-1040) FOR THE YEAR STATED ABOVE IS HEREBY REQUESTED

FOR THE FOLLOWING REASON(S):

I DECLARE THAT THE EXTENSION REQUESTED HEREIN FOR FILING THE KETTERING CITY INCOME TAX RETURN FOR THE TAXABLE

YEAR STATED IS NECESSARY FOR THE REASON(S) GIVEN ABOVE AND THAT I AM AUTHORIZED TO SIGN THIS REQUEST.

SIGNATURE

OFFICE USE ONLY

SPOUSE SIGNATURE (IF FILING JOINTLY)

AMOUNT

APPROVED

TITLE (IF AN OFFICER OF THE CORPORATION)

DISAPPROVED

DATE

INSTRUCTIONS FOR FILING APPLICATION FOR EXTENSION OF TIME

TO FILE KETTERING INCOME TAX RETURN

Upon written request of the taxpayer made on or before the date for filing the return, and for good cause shown, the Tax Manager may extend the

time for filing such return for a period of time not to exceed six (6) months or one (1) month beyond any extension requested of or granted by the

Internal Revenue Service. No penalty shall be assessed in those cases in which the return is filed and the final tax paid within the period as

extended, provided all other filing and payment requirements of the Income Tax Code have been met. Interest accrues on any tax due on the

return from the date the return is originally due until paid. Please call (937) 296-2502 for the current rate.

File duplicate copies of this application along with a self-addressed, stamped envelope with the City of Kettering, Tax Division, P.O. Box 293100,

Kettering, Ohio 45429-9100. One of the copies, indicating approval (or disapproval), will be returned to the taxpayer or agent making the request.

This copy should be attached to the Income Tax Return when filed. The Income Tax Return may be filed anytime on or before the extended due

date.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1