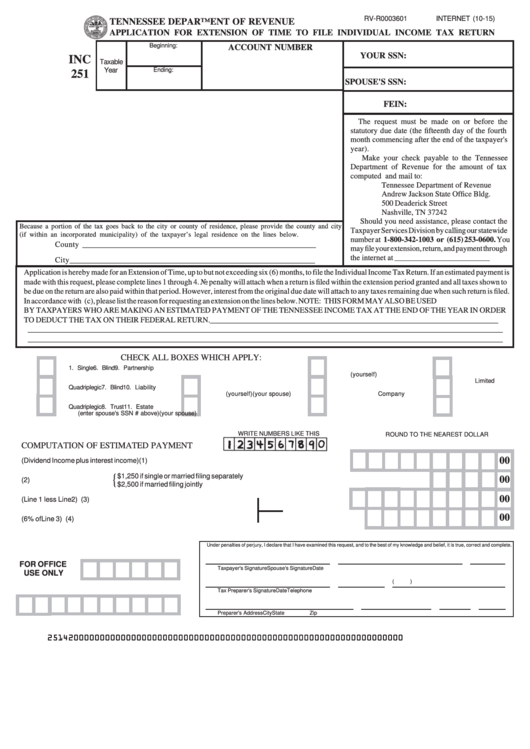

Form Inc 251 - Application For Extension Of Time To File Individual Income Tax Return - Tennessee Department Of Revenue

ADVERTISEMENT

RV-R0003601

INTERNET (10-15)

TENNESSEE DEPARTMENT OF REVENUE

APPLICATION FOR EXTENSION OF TIME TO FILE INDIVIDUAL INCOME TAX RETURN

Beginning:

ACCOUNT NUMBER

YOUR SSN:

INC

Taxable

Year

Ending:

251

SPOUSE'S SSN:

FEIN:

The request must be made on or before the

statutory due date (the fifteenth day of the fourth

month commencing after the end of the taxpayer's

year).

Make your check payable to the Tennessee

Department of Revenue for the amount of tax

computed and mail to:

Tennessee Department of Revenue

Andrew Jackson State Office Bldg.

500 Deaderick Street

Nashville, TN 37242

Should you need assistance, please contact the

Because a portion of the tax goes back to the city or county of residence, please provide the county and city

Taxpayer Services Division by calling our statewide

(if within an incorporated municipality) of the taxpayer’s legal residence on the lines below.

number at 1-800-342-1003 or (615) 253-0600. You

County ____________________________________________________________

may file your extension, return, and payment through

the internet at

City _______________________________________________________________

Application is hereby made for an Extension of Time, up to but not exceeding six (6) months, to file the Individual Income Tax Return. If an estimated payment is

made with this request, please complete lines 1 through 4. No penalty will attach when a return is filed within the extension period granted and all taxes shown to

be due on the return are also paid within that period. However, interest from the original due date will attach to any taxes remaining due when such return is filed.

In accordance with T.C.A. Section 67-2-114(c), please list the reason for requesting an extension on the lines below. NOTE: THIS FORM MAY ALSO BE USED

BY TAXPAYERS WHO ARE MAKING AN ESTIMATED PAYMENT OF THE TENNESSEE INCOME TAX AT THE END OF THE YEAR IN ORDER

TO DEDUCT THE TAX ON THEIR FEDERAL RETURN. __________________________________________________________________________

__________________________________________________________________________________________________________________________

__________________________________________________________________________________________________________________________

CHECK ALL BOXES WHICH APPLY:

1. Single

6. Blind

9. Partnership

(yourself)

Limited

2. Married Filing Jointly

4. Quadriplegic

7. Blind

10. Liability

(yourself)

(your spouse)

Company

3. Married Filing Separately

5. Quadriplegic

8. Trust

11. Estate

(enter spouse's SSN # above)

(your spouse)

WRITE NUMBERS LIKE THIS

ROUND TO THE NEAREST DOLLAR

COMPUTATION OF ESTIMATED PAYMENT

00

1. TOTAL TAXABLE INCOME (Dividend Income plus interest income) .................................... (1)

{

$1,250 if single or married filing separately

00

2. SUBTRACT EXEMPTION

............................. (2)

$2,500 if married filing jointly

00

3. AMOUNT SUBJECT TO TAX (Line 1 less Line 2) .............................

(3)

00

4. ESTIMATED PAYMENT (6% of Line 3) .............................................

(4)

Under penalties of perjury, I declare that I have examined this request, and to the best of my knowledge and belief, it is true, correct and complete.

FOR OFFICE

Taxpayer's Signature

Spouse's Signature

Date

USE ONLY

(

)

Tax Preparer's Signature

Date

Telephone

Preparer's Address

City

State

Zip

25142000000000000000000000000000000000000000000000000000000000000000

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1