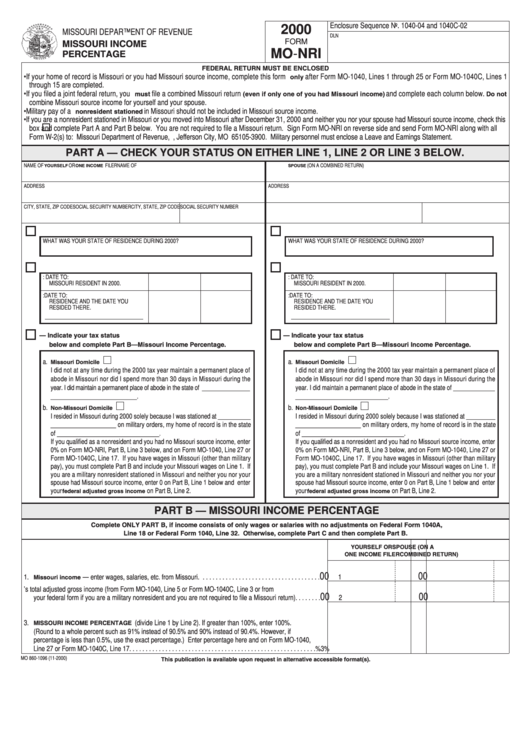

Form Mo-Nri - Missouri Income Percentage - 2000

ADVERTISEMENT

Enclosure Sequence No. 1040-04 and 1040C-02

2000

MISSOURI DEPARTMENT OF REVENUE

DLN

MISSOURI INCOME

FORM

MO-NRI

PERCENTAGE

FEDERAL RETURN MUST BE ENCLOSED

• If your home of record is Missouri or you had Missouri source income, complete this form only after Form MO-1040, Lines 1 through 25 or Form MO-1040C, Lines 1

through 15 are completed.

• If you filed a joint federal return, you must file a combined Missouri return (even if only one of you had Missouri income) and complete each column below. Do not

combine Missouri source income for yourself and your spouse.

• Military pay of a nonresident stationed in Missouri should not be included in Missouri source income.

• If you are a nonresident stationed in Missouri or you moved into Missouri after December 31, 2000 and neither you nor your spouse had Missouri source income, check this

box

and complete Part A and Part B below. You are not required to file a Missouri return. Sign Form MO-NRI on reverse side and send Form MO-NRI along with all

Form W-2(s) to: Missouri Department of Revenue, P.O. Box 3900, Jefferson City, MO 65105-3900. Military personnel must enclose a Leave and Earnings Statement.

PART A — CHECK YOUR STATUS ON EITHER LINE 1, LINE 2 OR LINE 3 BELOW.

NAME OF YOURSELF OR ONE INCOME FILER

NAME OF SPOUSE (ON A COMBINED RETURN)

ADDRESS

ADDRESS

CITY, STATE, ZIP CODE

SOCIAL SECURITY NUMBER

CITY, STATE, ZIP CODE

SOCIAL SECURITY NUMBER

1. NONRESIDENT OF MISSOURI

1. NONRESIDENT OF MISSOURI

WHAT WAS YOUR STATE OF RESIDENCE DURING 2000?

WHAT WAS YOUR STATE OF RESIDENCE DURING 2000?

2. PART-YEAR MISSOURI RESIDENT

2. PART-YEAR MISSOURI RESIDENT

a. INDICATE THE DATE YOU WERE A

DATE FROM:

DATE TO:

a. INDICATE THE DATE YOU WERE A

DATE FROM:

DATE TO:

MISSOURI RESIDENT IN 2000.

MISSOURI RESIDENT IN 2000.

b. INDICATE YOUR OTHER STATE OF

DATE FROM:

DATE TO:

b. INDICATE YOUR OTHER STATE OF

DATE FROM:

DATE TO:

RESIDENCE AND THE DATE YOU

RESIDENCE AND THE DATE YOU

RESIDED THERE.

RESIDED THERE.

3. MILITARY/NON-RESIDENT TAX STATUS — Indicate your tax status

3. MILITARY/NON-RESIDENT TAX STATUS — Indicate your tax status

below and complete Part B—Missouri Income Percentage.

below and complete Part B—Missouri Income Percentage.

a. Missouri Domicile

a. Missouri Domicile

I did not at any time during the 2000 tax year maintain a permanent place of

I did not at any time during the 2000 tax year maintain a permanent place of

abode in Missouri nor did I spend more than 30 days in Missouri during the

abode in Missouri nor did I spend more than 30 days in Missouri during the

year. I did maintain a permanent place of abode in the state of _______________

year. I did maintain a permanent place of abode in the state of _____________

___________________________.

_____________________________.

b. Non-Missouri Domicile

b. Non-Missouri Domicile

I resided in Missouri during 2000 solely because I was stationed at __________

I resided in Missouri during 2000 solely because I was stationed at _________

____________________ on military orders, my home of record is in the state

____________________ on military orders, my home of record is in the state

of ________________________________.

of ________________________________.

If you qualified as a nonresident and you had no Missouri source income, enter

If you qualified as a nonresident and you had no Missouri source income, enter

0% on Form MO-NRI, Part B, Line 3 below, and on Form MO-1040, Line 27 or

0% on Form MO-NRI, Part B, Line 3 below, and on Form MO-1040, Line 27 or

Form MO-1040C, Line 17. If you have wages in Missouri (other than military

Form MO-1040C, Line 17. If you have wages in Missouri (other than military

pay), you must complete Part B and include your Missouri wages on Line 1. If

pay), you must complete Part B and include your Missouri wages on Line 1. If

you are a military nonresident stationed in Missouri and neither you nor your

you are a military nonresident stationed in Missouri and neither you nor your

spouse had Missouri source income, enter 0 on Part B, Line 1 below and enter

spouse had Missouri source income, enter 0 on Part B, Line 1 below and enter

your federal adjusted gross income on Part B, Line 2.

your federal adjusted gross income on Part B, Line 2.

PART B — MISSOURI INCOME PERCENTAGE

Complete ONLY PART B, if income consists of only wages or salaries with no adjustments on Federal Form 1040A,

Line 18 or Federal Form 1040, Line 32. Otherwise, complete Part C and then complete Part B.

YOURSELF OR

SPOUSE (ON A

ONE INCOME FILER

COMBINED RETURN)

00

00

1. Missouri income — enter wages, salaries, etc. from Missouri. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

2. Taxpayer’s total adjusted gross income (from Form MO-1040, Line 5 or Form MO-1040C, Line 3 or from

00

00

your federal form if you are a military nonresident and you are not required to file a Missouri return). . . . . . . .

2

3. MISSOURI INCOME PERCENTAGE (divide Line 1 by Line 2). If greater than 100%, enter 100%.

(Round to a whole percent such as 91% instead of 90.5% and 90% instead of 90.4%. However, if

percentage is less than 0.5%, use the exact percentage.) Enter percentage here and on Form MO-1040,

Line 27 or Form MO-1040C, Line 17. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

%

3

%

MO 860-1096 (11-2000)

This publication is available upon request in alternative accessible format(s).

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2