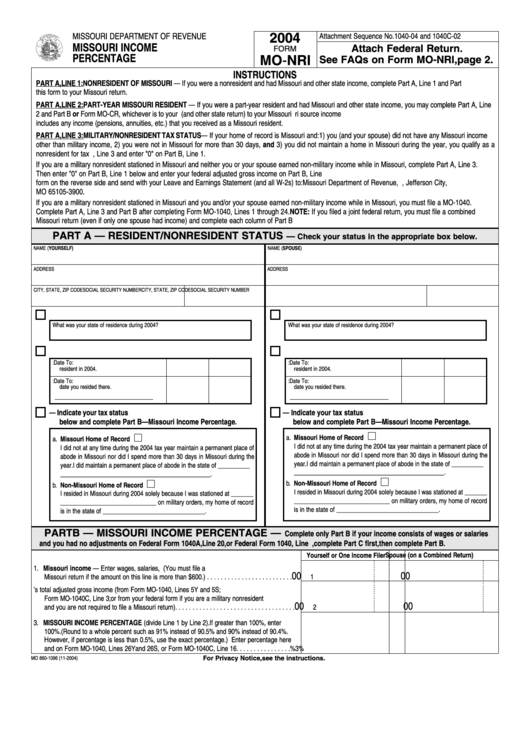

Form Mo-Nri - Missouri Income Percentage - 2004

ADVERTISEMENT

2004

Attachment Sequence No. 1040-04 and 1040C-02

MISSOURI DEPARTMENT OF REVENUE

MISSOURI INCOME

Attach Federal Return.

FORM

PERCENTAGE

MO-NRI

See FAQs on Form MO-NRI, page 2.

INSTRUCTIONS

PART A, LINE 1: NONRESIDENT OF MISSOURI — If you were a nonresident and had Missouri and other state income, complete Part A, Line 1 and Part B. Attach

this form to your Missouri return.

PART A, LINE 2: PART-YEAR MISSOURI RESIDENT — If you were a part-year resident and had Missouri and other state income, you may complete Part A, Line

2 and Part B or Form MO-CR, whichever is to your benefit. Attach this form or Form MO-CR (and other state return) to your Missouri return. Missouri source income

includes any income (pensions, annuities, etc.) that you received as a Missouri resident.

PART A, LINE 3: MILITARY/NONRESIDENT TAX STATUS — If your home of record is Missouri and: 1) you (and your spouse) did not have any Missouri income

other than military income, 2) you were not in Missouri for more than 30 days, and 3) you did not maintain a home in Missouri during the year, you qualify as a

nonresident for tax purposes. Complete Part A, Line 3 and enter "0" on Part B, Line 1.

If you are a military nonresident stationed in Missouri and neither you or your spouse earned non-military income while in Missouri, complete Part A, Line 3.

Then enter "0" on Part B, Line 1 below and enter your federal adjusted gross income on Part B, Line 2. You are not required to file a Missouri return. Sign this

form on the reverse side and send with your Leave and Earnings Statement (and all W-2s) to: Missouri Department of Revenue, P.O. Box 3900, Jefferson City,

MO 65105-3900.

If you are a military nonresident stationed in Missouri and you and/or your spouse earned non-military income while in Missouri, you must file a MO-1040.

Complete Part A, Line 3 and Part B after completing Form MO-1040, Lines 1 through 24. NOTE: If you filed a joint federal return, you must file a combined

Missouri return (even if only one spouse had income) and complete each column of Part B below. Do not combine incomes for you and your spouse.

PART A — RESIDENT/NONRESIDENT STATUS

—

Check your status in the appropriate box below.

NAME (YOURSELF)

NAME (SPOUSE)

ADDRESS

ADDRESS

CITY, STATE, ZIP CODE

SOCIAL SECURITY NUMBER

CITY, STATE, ZIP CODE

SOCIAL SECURITY NUMBER

1. NONRESIDENT OF MISSOURI

1. NONRESIDENT OF MISSOURI

What was your state of residence during 2004?

What was your state of residence during 2004?

2. PART-YEAR MISSOURI RESIDENT

2. PART-YEAR MISSOURI RESIDENT

a. Indicate the date you were a Missouri

Date From:

Date To:

a. Indicate the date you were a Missouri

Date From:

Date To:

resident in 2004.

resident in 2004.

b. Indicate other state of residence and the

Date From:

Date To:

b. Indicate other state of residence and the

Date From:

Date To:

date you resided there.

date you resided there.

3. MILITARY/NONRESIDENT TAX STATUS — Indicate your tax status

3. MILITARY/NONRESIDENT TAX STATUS — Indicate your tax status

below and complete Part B—Missouri Income Percentage.

below and complete Part B—Missouri Income Percentage.

a. Missouri Home of Record

a. Missouri Home of Record

I did not at any time during the 2004 tax year maintain a permanent place of

I did not at any time during the 2004 tax year maintain a permanent place of

abode in Missouri nor did I spend more than 30 days in Missouri during the

abode in Missouri nor did I spend more than 30 days in Missouri during the

year. I did maintain a permanent place of abode in the state of __________

year. I did maintain a permanent place of abode in the state of __________

_______________________________________________.

_______________________________________________.

b. Non-Missouri Home of Record

b. Non-Missouri Home of Record

I resided in Missouri during 2004 solely because I was stationed at _______

I resided in Missouri during 2004 solely because I was stationed at _______

______________________________ on military orders, my home of record

______________________________ on military orders, my home of record

is in the state of ________________________________.

is in the state of ________________________________.

PART B — MISSOURI INCOME PERCENTAGE —

Complete only Part B if your income consists of wages or salaries

and you had no adjustments on Federal Form 1040A, Line 20, or Federal Form 1040, Line 35. Otherwise, complete Part C first, then complete Part B.

Spouse (on a Combined Return)

Yourself or One Income Filer

1. Missouri income — Enter wages, salaries, etc. from Missouri. (You must file a

00

00

Missouri return if the amount on this line is more than $600.) . . . . . . . . . . . . . . . . . . . . . . . . .

1

2. Taxpayer’s total adjusted gross income (from Form MO-1040, Lines 5Y and 5S;

Form MO-1040C, Line 3; or from your federal form if you are a military nonresident

00

00

and you are not required to file a Missouri return). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

3. MISSOURI INCOME PERCENTAGE (divide Line 1 by Line 2). If greater than 100%, enter

100%. (Round to a whole percent such as 91% instead of 90.5% and 90% instead of 90.4%.

However, if percentage is less than 0.5%, use the exact percentage.) Enter percentage here

and on Form MO-1040, Lines 26Y and 26S, or Form MO-1040C, Line 16. . . . . . . . . . . . . . . .

%

3

%

For Privacy Notice, see the instructions.

MO 860-1096 (11-2004)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2